Monero at a crossroads; will $200 or $140 arrive first for XMR?

[ad_1]

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Monero has traded within a range since mid-September

- XMR is poised for a breakout, but a pullback could also materialize

Monero has traded within a range between $152 and $136 since September. Technical indicators showed good buying pressure and a likely breakout to the upside.

Here’s AMBCrypto’s Price Prediction for Monero [XMR] in 2022-23

A recent article highlighted the bearish signals that Monero flashed in recent weeks. For instance, the transaction count decreased in September but saw a recovery in October.

Bulls threaten a breakout but volatility could see a pullback

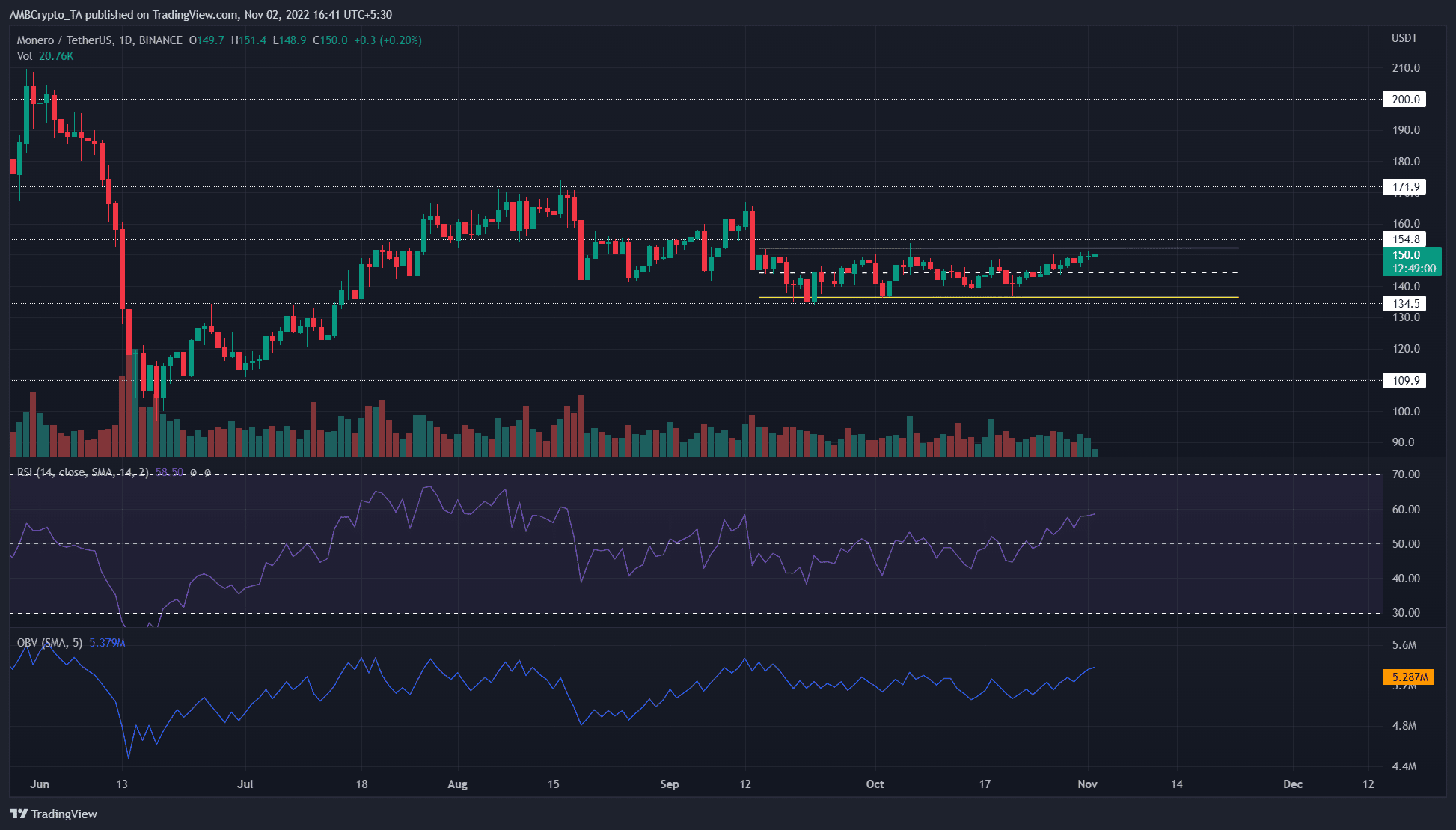

Source: XMR/USDT on TradingView

The price action showed XMR approached the highs of a near two-month range. This region of resistance was one that XMR bulls have struggled to crack since late September.

The technical indicators showed some bullish signs. The RSI on the 12-hour chart climbed above neutral 50 to denote bulls have found some strength in the market. Meanwhile, the OBV also climbed above a level of resistance from mid-September.

Together, these findings showed that the market began to show some bullish intent in the past few days. However, the trading volume has been average in recent weeks. If the price climbed past $156 without a surge in volume, it could be an early indication of a failed breakout.

Weighted sentiment finally flips positive and a rally could ensue

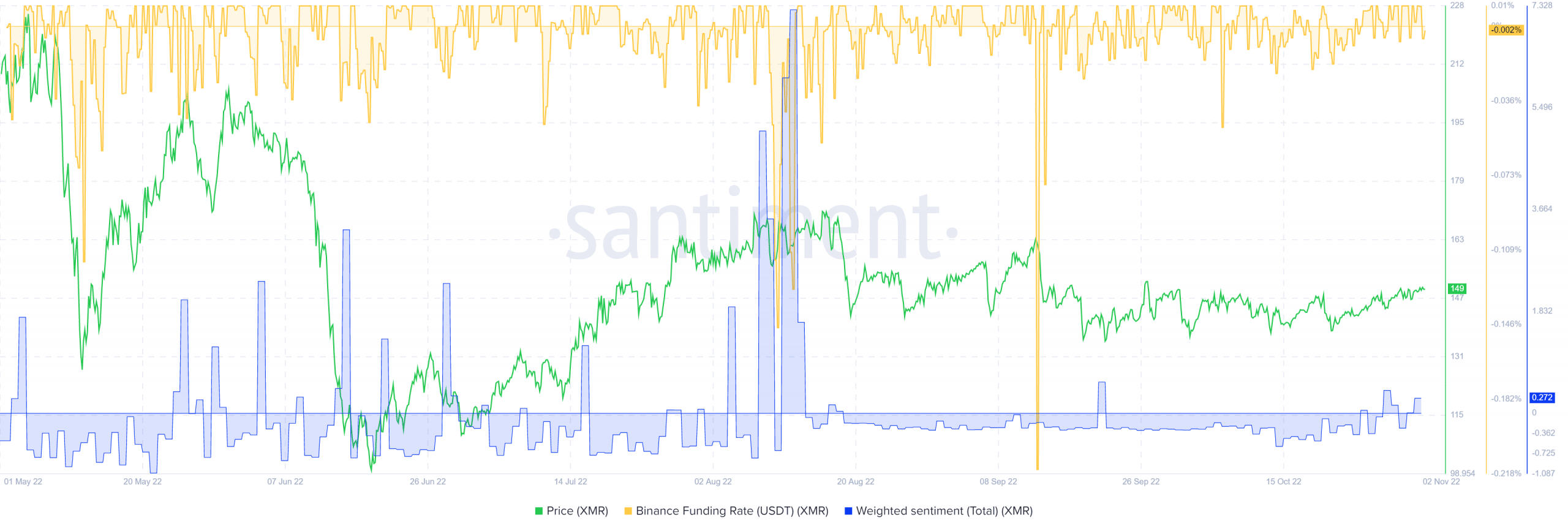

Source: Santiment

Santiment data showed funding rate was positive in recent days for XMR. At press time, it entered negative territory. However, overall the inference is that the futures market participants have been bullish in the past few days.

This occurred alongside the rally in price. Data from Coinglass also showed funding rates on major exchanges such as Binance to flip to positive.

The weighted sentiment has been weakly negative since August. However, this began to change. The sentiment appeared to have shifted into a slightly positive zone. If social interactions continue to remain so, bullish intent could quickly cascade and a rally upward can materialize.

In summation, traders might want to wait for a breakout past the range on significant volume. Thereafter a retest of the range highs near $156 can offer a buying opportunity targeting $172 and $200. Invalidation of this idea would be a session close below $148.

[ad_2]

Source link

Leave a Reply