Cboe Files for Ethereum ETF Options

Cboe Files for Ethereum ETF Options Trading

Cboe BZX Exchange has submitted a 19b-4 filing with the Securities and Exchange Commission (SEC) to list and trade options on spot Ethereum ETFs. This move seeks expedited approval and would allow options trading on various Ethereum funds, including the Bitwise Ethereum ETF, the Grayscale Ethereum Trust, and the Grayscale Ethereum Mini Trust.

The filing highlights the benefits of offering these options, stating they provide investors with a relatively lower-cost tool for Ethereum exposure and a hedging mechanism for their existing Ethereum positions. Cboe describes its proposal as "competitive," noting a similar, but twice-delayed, submission from NYSE American.

SEC Concerns and Potential Timeline

The SEC's previous postponements of NYSE's proposal cited concerns regarding market manipulation, investor protection, and maintaining fair trading. These concerns fall under Section 6(b)(5) of the Securities Exchange Act of 1934. If approved, Ethereum ETF options will follow the same rules as other fund share options, aligning with existing frameworks for precious-metal-backed commodities and Bitcoin funds.

Nate Geraci, president of The ETF Store, suggests a possible approval timeline based on the timeframe between spot Bitcoin ETF launches and options approval. He estimates a decision within the next few months, aligning with the November 2024 launch of spot Bitcoin ETF options.

Strong Investor Demand for Ethereum ETFs

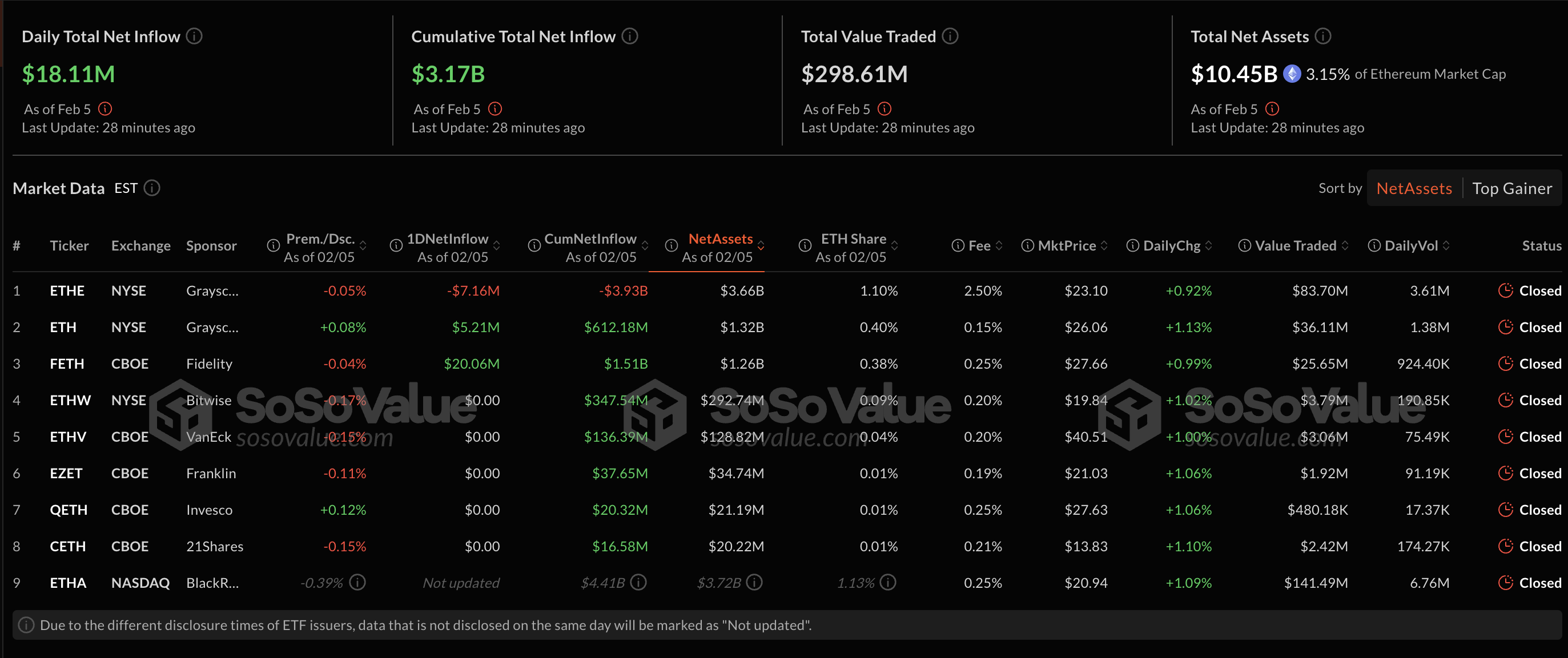

The filing comes amidst significant investor interest in Ethereum ETFs. Spot Ethereum ETFs have seen five consecutive days of net inflows, culminating in a record high of $307.77 million in daily net inflows on February 4, 2025. This follows a record high of $1.5 billion in total trading volume on Monday. The continued strong demand underscores the potential for significant activity in the options market once approved.

Source: SoSo Value

Codeum: Your Partner in Blockchain Security

Codeum offers comprehensive blockchain security services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. As the crypto market evolves, robust security is crucial. Contact Codeum to ensure your project's security and compliance.