Ethereum's Price: $3,000 on the Horizon?

Ethereum Futures Signal Potential Upside

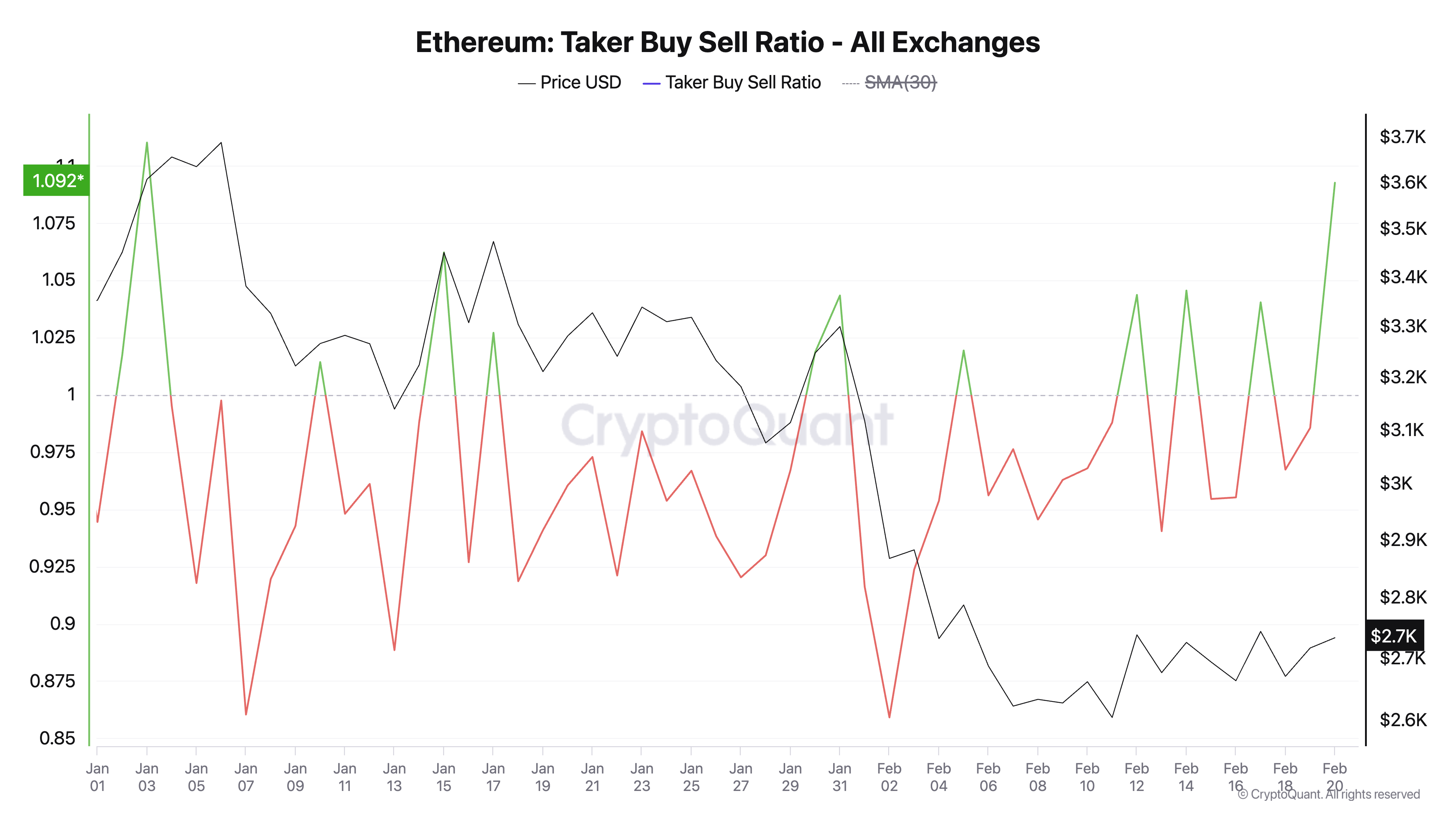

Despite trading sideways between $2,585 and $2,799 since early February, Ethereum (ETH) futures traders exhibit unwavering bullish sentiment. This is evident in a rising taker buy-sell ratio, reaching its highest point since early January.

Resilience in the Futures Market

Data from CryptoQuant reveals a 1.09 taker buy-sell ratio for ETH/USD, indicating significantly more buy volume than sell volume in the futures market. A ratio above 1 signifies bullish market sentiment.

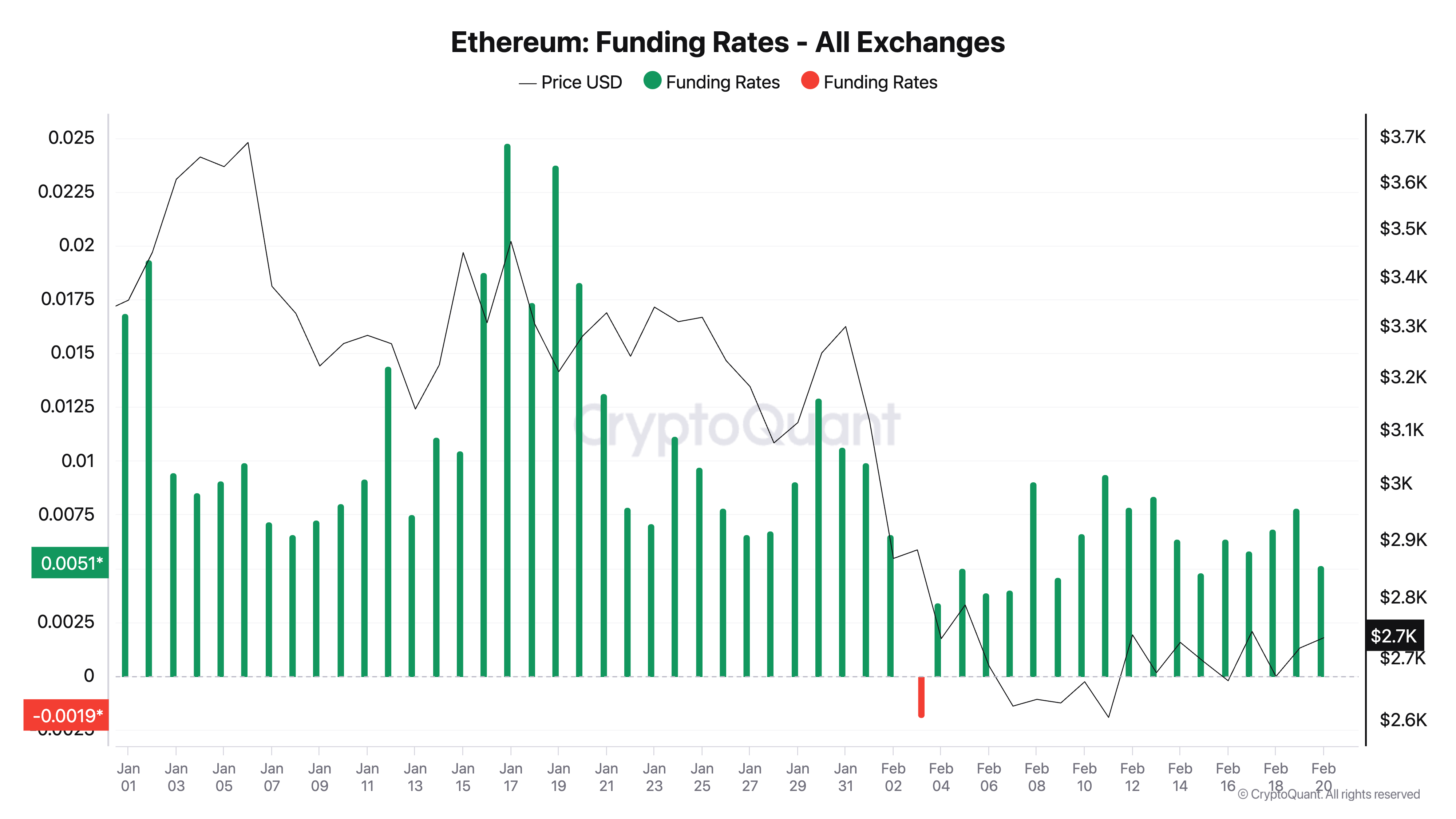

Further supporting this bullish outlook is ETH's positive funding rate, currently at 0.0051%. A positive funding rate suggests that long position holders (buyers) are paying short position holders, which reflects overall bullish market sentiment.

Targeting $3,000: A Realistic Scenario?

A decisive break above the $2,799 resistance could propel ETH towards $2,967. Continued strong demand at this level could lead to a rally beyond the key $3,000 mark, potentially reaching $3,202. However, a breakdown below the $2,585 support could trigger a price drop to $2,467, or even lower to $2,150 if buyers fail to defend this level.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Market conditions are volatile. Conduct thorough research and consult a professional before making investment decisions.

Codeum: For robust smart contract security and development, consider Codeum's services. We offer smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies.