PEPE: A rally is likely if bulls defend this support level

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bears looked to extend dominance, with prices resting on a key support level.

- Supply on exchange rose, hinting at increased selling pressure.

The selling pressure on Pepe [PEPE] strengthened after bears flipped the $0.00000151 support to resistance. This suggested a weakening of buyers which could have a significant impact on PEPE’s long-term price action.

Read Pepe’s [PEPE] Price Prediction 2023-24

Meanwhile, the last 48 hours have been a rollercoaster in the crypto market. Bitcoin [BTC] pumped from $28.9k to $30k before retracing to trade at the $29k price level again, as of press time.

With BTC’s movement having minimal effect on PEPE, price action at this critical support level could be key to the memecoin’s next price move.

Bears look to extend dominance

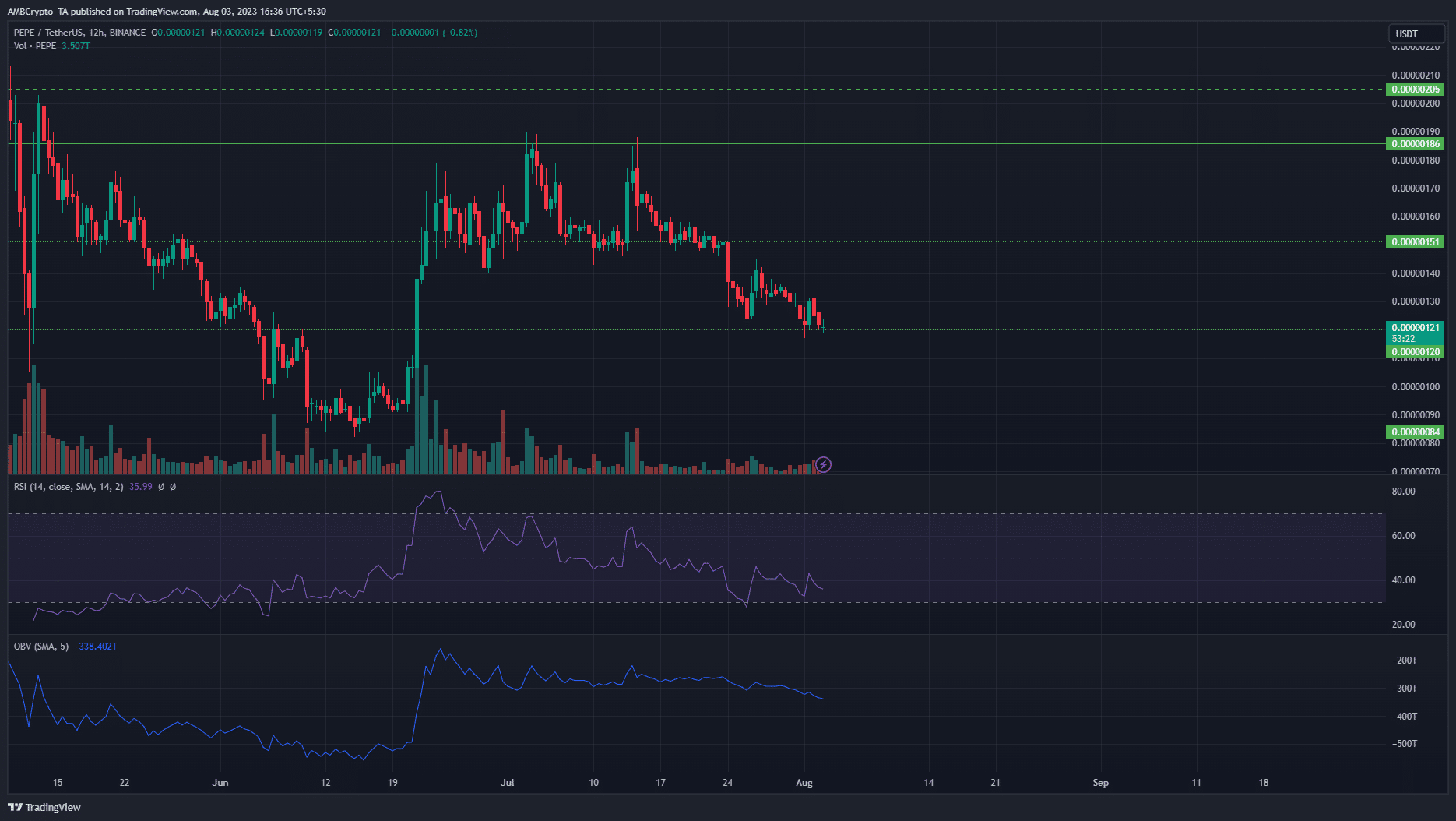

Source: PEPE/USDT on Trading View

After PEPE’s bullish momentum hit a major barrier at the $0.00000186 price zone, bears controlled the price action. A 20% drop between 14 July and 24 July took PEPE to the $0.00000151 support. The bullish defense at this level was quickly blown away with another 20% drop taking it to the critical $0.00000121 level.

The $0.00000121 price zone is vital for bulls, as the last bullish rally had to flip this level for sustained gains. If bulls surrender this level, PEPE could hit another year’s low between $0.00000080 – $0.000001.

Although the price chart highlighted the bearish dominance, whale movements hinted at an accumulation of PEPE at low prices.

A recent report highlighted a significant outflow of 677 billion PEPE tokens from a major exchange. If the accumulation trend continues, bulls can expect a rally from this support level.

90d Mean coin age declined

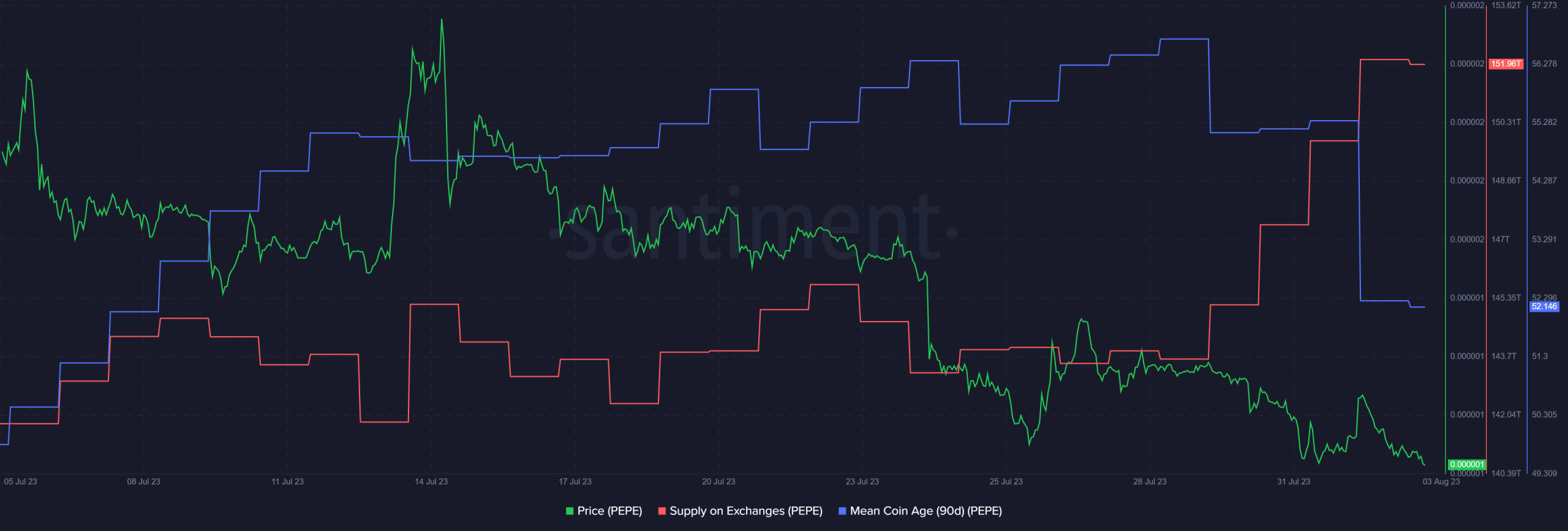

Source: Santiment

A look at PEPE’s on-chain metrics from Santiment showed a dip in its 90d mean coin age. The drop-off hinted at increased movement between addresses, which suggested that traders could be preparing for another off-load.

How much are 1,10,100 PEPEs worth today?

Closely related, the supply on exchanges rose, which signaled where the tokens being moved were ending up. The increase in supply on exchanges could lead to additional selling pressure.

A further price slump from the press level could see price reach $0.000001. This was where the previous rally began in mid-June, and buyers will be hoping for similar results.

Leave a Reply