ETH Price Surge Amid Solana Meme Coin Fallout

ETH Price Turns Bullish as Solana Meme Coin Drama Impacts Market

Ethereum (ETH) has shown a bullish price trend, breaking above $3,000 for the first time since February 2nd. This upward movement coincides with a noticeable capital outflow from Solana and inflow into Ethereum, supported by rising stablecoin reserves and Total Value Locked (TVL).

Short-term Exponential Moving Averages (EMAs) on the ETH price chart are trending upward, hinting at a potential golden cross that could propel ETH towards $3,020. This scenario suggests a possible 22% rally. Conversely, a failure to break through resistance could lead to another retest of key support levels.

Capital Flight From Solana to Ethereum

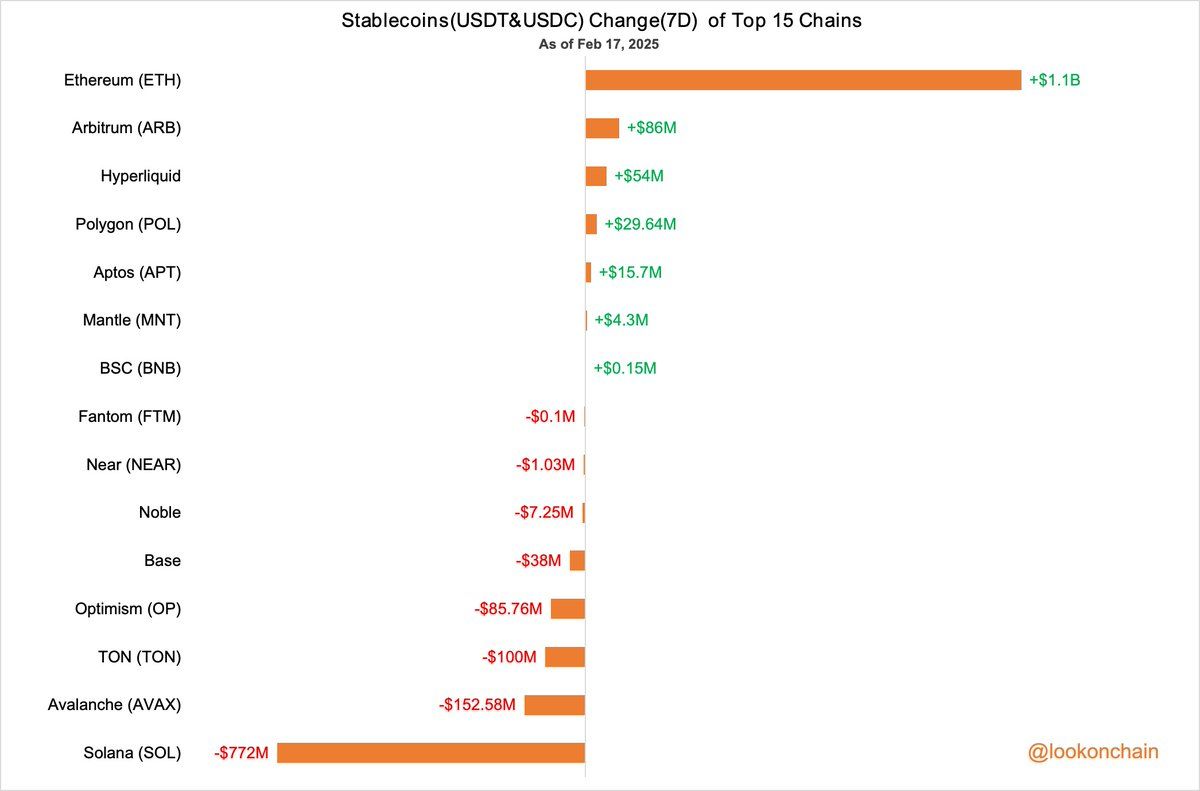

Data from Lookonchain reveals a significant shift in stablecoin holdings. Over the past seven days, Ethereum's USDC and USDT holdings increased by $1.1 billion, while Solana saw a $772 million outflow. This follows the launch of the LIBRA meme coin on Solana, raising concerns about the ecosystem's sustainability and prompting investors to move funds to Ethereum.

The uncertainty surrounding Solana's meme coin landscape and key protocols like Jupiter, Pumpfun, and Meteora, appears to be driving this capital flight. Traders are seemingly reducing their Solana exposure due to this increased risk.

Ethereum, meanwhile, benefits from this inflow, potentially boosting DeFi activity, trading volumes, and new token launches.

Ethereum TVL Rises While Solana's Declines

The trend is further evidenced by Total Value Locked (TVL) data. Solana's TVL, which peaked at $14.2 billion on January 18th, has been steadily declining. In just four days, it dropped from $10.95 billion to $10.5 billion.

Conversely, Ethereum's TVL has risen from $59.66 billion on February 2nd to $63.7 billion by February 16th.

This divergence in TVL reinforces the stablecoin data, indicating a clear preference for Ethereum over Solana among investors.

ETH Price Prediction: Potential for 22% Growth?

While ETH's EMAs are currently bearish, the upward movement of short-term EMAs suggests a potential golden cross. This could push ETH to test resistance at $3,020, potentially leading to a rise to $3,442 (a 22% increase). The upcoming Pectra upgrade may also contribute to this bullish trend.

However, a strengthening downtrend could see ETH retest support at $2,551, potentially leading to a further drop to $2,160 if this level is broken.

Codeum Note: Codeum offers comprehensive blockchain security solutions, including smart contract audits, KYC verification, and custom development services to help navigate the complexities of the crypto market. Partner with us for secure and successful blockchain projects.

Disclaimer: This analysis is for informational purposes only and not financial advice. Market conditions change rapidly. Conduct thorough research and consult a professional before making any investment decisions.