Decoding Ethereum [ETH] whales’ movement for your next trade

Ethereum, the second-largest cryptocurrency in the world, witnessed a lot of volatility in its prices after the merge. However, over the last seven days, Ethereum’s price seems to be forming a plateau. In fact, it appears that the whales may stop supporting Ethereum.

Here’s AMBCrypto’s Price Prediction for Ethereum for 2022-2023

Taking a closer look

One of the reasons for the growth in Ethereum’s prices could be large investors. According to analytics provider CryptoQuant’s update, a spike in prices with low trading volume could indicate that the price movement is at the mercy of whales.

Interestingly, at press time, it appeared that the whales began to lose interest in ETH.

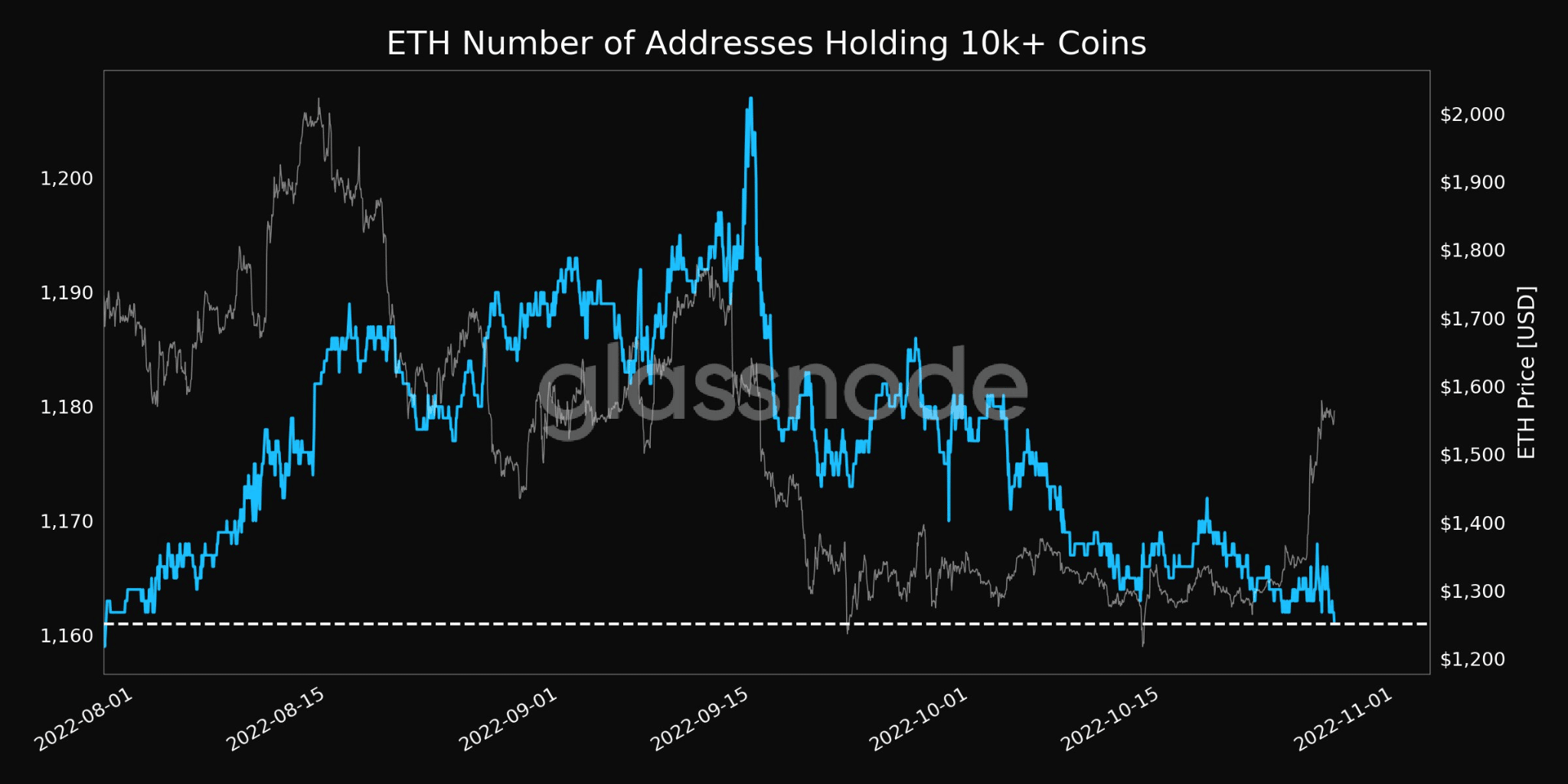

A tweet posted by analytics firm glassnode, indicated that the number of addresses holding more than 10 thousand coins had decreased to reach a 1-month low.

Source: glassnode

Along with the decline in addresses holding huge amounts of ETH, the number of active addresses also witnessed a decline. According to glassnode’s data, the number of active addresses on the Ethereum network decreased and reached a 3-month low on 27 October.

Despite the decline in activity, there were other areas where Ethereum showed gains.

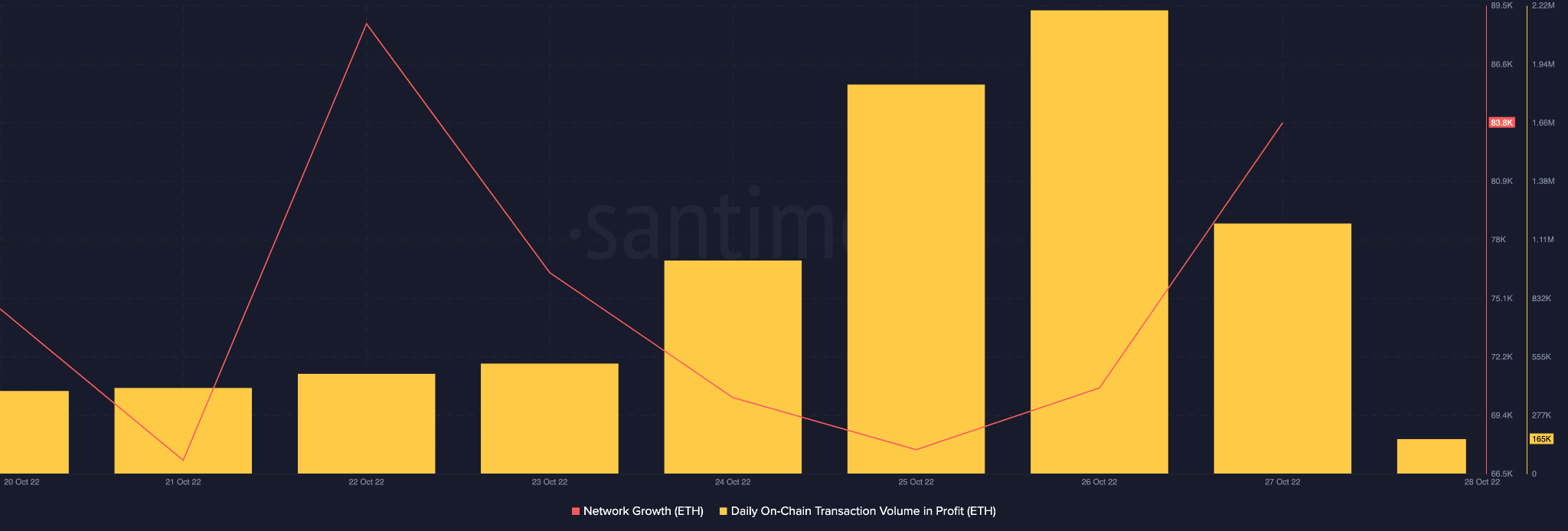

Ethereum’s network growth increased over the past few days. Thus, indicating that the number of new addresses that transferred Ethereum for the first time increased.

Furthermore, the volume of transactions in profit also increased during the same time period.

Source: Santiment

Despite the volatility of Ethereum’s current state, major firms continued to show their faith in the altcoin.

For instance, Google, in a blog post posted on 28 October, announced that they will be launching a Blockchain node engine, which will help customers monitor their Blockchain nodes.

At press time the service was only available for the Ethereum network, Google will eventually plan on providing this service to more networks later. However, there is a possibility that Ethereum could benefit from the first-mover advantage in this situation.

It remains to be seen what direction ETH will take in the future.

At the time of writing, Ethereum was trading at $1,500 and had depreciated by 3.06% over the last 24 hours. Ethereum’s volume also decreased by 14.98% during the same time period.

Leave a Reply