ETH Price: Bullish Divergence Signals Recovery?

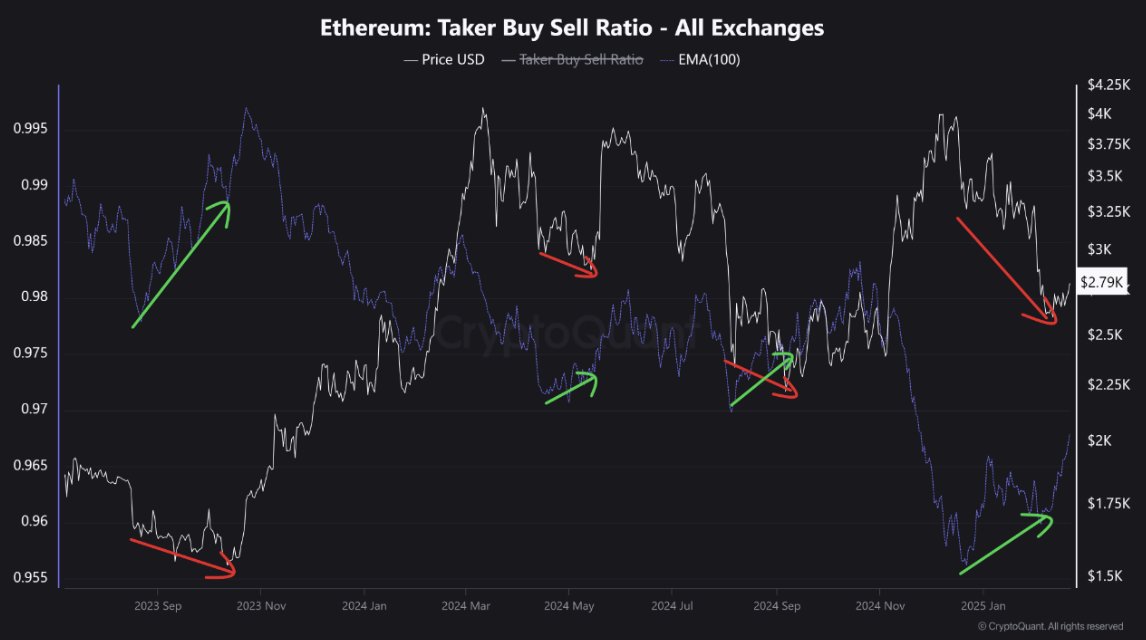

Recent Ethereum (ETH) market activity presents a complex picture, with indicators suggesting both bullish and bearish possibilities. A major bullish divergence, observed in the taker buy-sell ratio against the price trend, hints at a potential market recovery. This pattern has historically preceded price rebounds, as seen in September 2023 and between November 2024 and January 2025.

Bullish Divergence and Whale Activity

Despite a current ETH price of approximately $2,800, the bullish divergence suggests an upcoming uptrend. This is further supported by whale activity: large accounts have accumulated an additional 140,000 ETH, signaling strong confidence and potentially long-term bullish sentiment.

The chart below from CryptoQuant illustrates this historical divergence pattern:

Contrasting Signals from DEX Traders

However, the Cumulative Volume Delta (CVD) reveals a contrasting trend. Smart decentralized exchange (DEX) traders are increasingly taking profits or closing positions, indicating potential risk aversion at current price levels. This profit-taking could introduce short-term price volatility and downward pressure.

The image below from iCryptoAI/X shows the contrast between whale accumulation and DEX trader activity:

Ethereum's Oversold Condition

Currently, ETH is trading in the oversold zone, which historically signals a potential price reversal. This positioning below the critical threshold in log curve zones increases the likelihood of a price bounce. Similar situations in mid-2017 and late 2020 led to significant price rebounds.

See the log curve analysis below from Coinvo/X:

Conclusion: Navigating Uncertainty

While the oversold condition and bullish divergence suggest a potential recovery, external factors and broader market sentiment could override this. The interplay between whale accumulation, DEX trader profit-taking, and overall market conditions will determine whether ETH experiences a bullish reversal or a prolonged downtrend. Codeum provides expert services to navigate this complexity, from smart contract audits to tokenomics consultation, helping you make informed decisions in this dynamic market.

Codeum's Services:

- Smart contract audits

- KYC verification

- Custom smart contract and DApp development

- Tokenomics and security consultation

- Partnerships with launchpads and crypto agencies