Ethereum Price: Will $3000 Hold?

Ethereum Price Fluctuation: A Critical Juncture

Ethereum (ETH) has rallied 19% in the past week, pushing its price close to $3,000. While this upward trend is fueled by broader market optimism, potential profit-taking poses a significant challenge to sustaining this level.

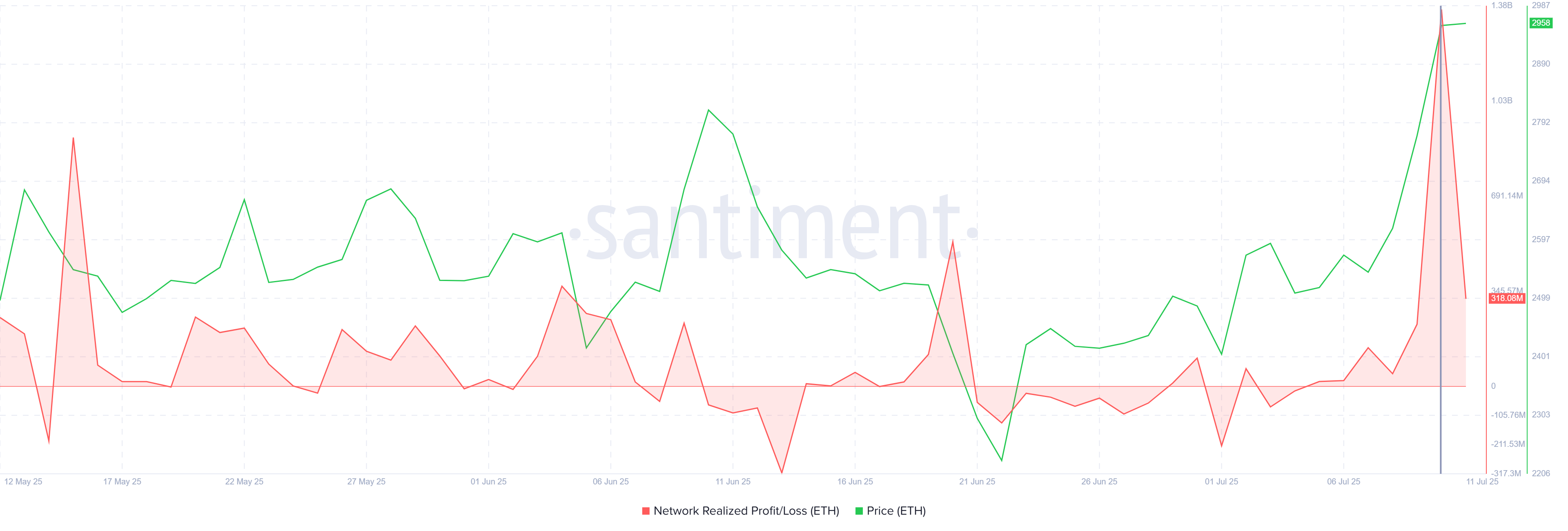

Significant Selling Pressure Emerges

The Network Realized Profit/Loss metric has surged to $1.36 billion, the highest since December 2022. This indicates substantial selling pressure, with the last 24 hours showing the highest sell-off in 31 months. Historically, such events precede price corrections, urging caution.

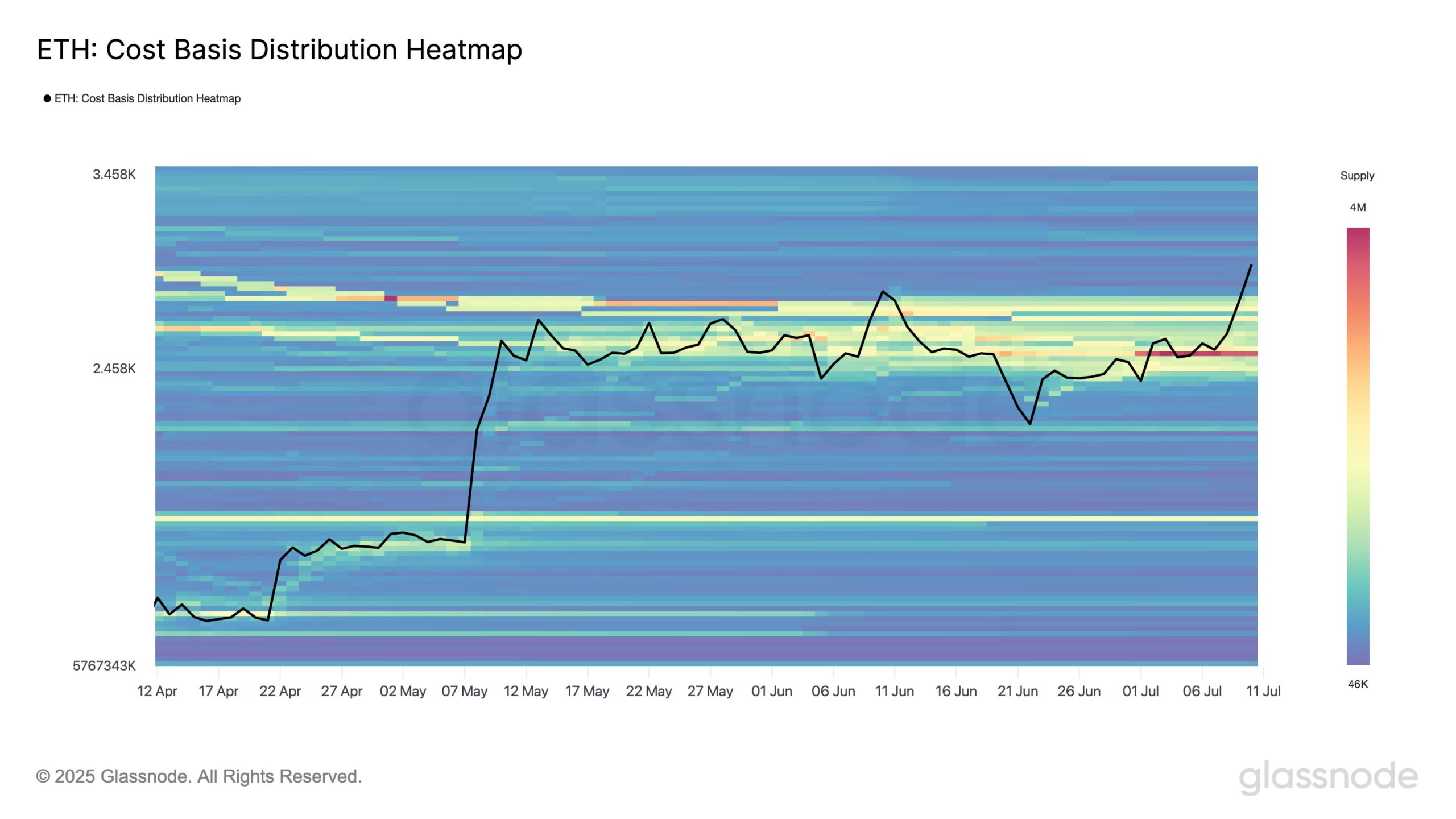

Analyzing Support Levels

Ethereum's cost basis distribution reveals a strong accumulation zone around $2,500, with over 3.45 million ETH having a cost basis near this level. This acts as a significant support, as evidenced by the recent bounce off $2,533.

The $3,000 Resistance: A Make-or-Break Point

Ethereum currently trades just below $3,000. After a five-month wait, breaking this resistance is crucial. However, sustaining $3,000 as support is the key challenge. Failure to do so could limit further gains.

While short-term profit-taking could cause a pullback, continued Bitcoin uptrend and overall bullish market sentiment could push Ethereum towards $3,530, confirming the ongoing bullish momentum. However, a significant correction could drop ETH below $3,000, potentially undoing this week's gains, though strong support at $2,500 is expected to limit the fall. This could delay a sustained move above $3,000 into Q3.

Codeum Note: Codeum offers comprehensive blockchain security solutions, including smart contract audits, KYC verification, and custom smart contract development to ensure the safety and success of your projects. Partner with us for robust security and seamless development.