Ethereum Price Consolidation: What's Next?

Ethereum (ETH) has seen a 9% increase over the past week, yet its price remains stubbornly around the $2,000 mark. While this upward movement is encouraging, several key indicators suggest a market lacking clear directional momentum.

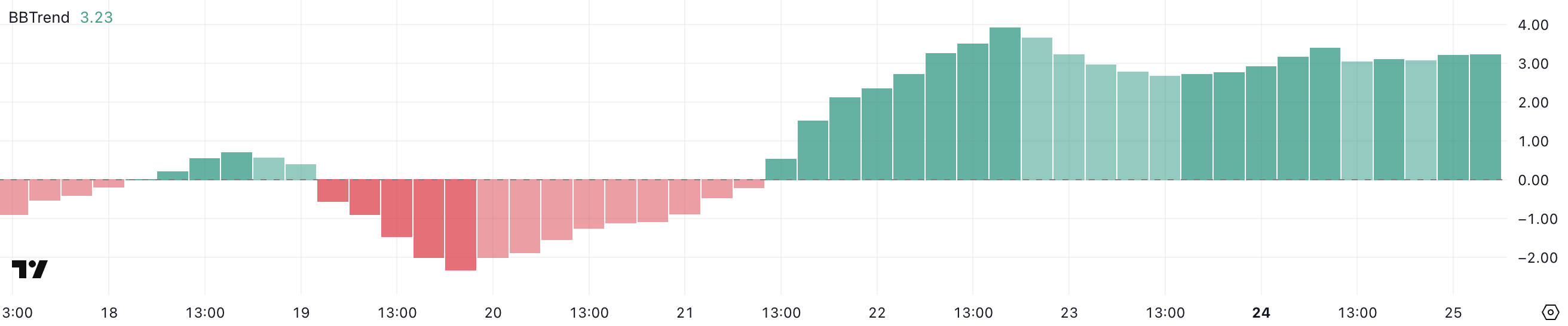

Ethereum BBTrend: A Positive, Yet Uncertain Signal

Ethereum's BBTrend currently sits at 3.23, remaining positive for three consecutive days. This indicator peaked at 3.93 on March 22, suggesting short-term strengthening. However, the last time it surpassed 5 (indicating strong trending conditions) was February 26. This sustained positive reading, although not aggressively so, hints at regaining momentum. Values below 0.5 signal a lack of trend, while readings above 1.0 show increasing strength; above 3 suggests a solid trend, and above 5 a very strong one.

Source: TradingView

The BBTrend (Bollinger Band Trend) measures price trend strength by quantifying price deviation from its mean, using Bollinger Bands. While the current 3.23 reading suggests some directional conviction, the absence of readings above 5 in the last month indicates ETH is trending but not experiencing a breakout or high-momentum phase.

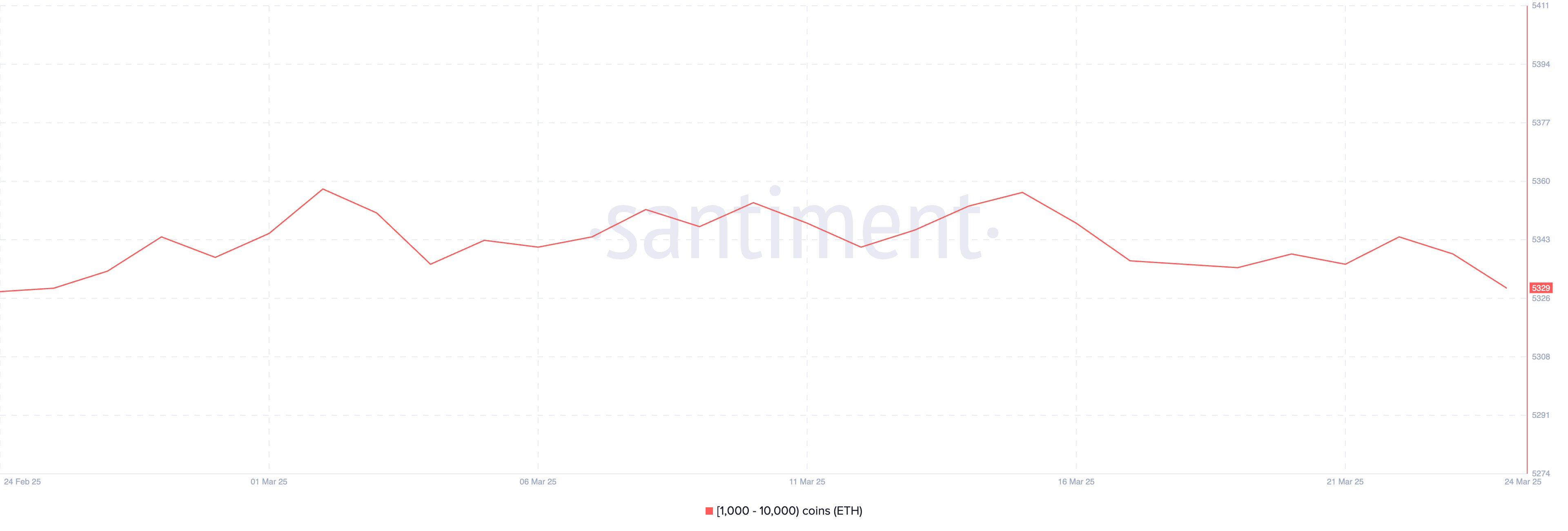

Whale Activity: A Month-Low Signals Caution

The number of Ethereum whales (wallets holding 1,000-10,000 ETH) has decreased to 5,329, a one-month low. This slight drop from 5,344 three days prior suggests a reduction in large-holder confidence or positioning. Even small changes in whale behavior can significantly impact the market, especially with moderate trend indicators.

Source: Santiment

Monitoring Ethereum whale wallets is critical because these large holders can influence price through substantial buying or selling. A declining whale count might indicate profit-taking, repositioning, or a more cautious stance among major investors, potentially limiting upside momentum in the near term.

Will Ethereum Fall Below $2,000?

Ethereum's EMAs show consolidation near the $2,000 level. If ETH tests the key support at $1,938 and fails to hold, further declines towards $1,867 and potentially $1,759 are possible. Conversely, a sustained uptrend breaking through the resistance at $2,320 could trigger a rally towards $2,546, or even $2,855 if momentum accelerates.

Source: TradingView

Codeum provides crucial blockchain security services, including smart contract audits, KYC verification, and custom development for secure and robust DApps. Partner with Codeum for peace of mind in your blockchain projects.

Disclaimer: This analysis is for informational purposes only and not financial advice. Market conditions are subject to change. Conduct your own research before making financial decisions.