LDO Breakout: Is $3.20 Next for Lido DAO?

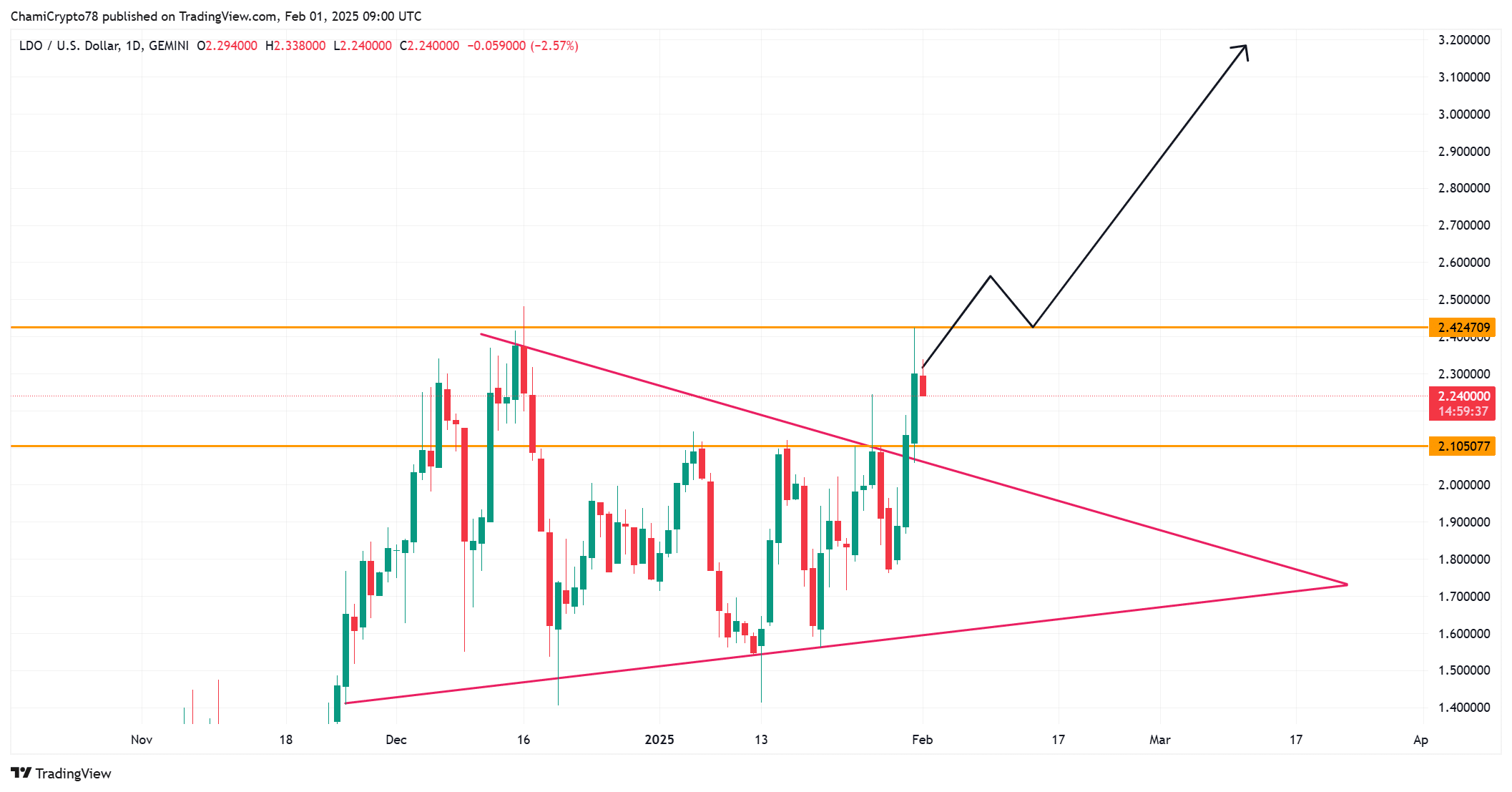

Lido DAO (LDO) recently broke above its descending triangle pattern, sparking optimism among traders. This bullish move suggests strong buying pressure, with price targets potentially reaching $2.80 and possibly $3.20. At the time of writing, LDO is trading at $2.29, up 6.95% in the last 24 hours. However, resistance levels remain, raising questions about the sustainability of this momentum.

Lido's Permissionless Staking and Ethereum

Lido's permissionless staking is transforming Ethereum's staking landscape. Unlike traditional methods requiring 32 ETH, Lido enables users to stake smaller amounts, boosting decentralization and accessibility for smaller investors. This approach enhances Ethereum's security by distributing validation power more widely, potentially increasing LDO's long-term value.

LDO's Potential for Further Growth

The breakout from the descending triangle is a significant bullish signal, often indicating a trend reversal. The next key resistance level is $2.42. A successful breach could propel LDO towards $2.80 and potentially $3.20. Conversely, failure to hold above the breakout level might lead to a retest of $2.10. Increased trading volume is crucial for confirming the strength of this move.

Source: TradingView

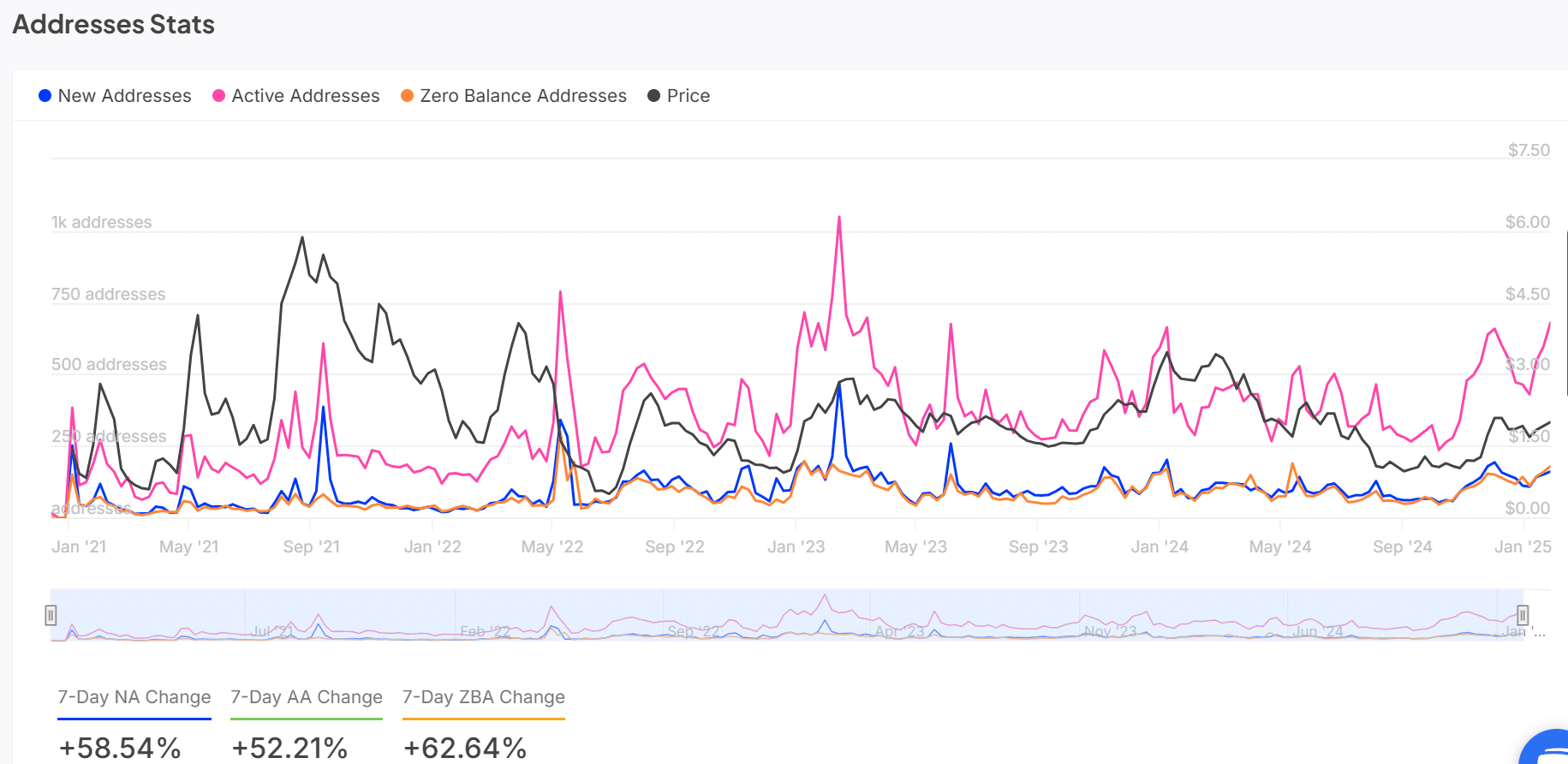

Growing Investor Interest: Address and Whale Activity

On-chain data shows a remarkable increase in activity: 58.54% more new addresses and 52.21% more active addresses, indicating growing retail participation. This rise often correlates with bullish price movements and reflects increased confidence in Lido's ecosystem.

Source: IntoTheBlock

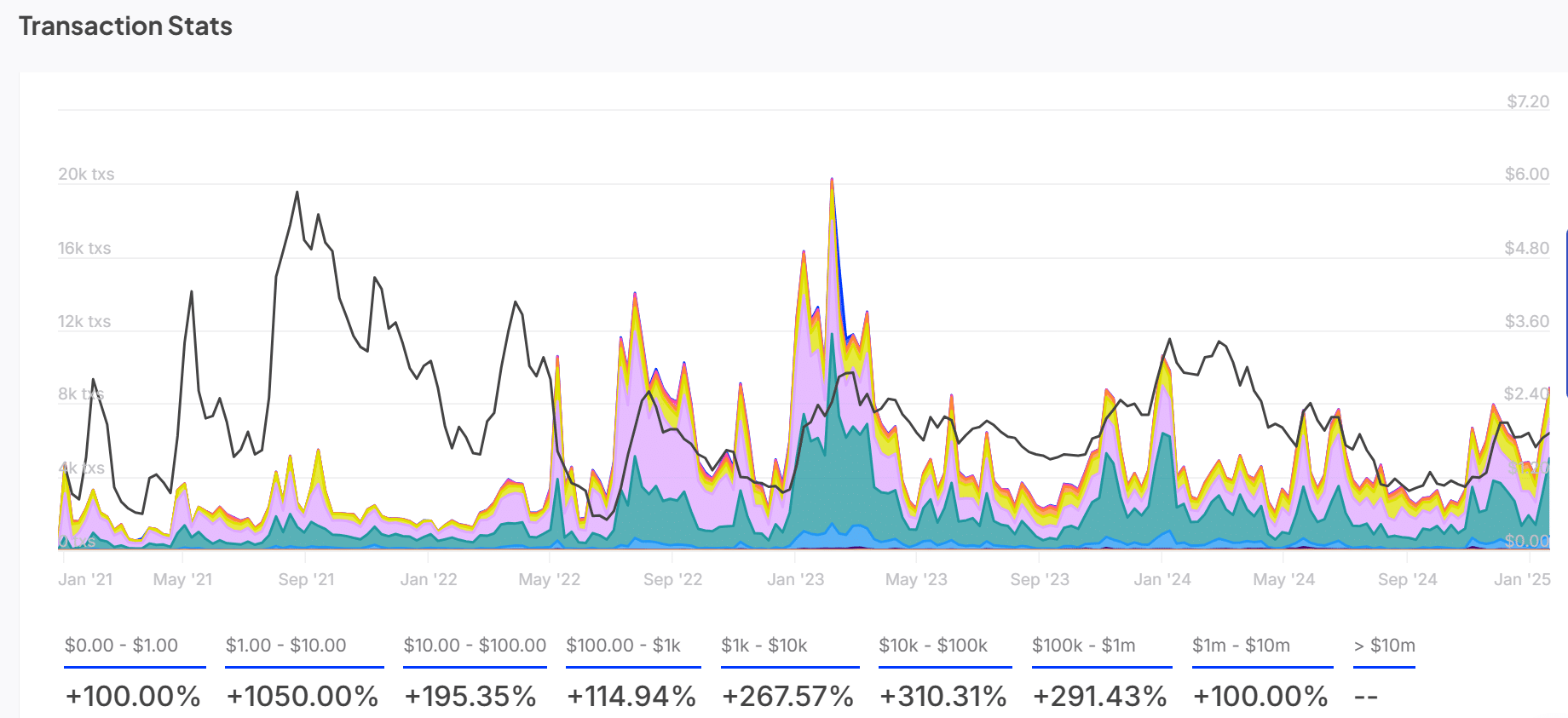

Large transactions ($100k-$1M) also surged by 291.43%, suggesting significant accumulation by institutional investors and whales. This accumulation often stabilizes prices and can precede significant breakouts.

Source: IntoTheBlock

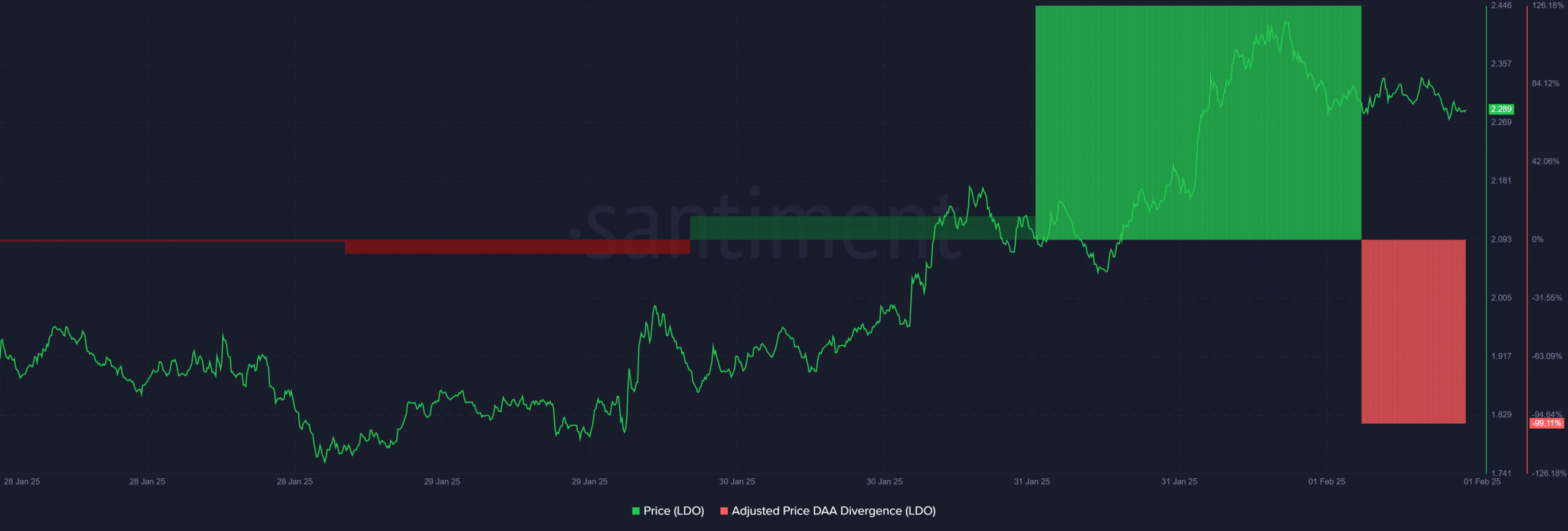

Price Divergence: A Note of Caution

Despite the bullish breakout, a significant negative price divergence (-99.11%) is observed. This means price growth is not fully supported by increasing network activity, which may signal a potential slowdown or correction.

Source: Santiment

Conclusion: Weighing the Risks and Rewards

While LDO's breakout, increasing address activity, and institutional accumulation paint a positive picture, the price divergence warrants caution. Breaking $2.42 is crucial for confirming further upside. However, a temporary pullback remains a possibility. Codeum provides comprehensive blockchain security services, including smart contract audits, to help navigate the complexities of the crypto market. Contact us for a consultation.