Ethereum Holding Times Surge: Is a Price Breakout Imminent?

Ethereum Holding Times Surge: Is a Price Breakout Imminent?

Ethereum (ETH) has consolidated around the $3,500 mark for over a month. However, recent on-chain data suggests a potential shift could be underway, potentially leading to a price breakout.

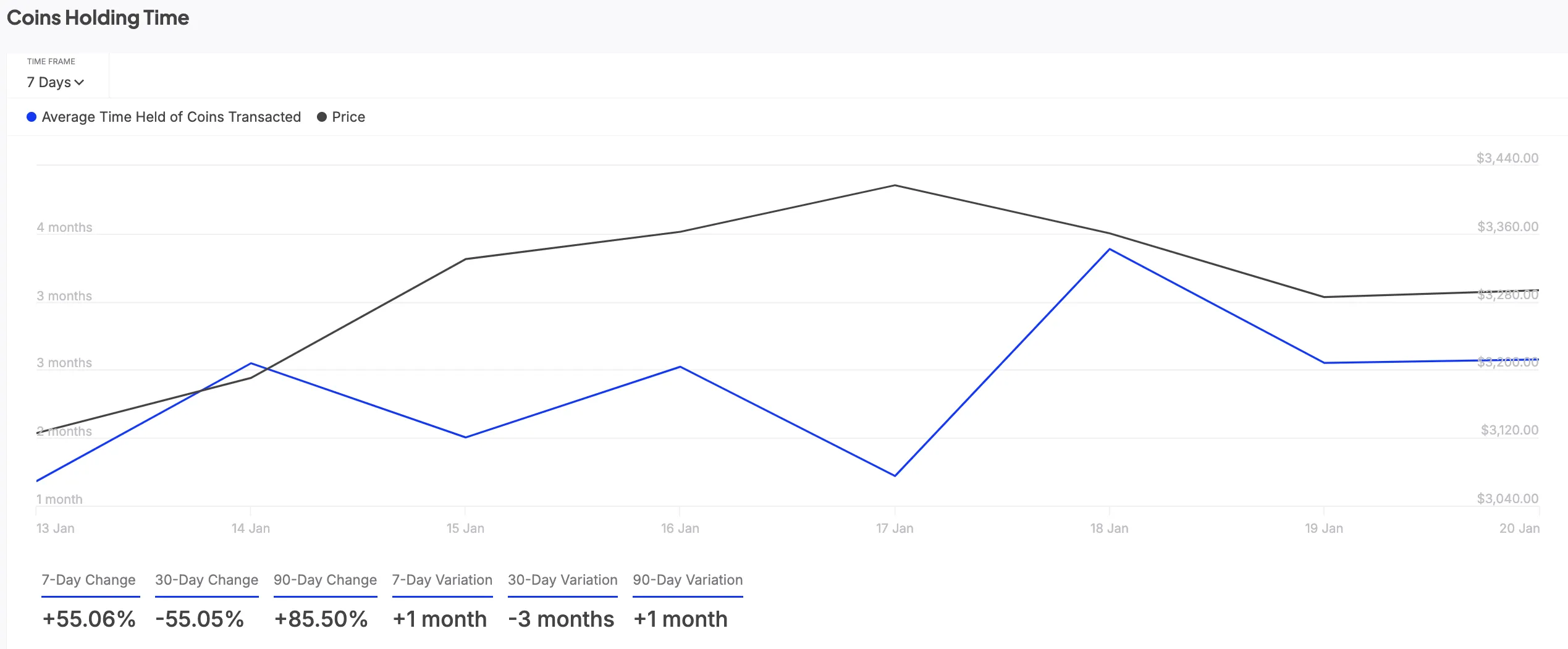

Increased Ethereum Holding Times

Analysis of on-chain data reveals a notable increase in the holding time of ETH coins over the past seven days. IntoTheBlock reports a 55% surge in holding time. This signifies stronger investor conviction and potentially reduced selling pressure, which could drive up ETH's price.

Longer holding periods indicate investors are less inclined to sell their ETH, which could be a significant bullish signal.

Positive Funding Rate Fuels Bullish Sentiment

Despite the sideways price movement, ETH's funding rate has remained positive, currently at 0.019%. This suggests consistent demand for long positions among futures traders, further bolstering the bullish outlook.

A positive funding rate indicates that more traders are betting on ETH's price rising. This is a crucial indicator of market sentiment.

ETH Price Prediction: A Potential Breakout?

The combination of increased holding times and a positive funding rate suggests a potential upside for ETH. A break above the resistance level of $3,516 could propel ETH towards $3,684. However, a failure to break this resistance might lead to a pullback towards the support level of $3,210.

Disclaimer: This analysis is for informational purposes only and should not be considered financial or investment advice. Market conditions are subject to rapid change. Conduct your own research and consult a financial professional before making any investment decisions.

Codeum Note: Codeum offers comprehensive blockchain security and development services, including smart contract audits, custom smart contract and DApp development, and tokenomics consultation to help mitigate risks and ensure the security of your projects.