Ethereum Creator Vitalik Calls Bitcoin Maximalist Michael Saylor a ‘Total Clown’

[ad_1]

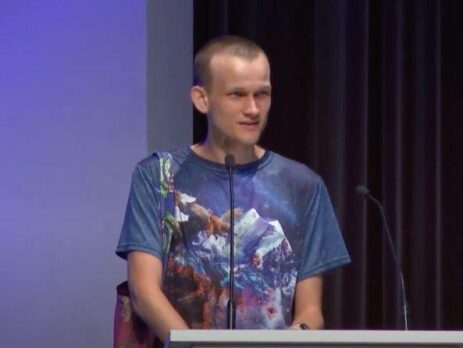

On Sunday (July 31), Russian-Canadian programmer Vitalik Buterin, who is the creator of Ethereum, called Michael Saylor (Co-Founder, Chairman, and CEO of MicroStrategy Inc.) out for his recent comments about U.S. securities laws and their application to the crypto space.

It is worth remembering that on 11 August 2020, MicroStrategy announced via a press release that it had “purchased 21,454 bitcoins at an aggregate purchase price of $250 million” to use as a “primary treasury reserve asset.”

Saylor said at the time:

“Our decision to invest in Bitcoin at this time was driven in part by a confluence of macro factors affecting the economic and business landscape that we believe is creating long-term risks for our corporate treasury program ― risks that should be addressed proactively.“

Since then MicroStrategy has continued to accumulate Bitcoin and its CEO has become one of Bitcoin’s most vocal advocates. MicroStrategy’s latest $BTC purchase, which Saylor tweeted about on June 29, means that the firm is now HODLing around 129,699 bitcoins, which were “acquired for ~$3.98 billion at an average price of ~$30,664 per bitcoin.”

On July 12, during an appearance on YouTube series “Not Investment Advice“, Saylor said that the basis for U.S. securities laws was the bible (more specifically, the Old Testament):

“Most of the crypto industry, it just went, fast broke things, lacking adult supervision. Very entrepreneurial and that works until it doesn’t work anymore. It’s pretty clear it’s not working anymore. And the next decade, you’re gonna have to have lawyers and accountants. I know people are saying, ‘well, I guess Celsius should have disclosed what they were doing’. You know who discloses what they’re doing? Publicly traded companies…

“Just keep in mind: the basis of securities laws are biblical; they go back thousands of years, I mean, Hammurabi’s Code even. The basis of securities laws are ‘thou shalt not lie, cheat, or steal’. That’s the basis of the law. So saying ‘these are antiquated laws from 1933 that don’t apply to crypto’ that’s kind of a dead on arrival argument. The law is ‘don’t lie, cheat, or steal’. It’s just instantiated in different years and different places. And so, the future the industry is going to have to be based on an ethically sound foundation, a technically sound foundation, and an economically sound foundation.

“And as you can tell, I think Bitcoin is economically, technically, and ethically sound. You’ve you’ve got a million reasons why. We could talk about it for thousands of hours. If you want to build a business in this industry, you need to be inspired by those three principles.

“And the simple thing to do is just use Bitcoin as your token and then build on top of that monetary protocol and on top of that monetary asset, but if you’re not going to do that, you definitely have to think long and hard about the economic, ethical, and technical implications of what you’re doing.“

This led Buterin to wonder out loud earlier today why Bitcoin maximalists like to choose as heroes “total clowns” like Michael Syalor:

Anyway, according to a report by CoinDesk, on Wednesday (July 27), Saylor, who is a self-confessed Bitcoin maximalist, spoke at a two-day crypto conference in Turkey — “Blockchain Economy Istanbul” — where he shared his thoughts on Ethereum.

The CoinDesk report mentioned that Saylor had “noted that he was speaking as an institutional investor and in that regard, one would ‘have to wait until the protocol is complete.’” Apparently, “he pointed out that Ethereum co-founder Vitalik Buterin said in a speech last week that Ethereum was 40% done and had laid out a roadmap of three to four years, which means the ‘protocol doesn’t look like it’s going to be completed or stable for another 36 months.’”

Regarding the soundness of Ethereum, Saylor said:

“‘Technically sound’ means I need to see the protocol function for that thing after about five to 10 years. So we don’t know that, either. Right? Because if you are hard forking and changing it, every time you do a big upgrade, you introduce new attack surfaces…

“‘Ethically sound’ means I need to know that nobody could change [the protocol], which includes Vitalik. I need to know that no one at the Ethereum foundation, no individual can change the protocol because if they could change the protocol, it makes it a security and if it makes it a security, then it’s not going to become global money.“

According to a report by The Daily Hodl, the MicroStrategy CEO stated on July 7 during an interview with crypto market commentary show “Altcoin Daily” that $ETH is a security. Saylor was asked by the show’s host to give his take on Bitcoin and Ethereum being regarded as commodities by certain U.S. legislators as well as a few officials from the Securities and Exchange Commission (SEC) and Commodities and the Commodities Futures Trading Commission (CFTC).

Here are the reasons that Saylor gave for believing that Ethereum is a security:

“I think it’s pretty obvious it’s a security. It was issued via an ICO [initial coin launch]. There’s a management team. There was a pre-mine. There’s a hard fork. There are continual hard forks… For it to be a commodity, there can’t be an issuer and the truth is you can’t really make decisions. One of the fundamental insights in the crypto industry is the fact that you can change it is what makes it a security...

“If you look at most of these cryptos, where they have hard fork after hard fork after hard fork, the problem with a hard fork is changing the protocol means that some development team is making a decision, and if you can change the protocol in a material way, you can change the monetary protocol. A hard fork can change the issuance pattern, or it can change the value of something. So that makes an investment contract under securities law.“

On 14 June 2018, William Hinman, then director of the Division of Corporation Finance at the SEC, made a speech at Yahoo Finance’s “All Markets Summit: Crypto” one-day event in San Francisco, California. The speech was about how the SEC plans to use the “Howey Test” to determine whether a digital asset should be considered a security or not. The only two cryptocurrencies Hinman mentioned by name were Bitcoin (BTC) and Ether (ETH), neither of which he said should be considered as securities:

“And so, when I look at Bitcoin today, I do not see a central third party whose efforts are a key determining factor in the enterprise. The network on which Bitcoin functions is operational and appears to have been decentralized for some time, perhaps from inception. Applying the disclosure regime of the federal securities laws to the offer and resale of Bitcoin would seem to add little value.[9]

“And putting aside the fundraising that accompanied the creation of Ether, based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions. And, as with Bitcoin, applying the disclosure regime of the federal securities laws to current transactions in Ether would seem to add little value.“

[ad_2]

Source link

Leave a Reply