Refreshes 4-month High Above $8.80; More Gains In Offer?

[ad_1]

Published 1 hour ago

Chainlink (LINK) price analysis indicates an extension of the previous up trend. However, as the U.S trading session begins the price moved in a very range-bound manner and recovered after testing the intraday low of $8.27.

The addition of new buyers is required to continue with the bullish momentum. The price faces rejection near $8.80.

- Chainlink price retested the 4-month highs above $8.80 on Tuesday.

- The price looking for a decisive break out above $8.80 to test the psychological $10.0 level.

- The nearest support is placed at around $8.20.

Chainlink price signals upside continuation

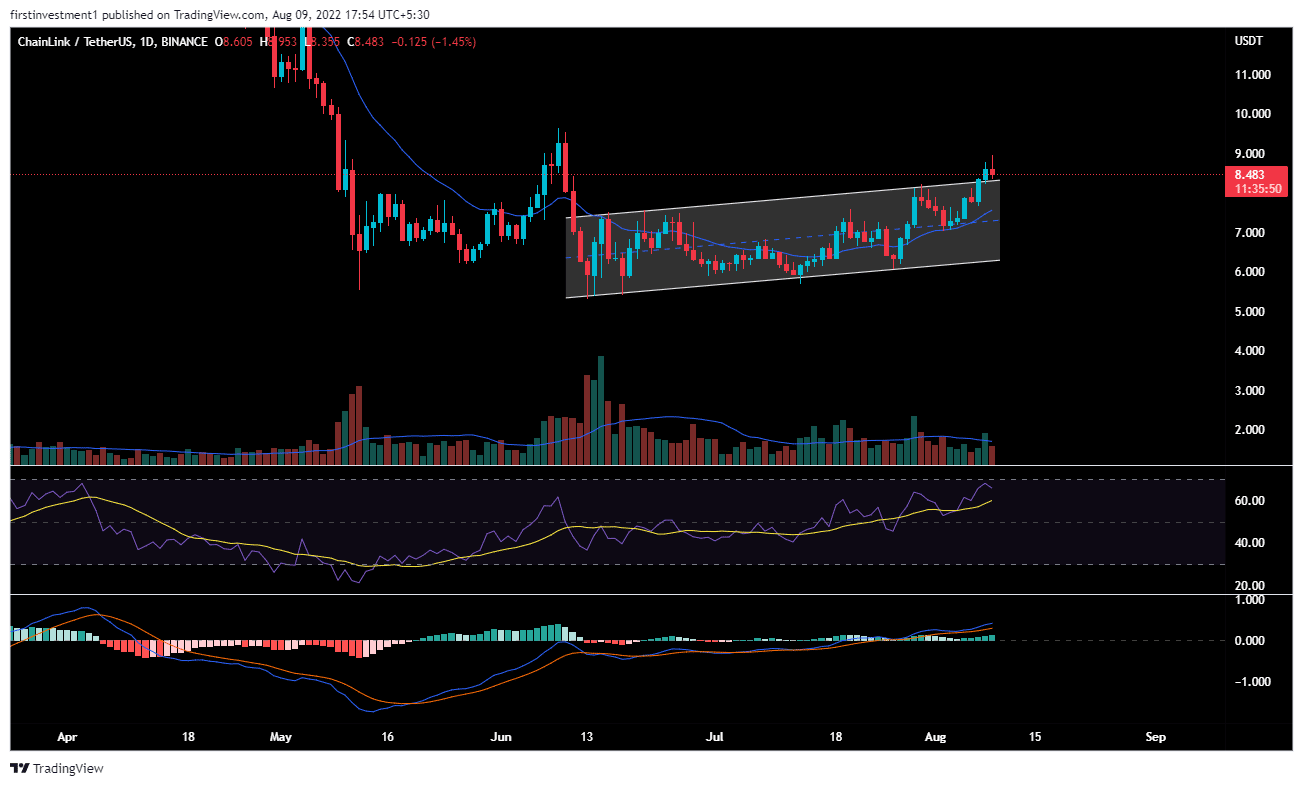

On the daily chart, the price is trading in a rising channel, making higher highs and higher lows. The price consolidated in a range of $6.20 and $7.40 since June 06.

Finally, the price breaks above the price range on July 29 with above-average volumes and surged 16%. Further, the price tagged the swing high of $8.95.

Currently, the bulls seemed to be resting near the higher levels. There is a higher probability that the price would produce a breakout on the higher side. However, the condition is that the buyers must hold $8.80 on a daily closing basis.

On moving higher, the Chainlink price would target the psychological $10.0 level.

On the other hand, the downside seems to be capped near $8.0. If broken would amplify the selling.

The RSI (14) is trading above 50, indicating that the average gain is larger than the average loss. Any uptick in the indicator would strengthen the bullish outlook.

The MACD indicator is also positive. A positive MACD value, created when the short-term average is above the longer-term average, is used to signal increasing upward momentum. This value can also be used to suggest that traders may want to refrain from taking short positions until a signal suggests it is appropriate.

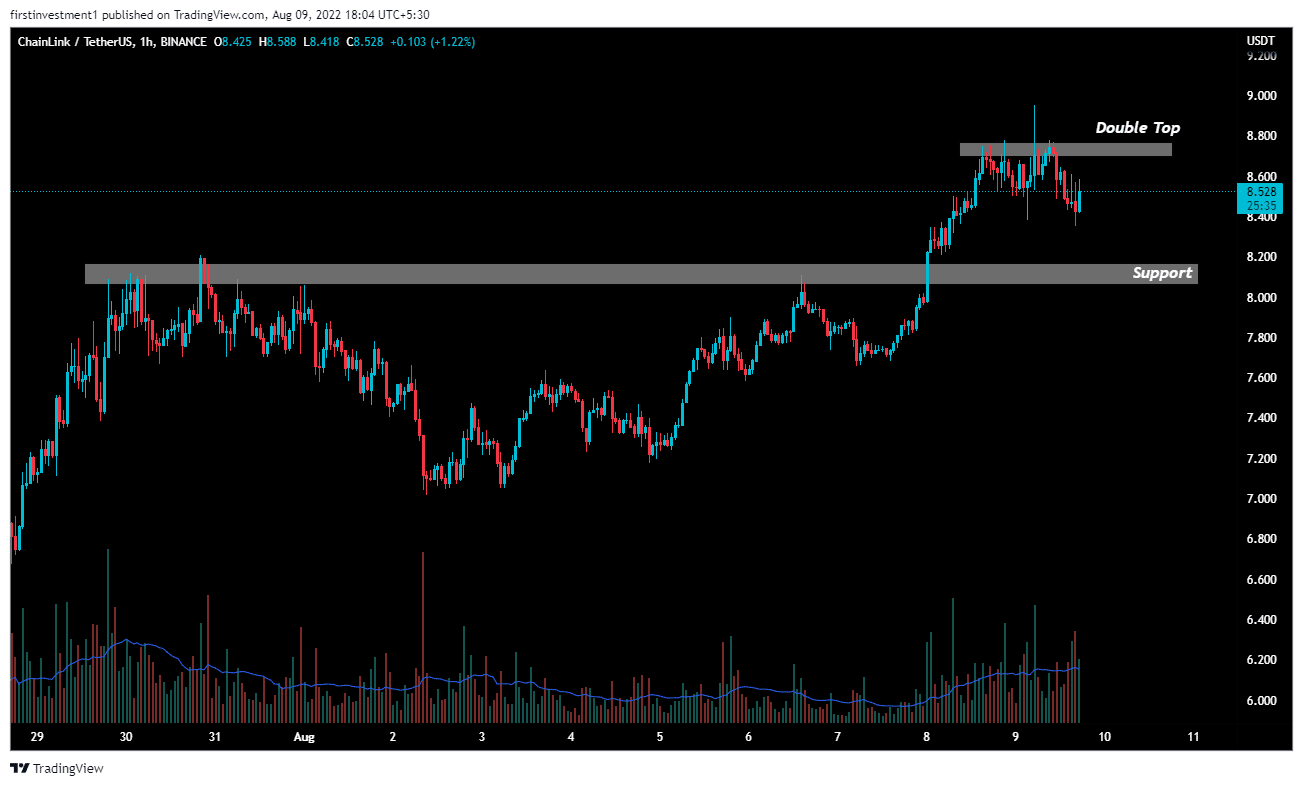

On the hourly time frame, the price formed a ‘Double Top pattern, indicating selling pressure on higher levels.

These constitute two-possible scenarios. First, if the price is not able to break above $8.760 within a day, then we can expect a good fall of up to $8.13.

Secondly, if the price is able to break above $8.760, then we can expect a good bullish momentum of up to $9.4. As reflected by above-average volumes, there is a higher probability of breaking above the $8.760 level, which is also resistance for now.

Conclusion

Chainlink price is consolidating with a positive bias on all time frames. Above $8.800 on a daily basis closing, we can put a trade on the buy side.

As of press time, LINK/USD is reading at $8.58, down 0.37% for the day. According to CoinMarketCap data, the 24-hour trading volume held near $642,818,628 with more than 14% gains.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Close Story

[ad_2]

Source link

Leave a Reply