Polkadot Treasury releases latest report as concerns loom over DOT’s future

[ad_1]

- Polkadot’s treasury released its latest spending report showing higher expenditure but with a twist.

- DOT bulls have a chance at regaining control but on-chain data revealed demand hesitation.

Is the Polkadot ecosystem struggling as crypto winter extends its grip? As of 20 October, Polkadot released its latest treasury spending report and it offers some insights into the state of the network.

Is your portfolio green? Check out the DOT Profit Calculator

The Treasury spending report revealed how the Polkadot ecosystem faired in the last 12 months and by extension, the last four years. According to the report, the Polkadot Treasury’s spending registered 4 years of consecutive growth in the last four years.

For perspective, their spending jumped from $13.4 million in 2022 to $21.06 million in 2023. Note that this accounts for the last 12 months as of 18 October.

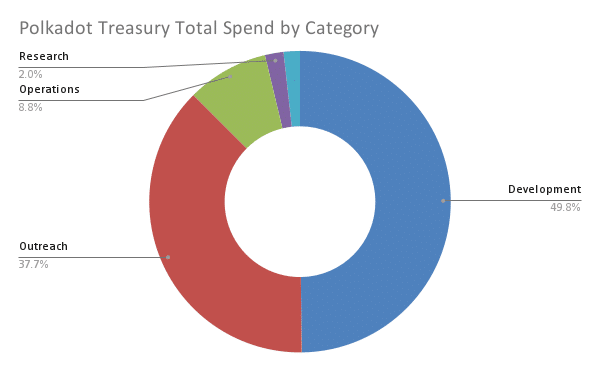

As of October 18, the Polkadot treasury has spent a total of US$21 million (3.9 million DOTs) in 2023, compared with US$13 million (1.7 million DOTs) last year. Development spending accounts for half, outreach spending 38%, operating expenses 9%, and research and other 2%.…

— Wu Blockchain (@WuBlockchain) October 20, 2023

The report revealed that most of the network’s spending went into development. A substantial amount went to outreach which included educational activities, media productions, and social activities. The fact that most of the funds were allocated toward development was a good sign. This was because it indicated that the network focused on building Polkadot’s ecosystem.

Source: Polkadot

While the above-mentioned data suggested that the Polkadot Treasury has been maintaining its focus on growth, the report may have revealed something concerning. Polkadot-related projects have reportedly been trimming their labor force. A sign that the ecosystem could be feeling the pressures of crypto winter.

DOT attempts to bounce back after a new YTD low

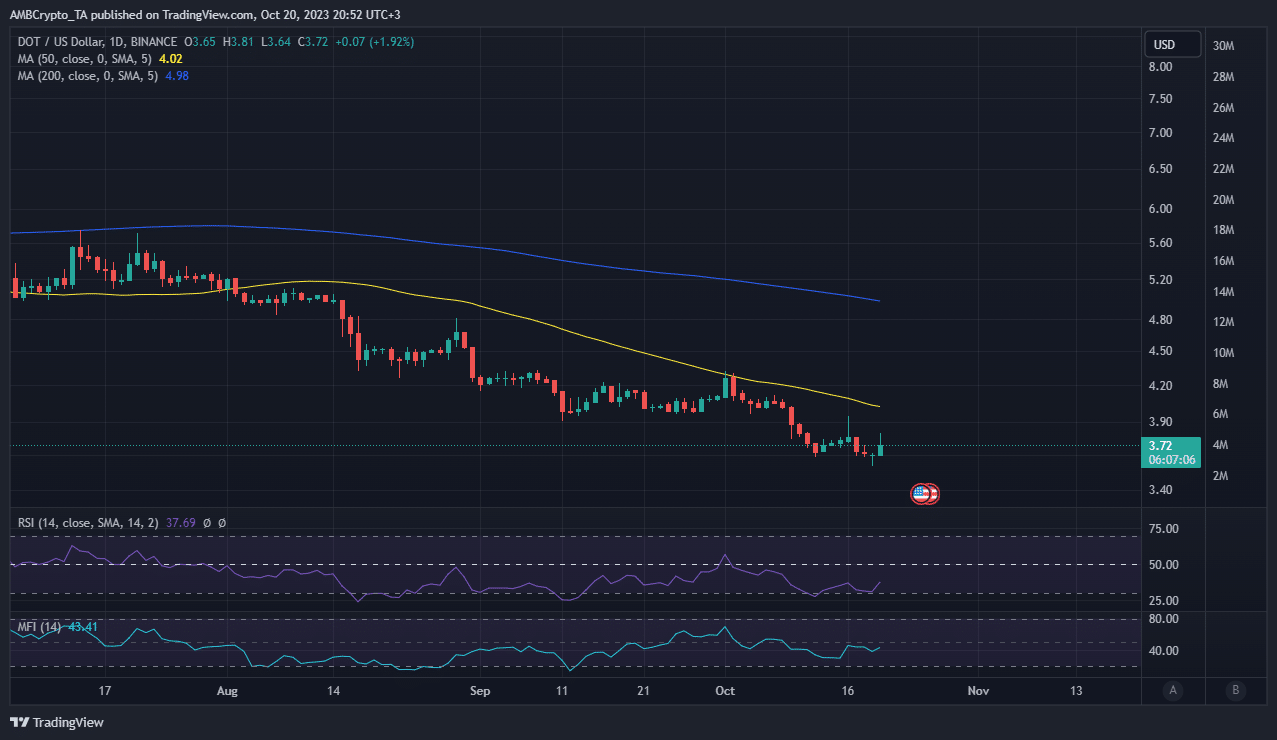

The concerns related to crypto winter resonate with Polkadot’s native cryptocurrency DOT which recently dropped to a new three-year low of $3.57. Lower highs on the Relative Strength Index (RSI) as compared to lower lows on the price action suggested that some bullish momentum has been building up may explain the bullish price action observed in the last 24 hours.

Source: TradingView

Are there signs that demand is rallying? Technically, declining sell pressure should give way to demand. However, demand also has to exist to take advantage and push prices higher.

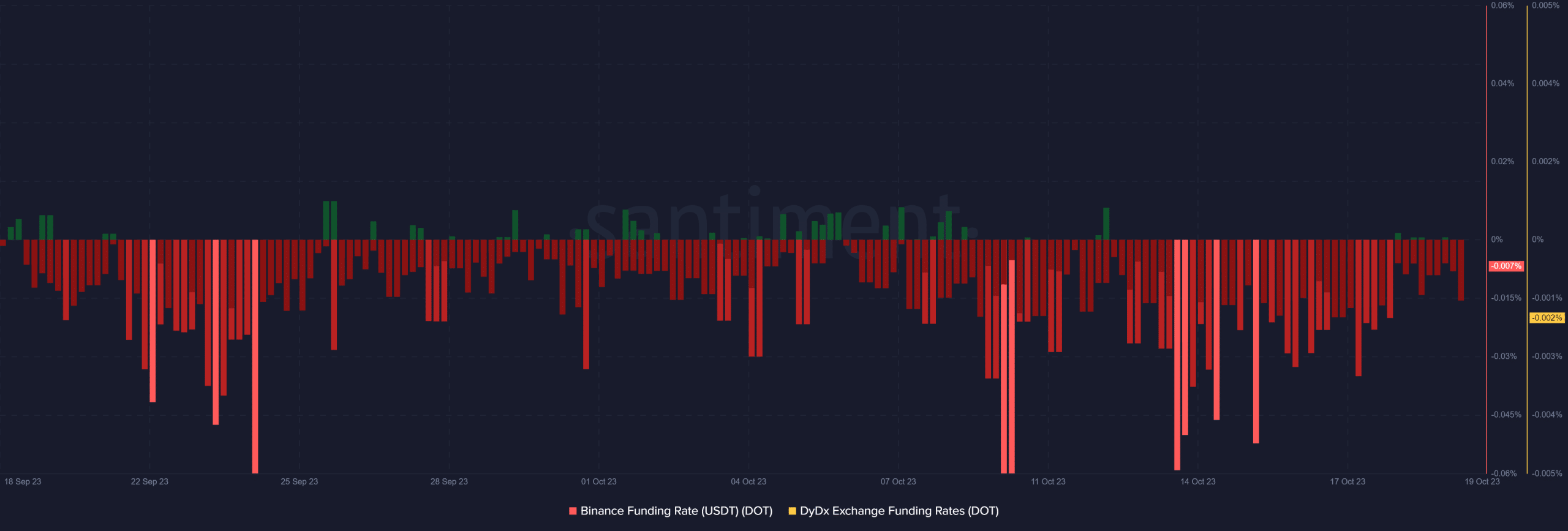

The state of demand in the derivatives industry revealed that negative funding rates have dominated in the last four weeks. Hence, the focus was on downside. It reflected the bearish price action but the negative funding rates have been declining.

Source: Santiment

Read about Polkadot’s price prediction for 2024

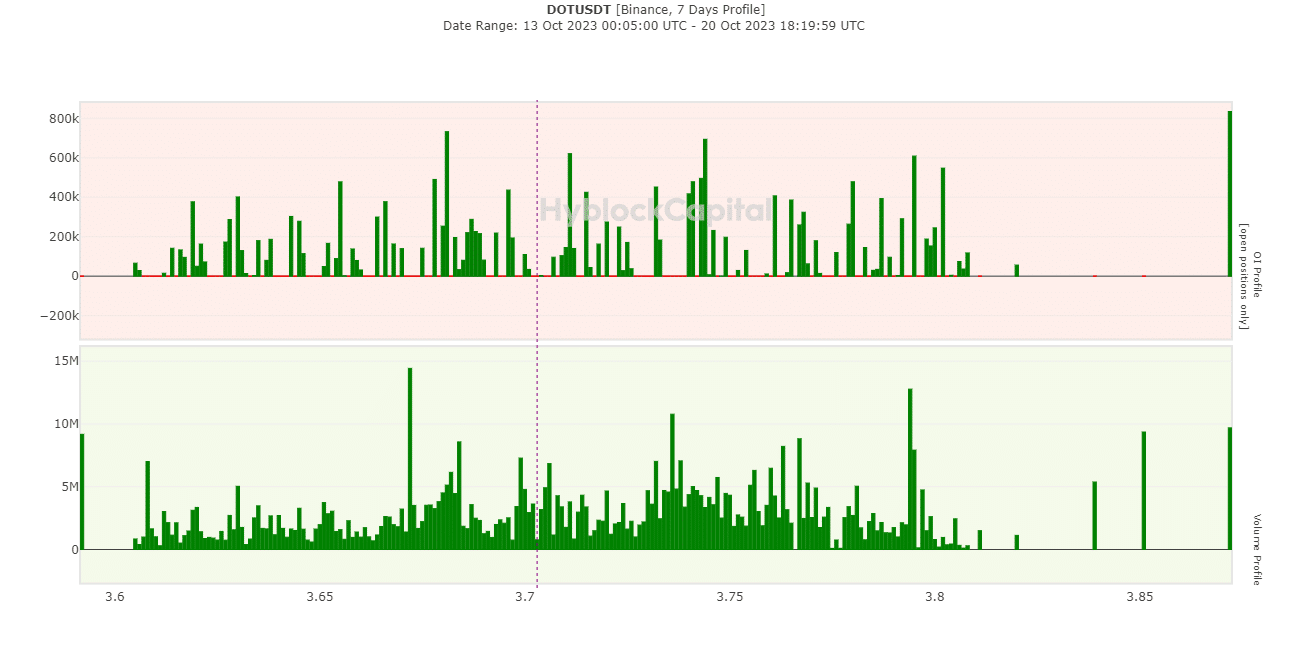

Despite the declining negative funding rates, positive funding rates have almost been non-existent. This suggested a demand in the derivatives market. We also observed a similar situation in the level of open interest. Binance’s OI and volume profile revealed that they dipped in the last three days as opposed to their performance in the few days prior.

Source: Hyblock

The same metric also highlighted a large spike in volume and open interest in the last 24 hours. This reflected the bullish price action, suggesting that we could see a surge in demand.

[ad_2]

Source link

Leave a Reply