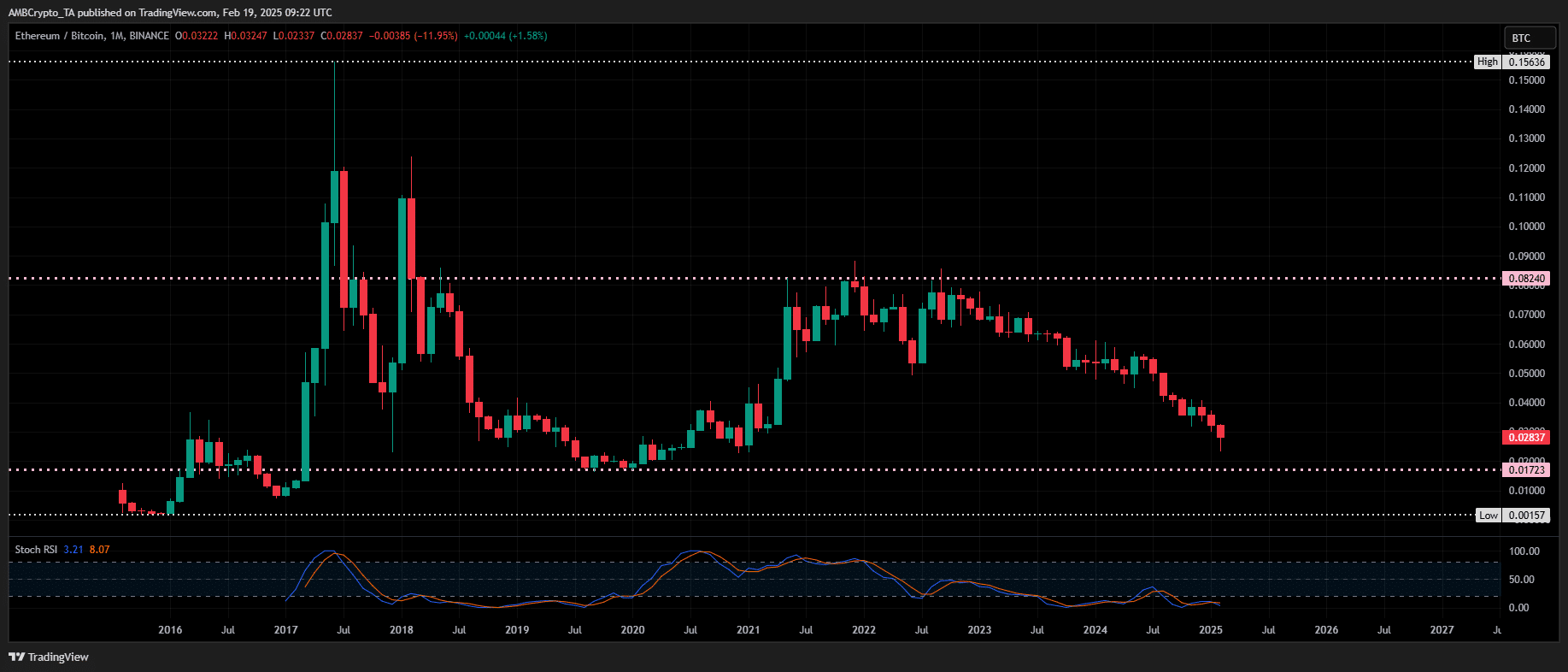

ETH/BTC: 2017-19 Cycle Repeat?

The ETH/BTC trading pair is exhibiting a striking resemblance to its 2017-2019 performance cycle, raising questions about whether history might repeat itself. This observation is particularly significant given the Stochastic RSI recently dipping below 20, a level indicative of an oversold market.

ETH/BTC Price Action: A Historical Parallel

Historical data shows that Ethereum (ETH) significantly outperformed Bitcoin (BTC) following a similar period in 2017-2019. The current ETH/BTC chart mirrors this pattern, testing key support levels. The prolonged period (two years) below the 20 RSI mark is an unusually oversold condition, which adds weight to this possible scenario. Experts predict potential ETH dominance by mid-Q3 2025.

Source: TradingView (ETH/BTC)

Should this historical trend repeat, it suggests a potential shift in market momentum is underway. Following the 2017-2019 cycle, ETH experienced a remarkable 487% year-over-year gain in 2020, exceeding BTC's 302% return.

Supply Crunch and Technical Indicators

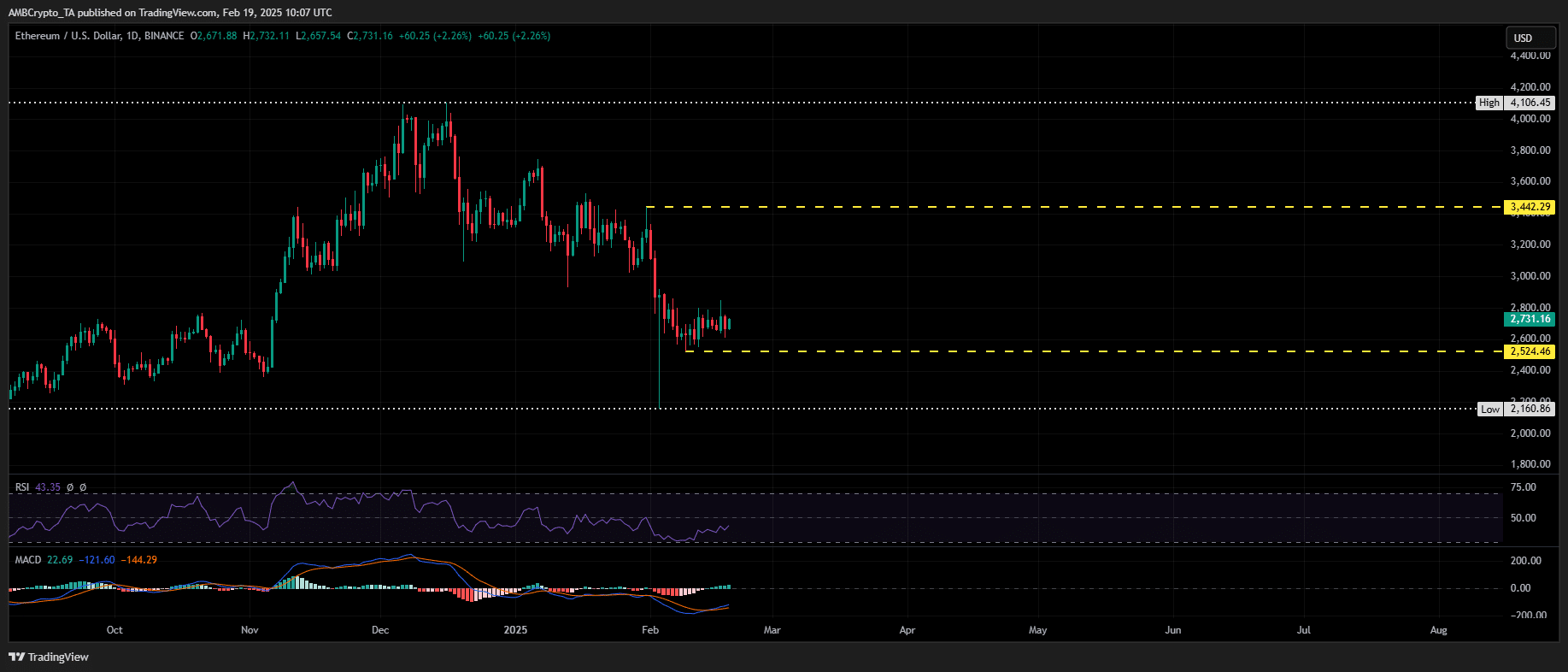

Further supporting the potential for a bullish reversal is the current Ethereum supply crunch. Exchange reserves are at an 8-year low, suggesting significant accumulation by investors. This consolidation within the $2.7K-$2.8K range, combined with an emerging bullish MACD crossover, hints at a possible trend reversal.

Investor Sentiment and Market Uncertainty

Despite the promising technical indicators, Ethereum's recent performance has been underwhelming. The market has seen a significant drop in ETH's market capitalization (over $80 billion this month), underperforming Bitcoin amidst broader market uncertainties.

While the RSI suggests a potential bottom for the ETH/BTC pair, a 20% decline in trading volume indicates weak accumulation. This dampens expectations for an immediate, sharp reversal.

Source: TradingView (ETH/USDT)

However, early bullish signals are present. For ETH to regain bullish momentum, it needs to reclaim $3.5K as support before attempting a breakout towards its post-election peak of $4K.

Codeum: Securing the Future of Blockchain

Navigating the complexities of the cryptocurrency market requires a robust understanding of security and technical analysis. Codeum offers comprehensive services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultations, and partnerships with launchpads and crypto agencies. Let us help you mitigate risk and navigate the opportunities within the blockchain ecosystem.

Traders should monitor volume increases and bullish divergences in the ETH/BTC pair to confirm the potential repetition of the 2017-19 cycle. The current consolidation could, in fact, be a setup for a remarkable rebound.