What Solana holders can expect from SOL’s price after this breakdown

[ad_1]

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- Solana witnessed a patterned breakdown while finding solid rebounding grounds over the past day.

- The altcoin’s funding rate on Binance still stood negative.

Cryptos linked to Sam Bankman-Fried and his associated company Alameda Research have undeniably been at the forefront of facing substantial sell-offs.

Consequently, Solana’s [SOL] collapse entailed a loss of more than half its value within three days before rebounding from the $14.4 support level.

Read Solana’s Price Prediction 2023-24

SOL’s funding rates depicted a slight ease in the heightened selling pressure over the past day. Its latest pullback put the alt on a bearish track.

At press time, SOL was trading at $21.42, up by over 30% in the last 24 hours.

Can SOL buyers continue to reject lower prices?

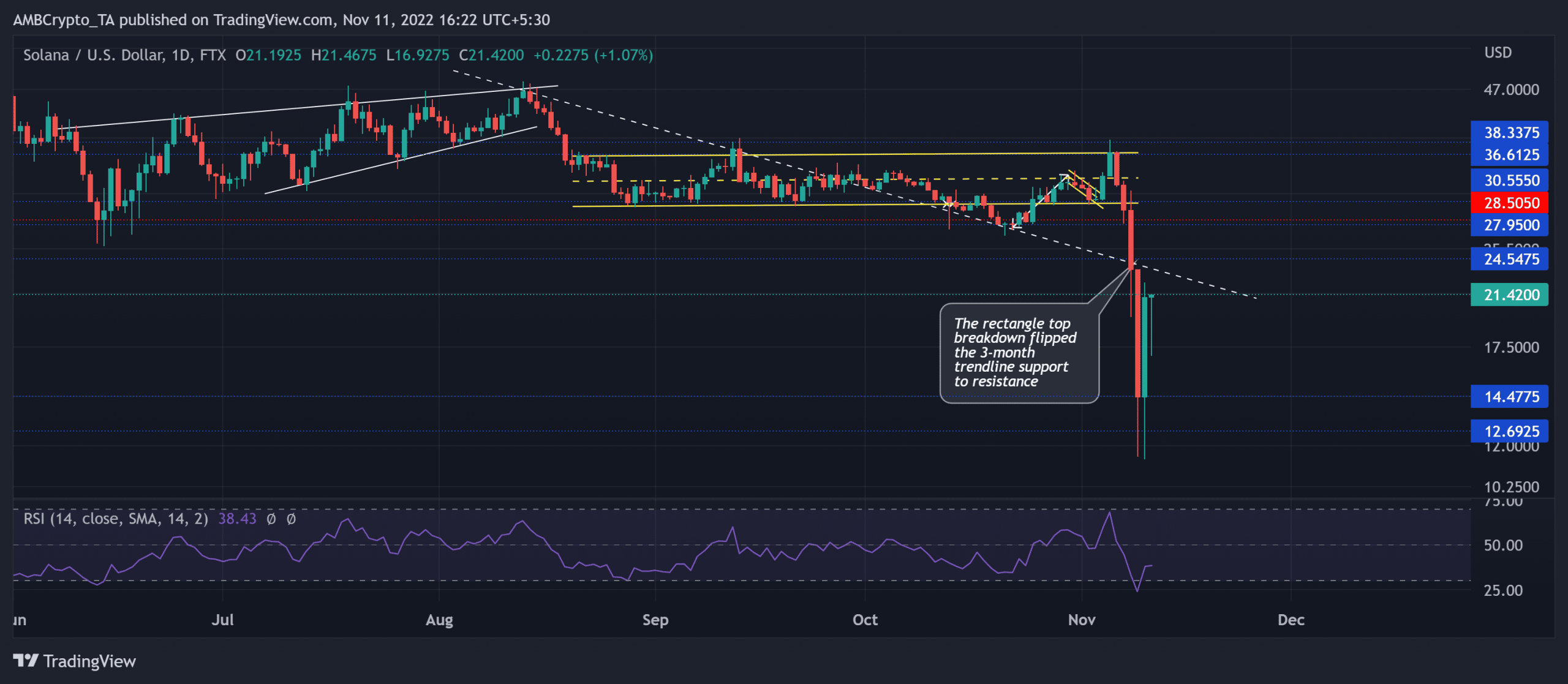

Source: TradingView, SOL/USD

SOL’s previous rebound from the $27-support induced a near-term rally, one that aided the bulls in retesting the $36 ceiling.

In the meantime, SOL’s sideways trajectory entailed a Rectangle Top (yellow) structure on the daily chart. As a result, the alt extended its compression phase before the recent breakout rally.

The patterned breakdown led SOL to drop below its trendline resistance (white, dashed). With buyers depicting inclinations to reject lower prices at the $14.4 support, SOL could enter a rather slow-moving phase.

The alt’s sellers could aim to restrict the buying rallies near the trendline resistance in the $23-$24 range. A close above this barrier could hint at a near-term bearish invalidation. An immediate or eventual decline could continue to find testing grounds near the $14.4-zone.

The Relative Strength Index (RSI) continued its sway in the bearish region after marking slight improvements. But the 24-hour gains on SOL’s charts could not induce a corresponding increase in the trading volumes. This made SOL’s position more fragile and susceptible to a reversal.

Can Solana see a comeback?

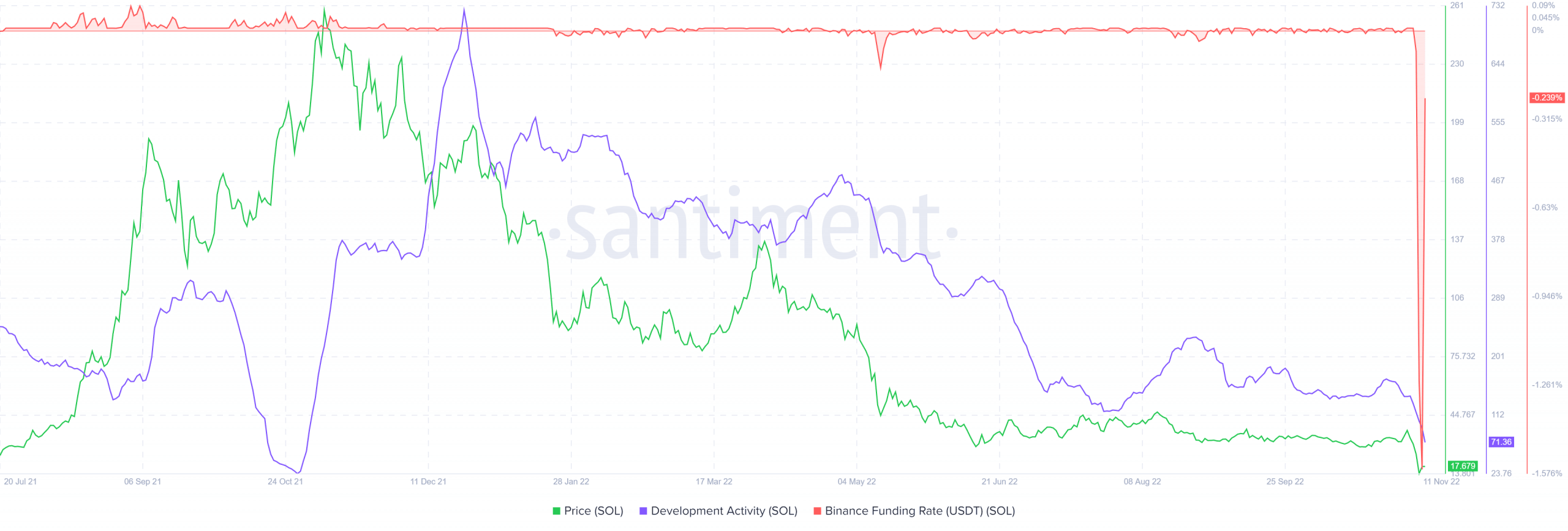

Source: Santiment

SOL revealed a corresponding declining trend in its development activity alongside the price over the last few months. The recent price pullback was succeeded by a sharp plunge in its development activity, given the increasing correlation between them. Thus, the buyers should keep a close watch on a potential reversal on this front.

Furthermore, SOL’s funding rate on Binance still stood in the negative zone while marking a substantial uptick over the past day.

The potential targets would remain the same as discussed. Finally, keeping an eye on the king coin’s movement could help make a profitable bet.

[ad_2]

Source link

Leave a Reply