Going long on SUSHI? You should take a look at these metrics first

[ad_1]

As of 3 November, the SUSHI token was seen generating a lot of interest from Ethereum whales. Reportedly, this interest was generated from SushiSwap’s recent deployment on the Boba network

Here’s AMBCrypto’s Price Prediction for Sushi for 2022-2023

Whaling around

WhaleStats, an organization dedicated to tracking crypto whales, tweeted on 3 November that SUSHI was one of the most used smart contracts among the top 5000 Ethereum whales in the last 24hrs.

This development occurred in lieu of SushiSwap’s deployment on the Boba Network. Boba Network is an L2 scaling solution for the BNBchain and it enables faster and cheaper transactions for users on various protocols.

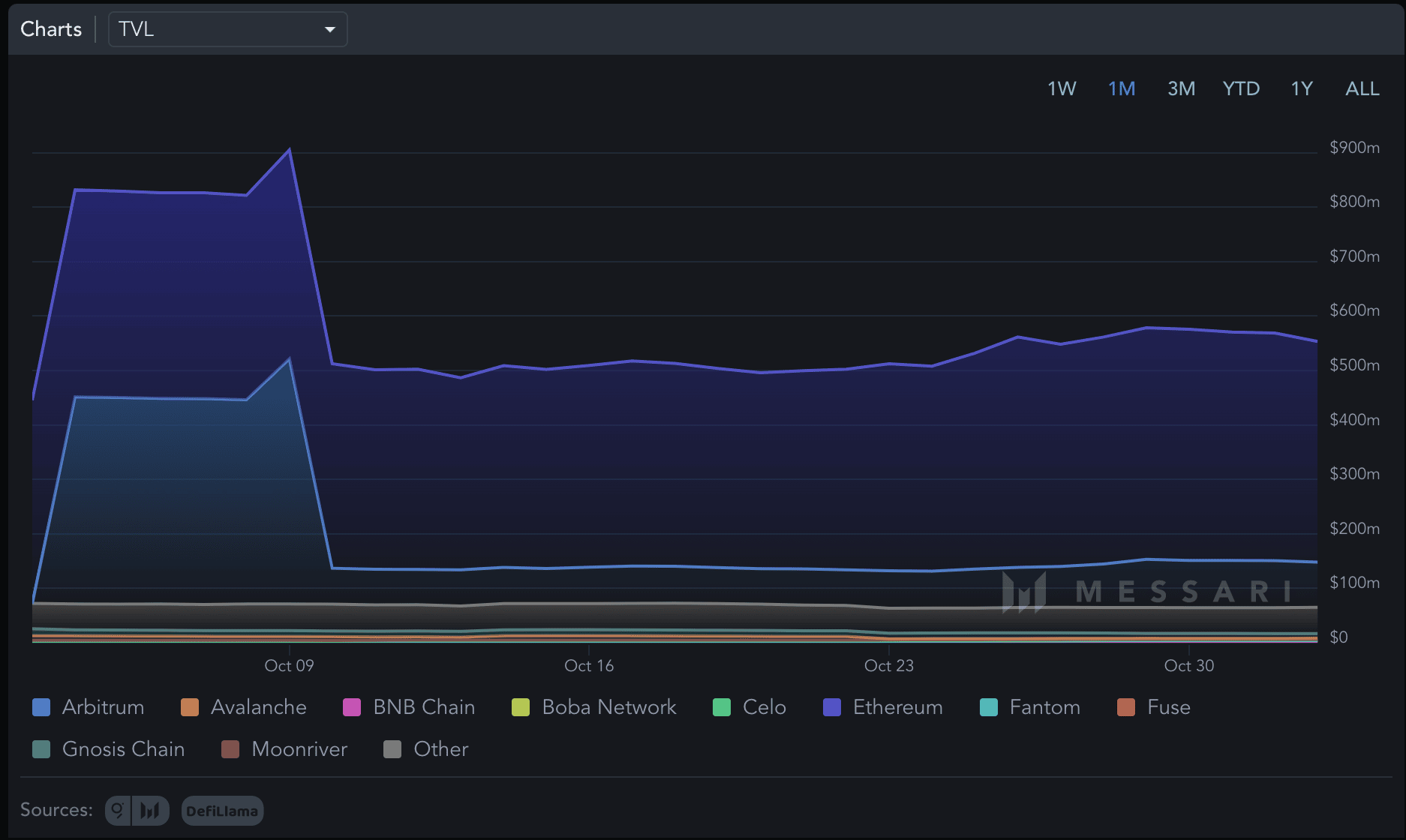

However, despite the increasing number of collaborations and growing interest from whales, the overall TVL of SushiSwap declined over the past month. At the time of press, the total value locked on SushiSwap was $554.85 million.

Source: Messari

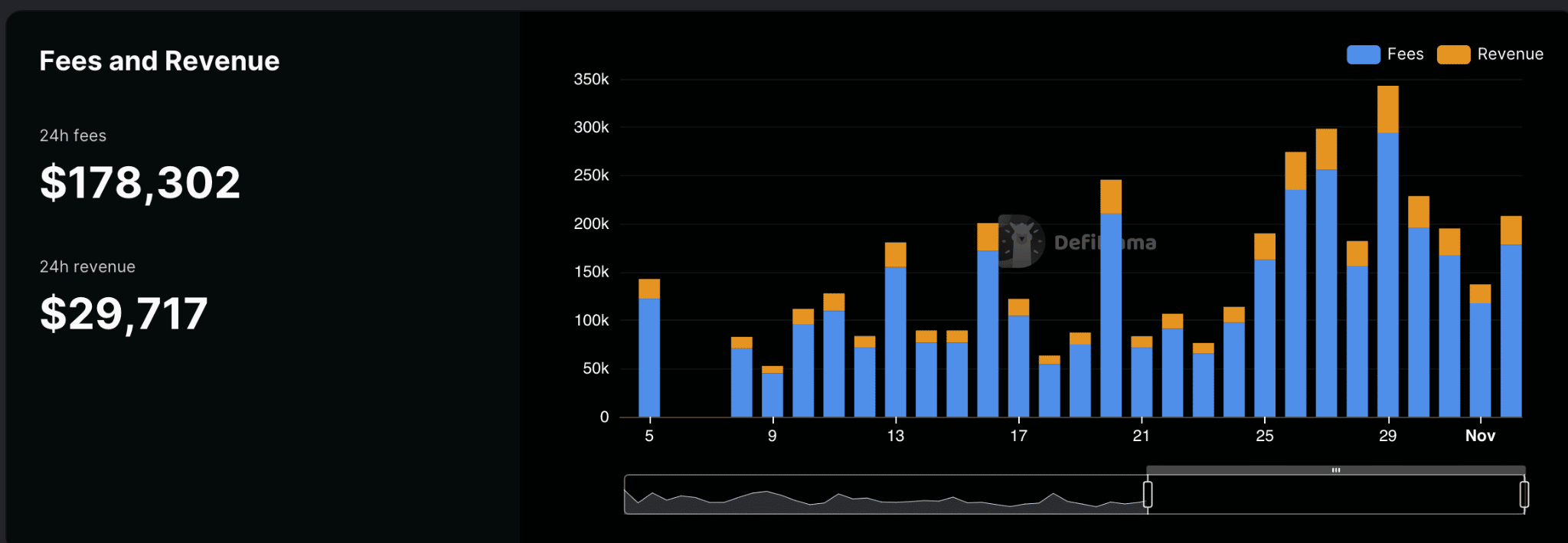

Despite its declining TVL, SushiSwap managed to show growth in terms of fees and revenue generated.

From the image below, it can be observed that the total fees generated by SushiSwap grew over the past 30 days. At the time of writing, SushiSwap had generated $178 thousand in fees over the past 24 hours. And, the total revenue generated was $29 thousand.

Source: DefiLama

Holders stay put

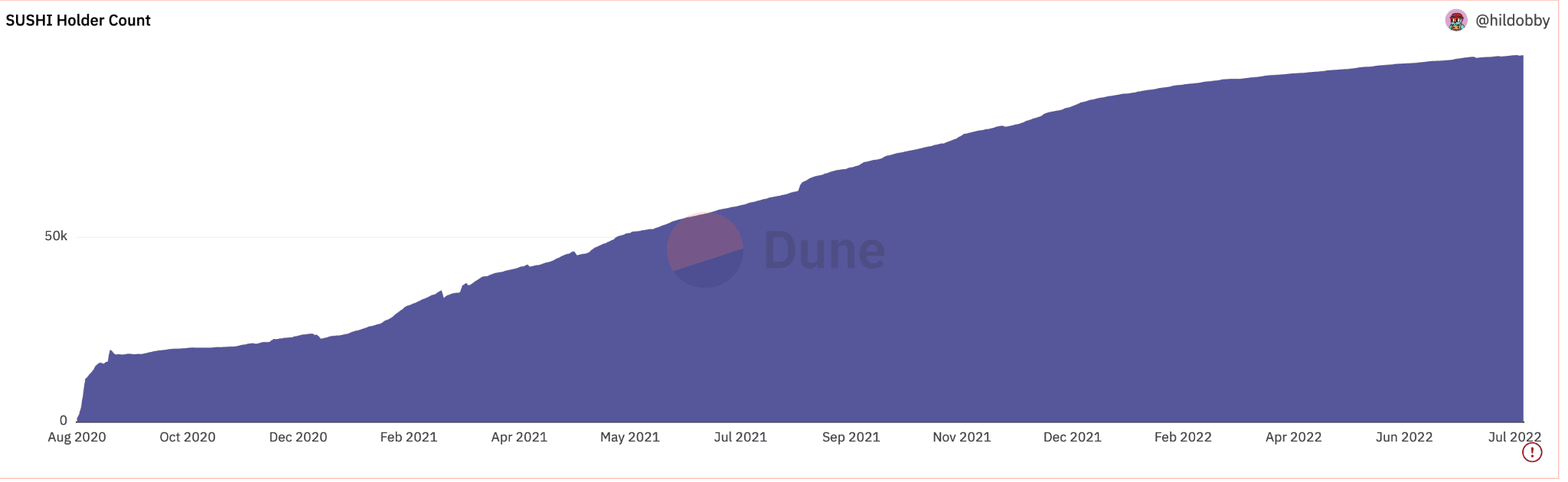

Another positive signal for SUSHI was its growing number of holders showing support for the token. As made evident by the image below, the number of addresses holding SUSHI continued to grow over time. Thus, suggesting that a large number of members from the crypto community have faith in the token.

Source: Dune Analytics

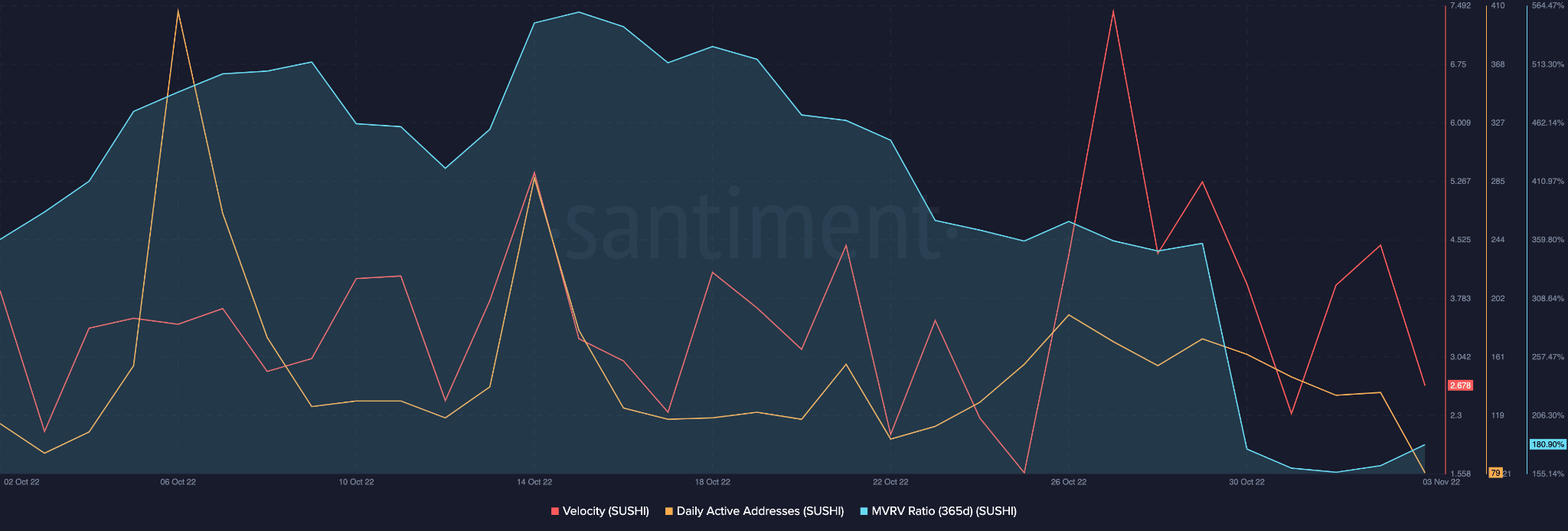

Despite the faith shown by holders of the SUSHI token, its daily activity continued to decline.

By looking at the image below, it can be observed that the number of daily active addresses on the SUSHI network had declined over the past month.

Along with that SUSHI’s velocity continued to decline as well.

These factors coupled with a declining MVRV ratio, paint a negative picture of SUSHI’s future.

Source: Santiment

However, despite these bearish indicators, the price of SUSHI continued to grow. At the time of writing, it was trading at $1.69 and its price had appreciated by 10.52% over the past 24 hours according to CoinMarketCap. Its volume also witnessed an uptick of 69.04% at press time.

[ad_2]

Source link

Leave a Reply