Abraxas Capital's $561M ETH Buy: A Market Shift?

Abraxas Capital is making headlines after accumulating $561 million worth of Ethereum (ETH) in a single week, solidifying its position as a major ETH whale. This significant investment raises questions about its potential impact on the cryptocurrency market.

Abraxas Capital's Aggressive ETH Accumulation

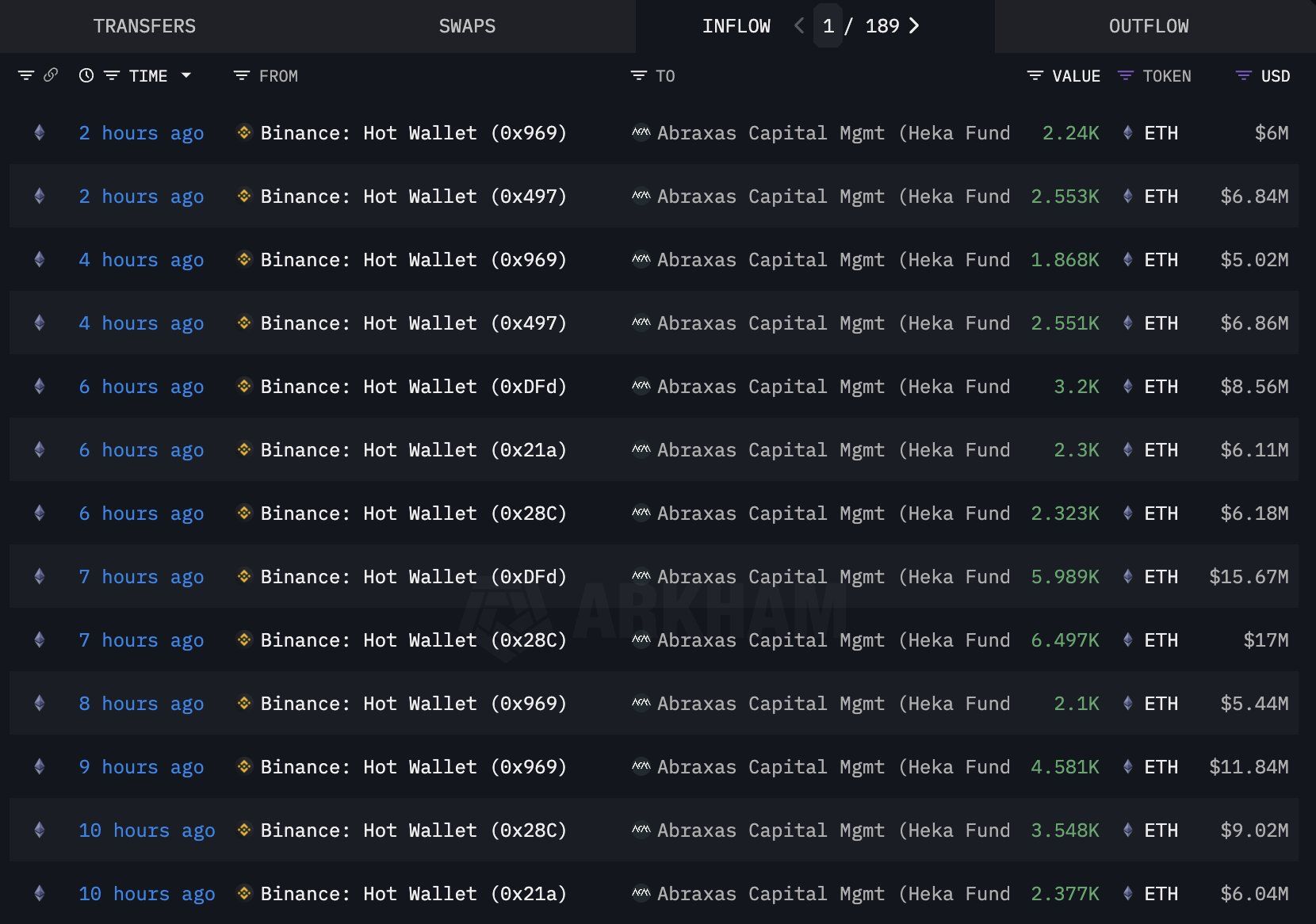

Between May 7th and May 14th, 2025, Abraxas Capital acquired 242,652 ETH, according to Lookonchain. Data from Arkham Intelligence reveals these purchases involved numerous transactions ranging from 2,100 to 6,497 ETH per instance, primarily withdrawn from Binance. The sheer volume of transactions—189 in just 10 hours—highlights an aggressive accumulation strategy.

Shifting Focus from BTC to ETH

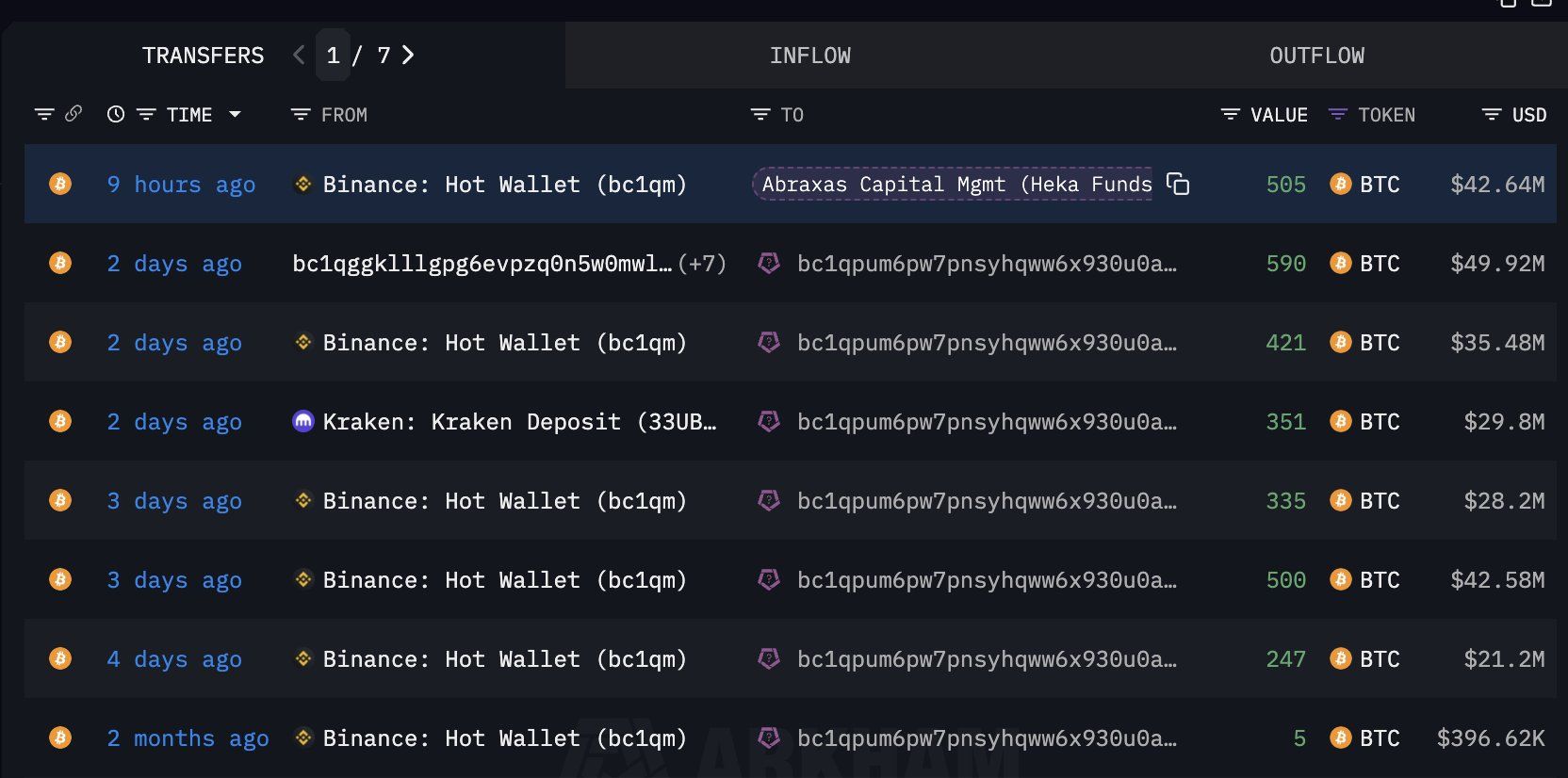

This large-scale ETH purchase is accompanied by a notable shift away from Bitcoin (BTC). Lookonchain reported that Abraxas Capital withdrew 2,949 BTC (approximately $250 million) from various exchanges. While they subsequently deposited 1,000 BTC into Kraken, their current BTC holdings are significantly reduced, with only 983 BTC remaining (roughly $98 million).

This strategic move suggests Abraxas Capital sees greater long-term potential in ETH, potentially driven by the flourishing Ethereum ecosystem encompassing DeFi and NFT applications. The surge in ETH holdings, coupled with reduced BTC positions, indicates a bullish outlook on Ethereum's growth, particularly following ETH's recent price surge above $2,500.

Analyst Perspective

"ETH is a bet on fundamentals. Ethereum dominates on developers, stablecoins, RWAs and NFTs." - A user on X

This sentiment mirrors a growing belief that Ethereum might eventually surpass Bitcoin. Predictions for 2026 suggest Ethereum's strategic reserve could reach 10 million ETH.

Disclaimer: BeInCrypto is committed to unbiased, transparent reporting. Readers should independently verify facts and consult with professionals before making investment decisions. See our Terms and Conditions, Privacy Policy, and Disclaimers for more information.

Codeum Note: Codeum offers comprehensive blockchain security services, including smart contract audits, KYC verification, custom smart contract and DApp development, and tokenomics and security consultation. We partner with launchpads and crypto agencies to ensure secure and robust blockchain projects.