Solana: Gauging SOL’s ability to induce breakout rally in the coming days

[ad_1]

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- Solana climbed above its EMA ribbons to exhibit an increased buying edge

- The altcoin’s Open Interest and price saw a slight uptick over the day

Solana’s [SOL] rebound from the trendline support induced a streak of green candlesticks over two weeks. This trajectory reaffirmed a surge in SOL’s bullish edge.

Here’s AMBCrypto’s price prediction for Solana [SOL] for 2023-24

The latest candlestick above the pattern exposed SOL to a further upside while keeping rebounding chances intact. In the meantime, the 20 EMA (red) strived to close above the 50 EMA on the daily chart.

At press time, SOL was trading at $32.40, up by 1.93% in just the last 24 hours.

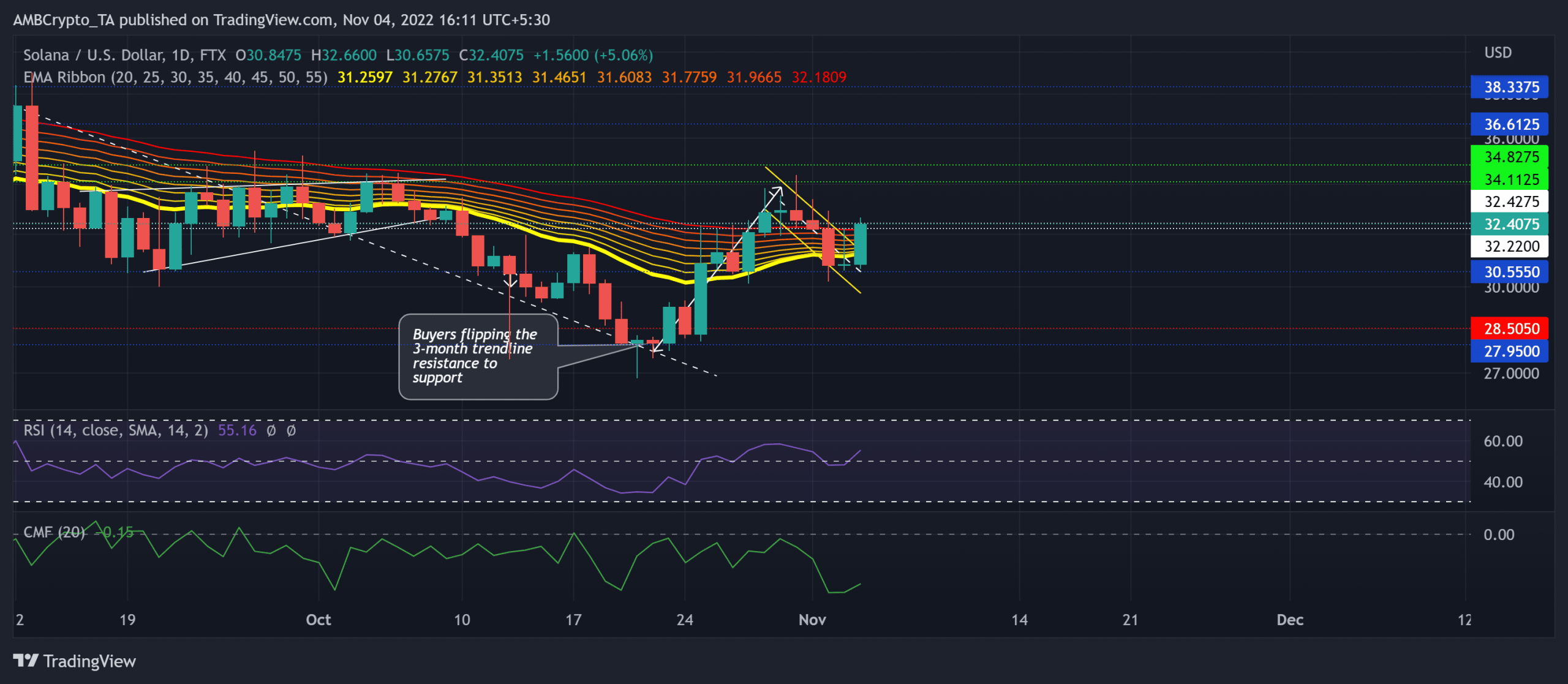

SOL witnessed a bullish pattern on its daily chart

Source: TradingView, SOL/USD

SOL’s latest revival from the $ 27-baseline induced a buying resurgence, one that aided the bulls in challenging the limitations of the EMA ribbons. Should the current candlestick close as green, it could fuel the bullish fire by confirming a morning star candlestick setup.

In the meantime, SOL’s growth entailed a bullish flag-like structure on the daily chart. As a result, SOL swayed above the EMA ribbons to depict a bullish edge.

A sustained close above the $32.4-resistance mark could expedite the buying pressure in the coming sessions. The buyers would look to pull the prices towards the first major hurdle around the $34-zone, before a likely bearish rebuttal. An immediate or eventual decline below the EMA ribbons could find testing grounds near the $30-zone.

The Relative Strength Index (RSI) found a close above the midline to flash a bullish advantage. Furthermore, the Chaikin Money Flow’s (CMF) high troughs in the last few days bullishly diverged with the price.

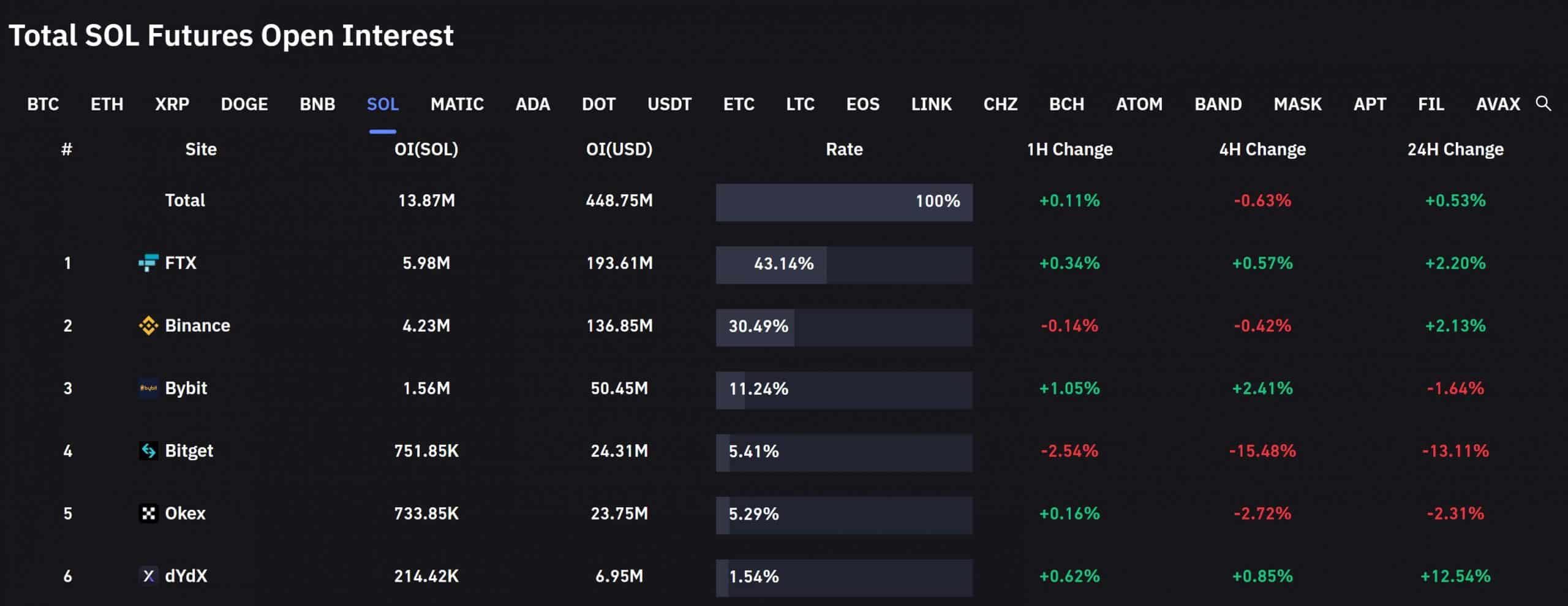

An increase in Open Interest

Source: Coinglass

An analysis of the total SOL Futures Open Interest revealed a slight spike in Open Interest over the last 24 hours. Correspondingly, the price action registered over 1.5% gains over the same time period. This reading entailed a bullish sign for the near term.

The potential targets would remain the same as discussed. Finally, keeping an eye on the king coin’s movement could help make a profitable bet.

[ad_2]

Source link

Leave a Reply