Ethereum Price Surge: Low Supply, High Leverage

Ethereum (ETH) has experienced a significant 9% price increase over the past week, mirroring a broader cryptocurrency market recovery from recent lows. This rally is fueled by improving market sentiment, but two key on-chain metrics suggest further ETH price momentum is possible.

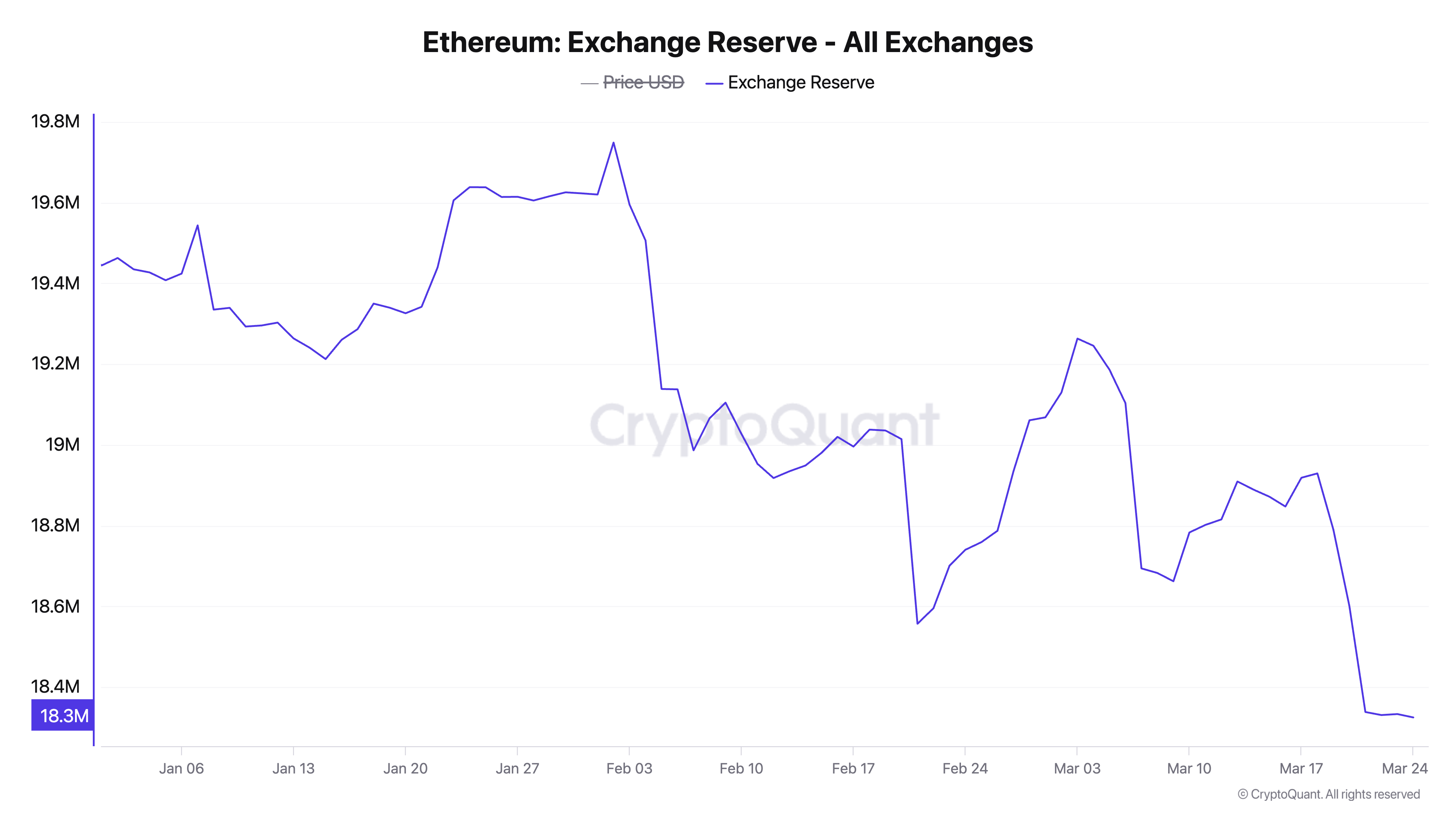

ETH Supply at Yearly Low

On-chain data shows ETH's exchange reserve has reached its lowest point this year, dropping to 18.32 million ETH—a 7% decrease from its February 2nd peak of 19.74 million. This signifies a reduction in the amount of ETH immediately available for trading.

This decrease in supply, coupled with consistent demand, typically creates upward price pressure. Holders are moving ETH off exchanges for long-term storage, staking, or participation in spot ETH ETFs.

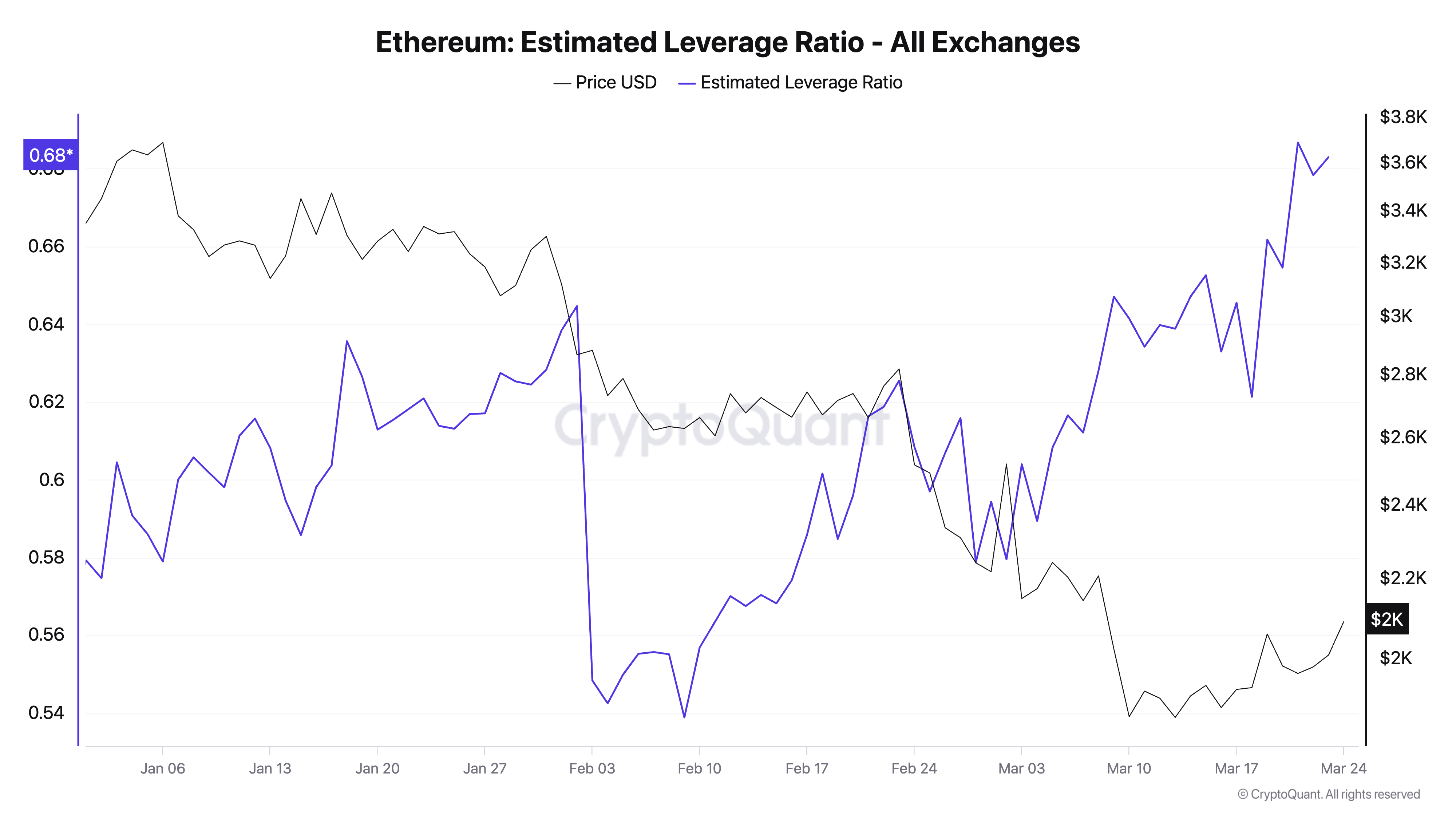

Rising Leverage Signals Increased Confidence

Simultaneously, Ethereum's Estimated Leverage Ratio (ELR) has increased, indicating traders are employing leverage to magnify their ETH bets. The ELR reached a year-to-date high of 0.686 on March 21st, slightly retracting to 0.683 currently.

This heightened leverage suggests considerable confidence in a near-term price rally, despite previous price challenges. Traders are willing to take on increased risk to potentially amplify their returns.

ETH's Price Outlook: Bulls vs. Bears

Currently trading at $2,089, ETH's Elder-Ray Index shows a positive 52.80 value, indicating growing bullish momentum. This is its highest reading in 30 days.

A continuation of bullish pressure could push ETH towards $2,148. However, if bearish sentiment returns, the price might drop to $1,759.

Disclaimer: This analysis is for informational purposes only and should not be considered financial or investment advice. Market conditions are volatile. Conduct thorough research and seek professional advice before making financial decisions.

Codeum: For secure and reliable smart contract development and blockchain solutions, consider Codeum’s services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies.