Ethereum Price Analysis: Poised for a $3,500 Rally?

Ethereum's recent failure to surpass $3,524 resulted in a price dip, leaving many wondering about its future trajectory. While volatility remains, several key indicators suggest a potential recovery is underway.

Signs of Ethereum's Recovery

Several factors point to a possible price increase for ETH:

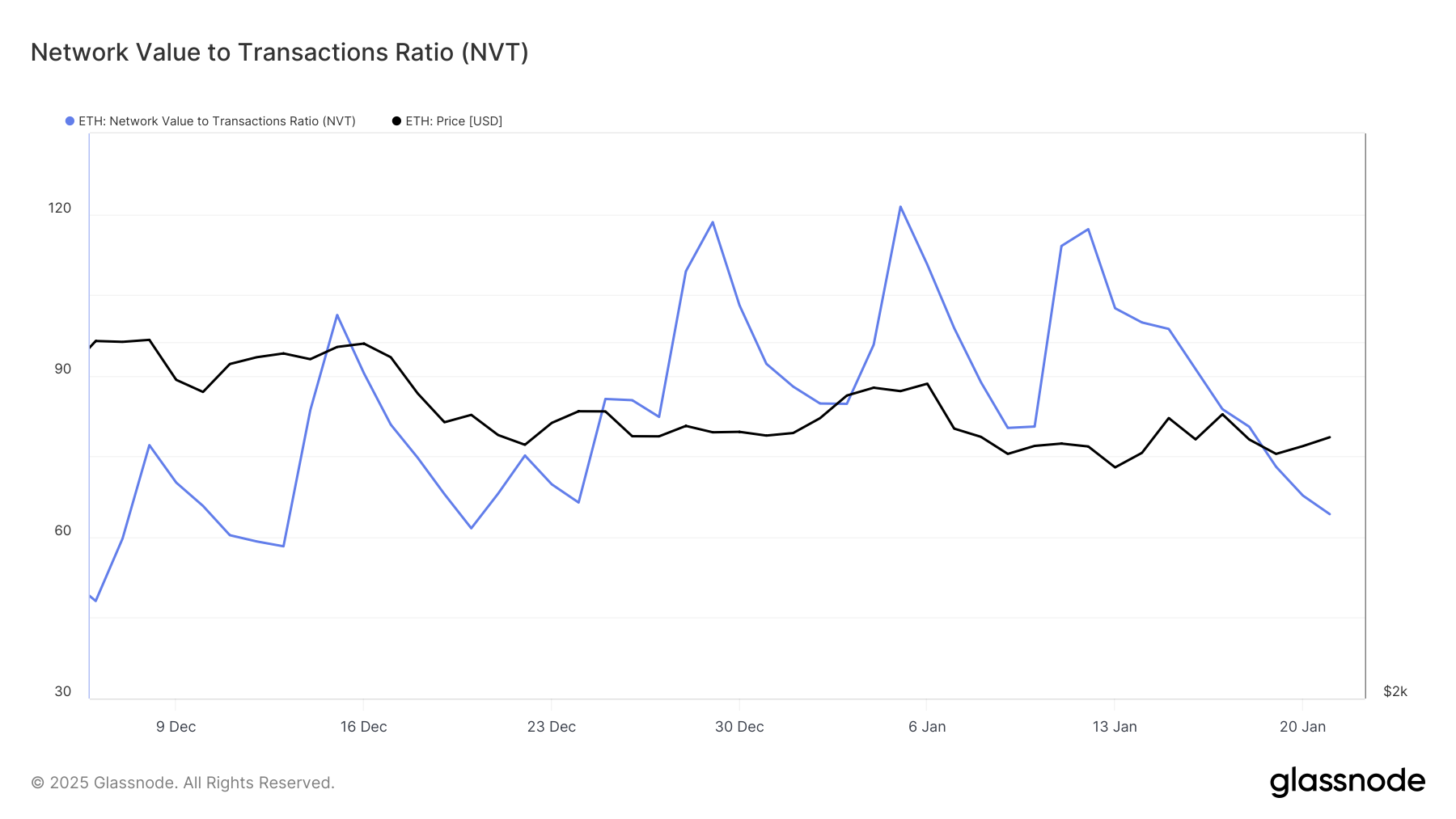

- Decreasing Network Value to Transaction (NVT) Ratio: A recent monthly low in the NVT ratio indicates a healthier balance between transaction activity and network value, suggesting reduced volatility and a potential catalyst for price recovery. This is illustrated in the following chart from Glassnode:

Source: Glassnode

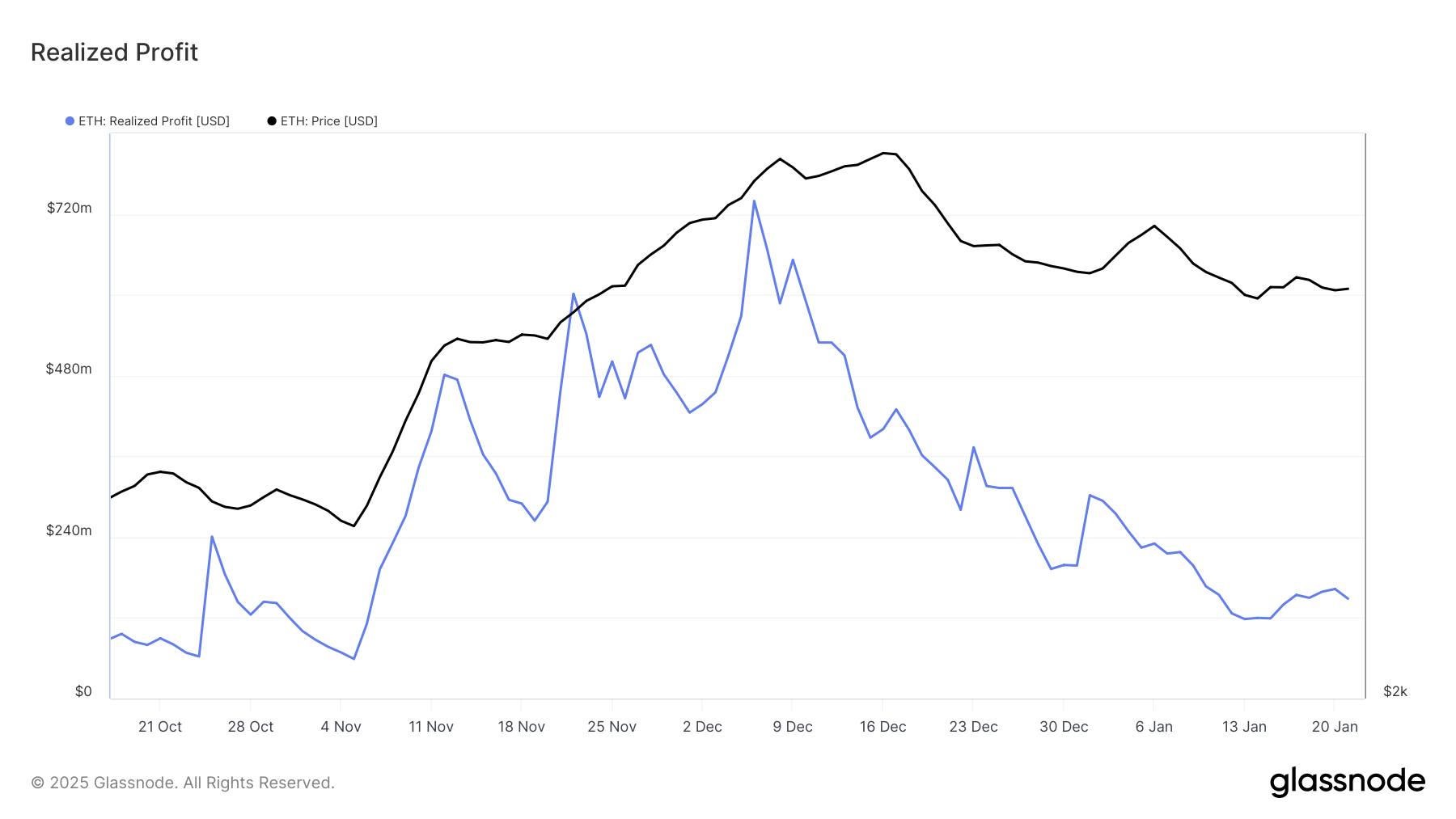

- Reduced Realized Profits: A six-week low in realized profits signifies decreased selling pressure. This suggests investors are holding onto their ETH, creating a more bullish market sentiment. The trend is highlighted in the chart below:

Source: Glassnode

ETH Price Prediction: Breaking the $3,500 Barrier

Currently trading near $3,300, Ethereum needs to overcome the resistance at $3,327 to initiate a rally towards $3,524—a potential 6% increase. Success here would clear the way for further growth, potentially targeting $3,711.

Source: TradingView

However, failure to establish $3,327 as support could lead to a retracement toward $3,200, delaying the path to $3,500. Careful monitoring of this key resistance level is crucial.

Codeum: Securing the Future of Blockchain

At Codeum, we understand the complexities of the blockchain space and the critical need for security. We offer a comprehensive suite of services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies, to help projects navigate the challenges and thrive in this dynamic environment. Contact us today to learn more.

Disclaimer: This price analysis is for informational purposes only and does not constitute financial advice. Market conditions are volatile. Conduct your own research and consult a financial professional before making any investment decisions.