Post-Correction Rally May Drive Solana Prices Above $38.6; Enter Now?

[ad_1]

Published 2 hours ago

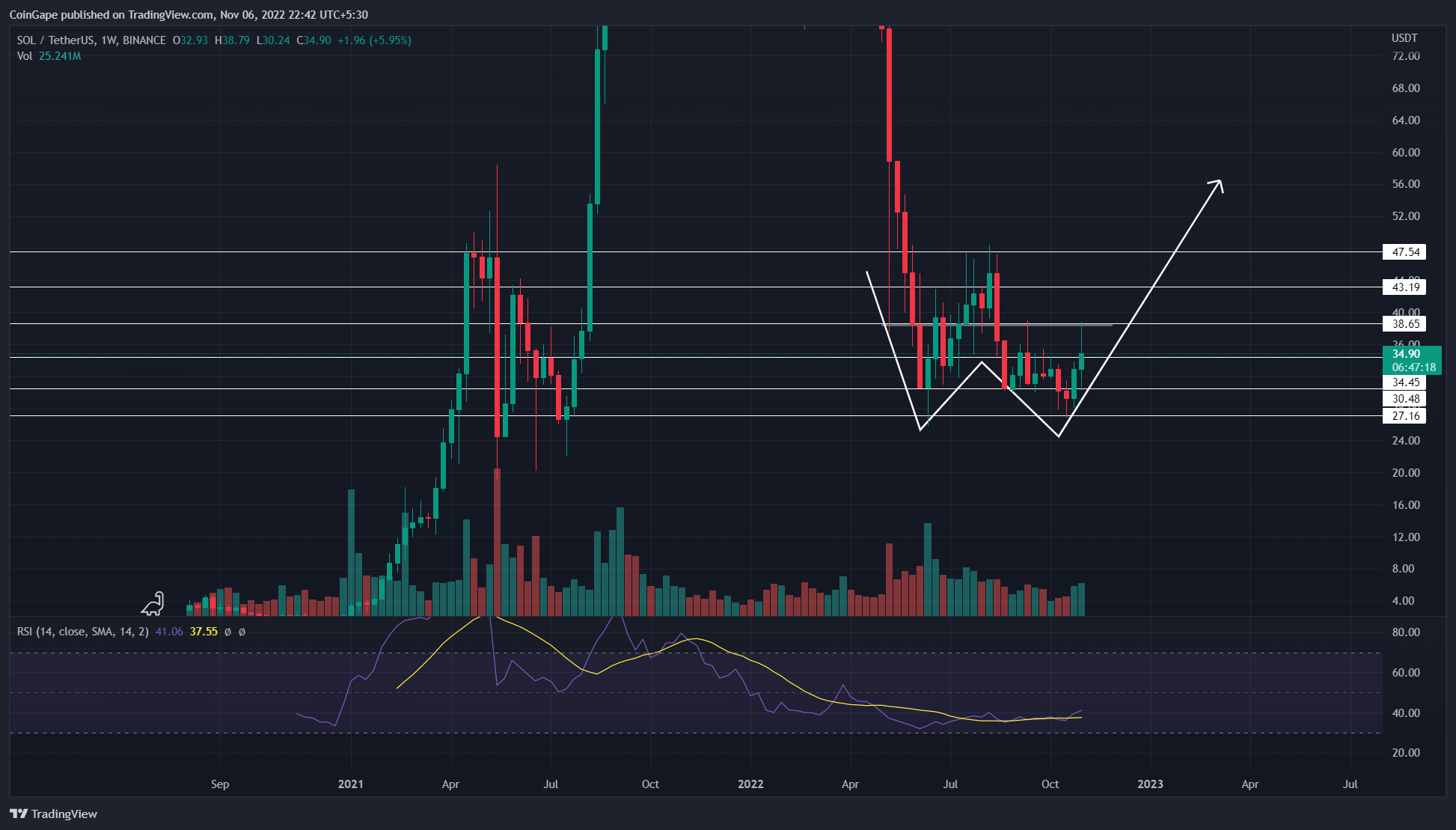

With the recent news of Google cloud becoming a Solana validator, the SOL price witnessed a significant inflow. On November 4th and 5th, the bullish rally showed a 26% gain and hit the monthly resistance of $38.65. However, the supply pressure at this resistance triggers a minor correction with a pullback opportunity for interest traders.

Key points

- The combined support of 0.382 Fibonacci retirement level and $34.5 offers a suitable launchpad to resume price recovery.

- Significant growth in daily-RSI slope validates high momentum recovery in Solana.

- The 24-hour trading volume in the Solana coin is $1.827 Billion, indicating a 9% loss.

Source-Tradingview

Source-Tradingview

The late October recovery rally in the crypto market triggered a sharp recovery in Solana price. The bullish reversal registered a 40% growth over the past two weeks and breached local resistances such as $30.5 and $34.5.

However, the altcoin could not break the $38.65 supply zone, resulting in a minor correction to the breached resistances. A volume retest candle indicates a temporary pullback which should eventually lead to the resumption of prevailing recovery.

The post-correction rally could push the prices above the monthly resistance of $38.65.

A bullish Pattern S+potted In Solana’s weekly chart

Source-Tradingview

Source-Tradingview

The Solana price shows a double bottom pattern in the weekly time frame chart. This bullish pattern is well known for trend reversal and offers a long position entry to interested traders. Thus, a breakout from the $38.65 barrier should intensify the bullish momentum for a rally to $47.5.

The $47.5 level stands as a neckline resistance for the aforementioned pattern, holding huge growth potential upon its breakout.

Conversely, a daily candle closing below $34.5 support will weaken the bullish thesis.

Technical indicator

MACD indicator: the MACD and signal lines jump above the neutral zone with a significant gap indicating growth in underlying bullishness.

EMAs: the rising coin price recently breached the 100-day EMA slope, which offers an extra edge for bull rally resumption. Moreover, a bullish crossover between the 20-and-50-day EMAs should attract more buyers in the market.

Solana Price Intraday Level

- Spot price:35.19

- Trend: Bearish

- Volatility: Medium

- Resistance levels: $38.65 and $43.2

- Support levels: $34.5 and $30.5

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Close Story

[ad_2]

Source link

Leave a Reply