ETH Retraces Toward $1,850; Is Correction Just Started?

[ad_1]

Published 41 mins ago

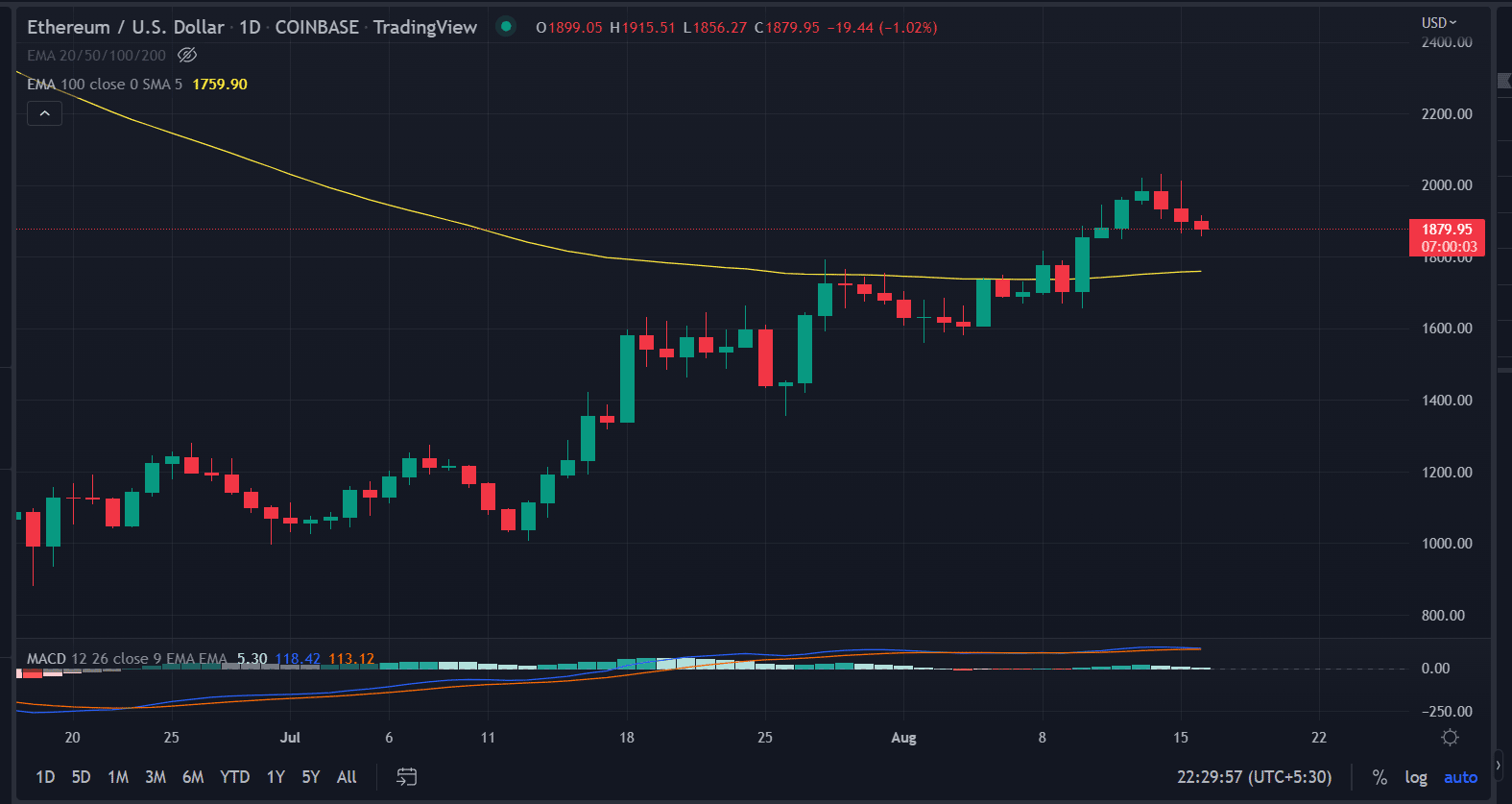

Ethereum price analysis shows the continuation of the bearish momentum. The price moved in a very narrow trading range that extends from $1,915 to $1,850. The market structure favors a corrective pullback after a decent upswing of nearly 45% from the lows of $1,005.25.

ETH retraces from the $1,900 mark following a period of consolidation after testing the crucial $2,000 mark on Saturday. But the formation of the small candlestick indicates the market is not favoring a reversal rather it could be taken as a healthy correction. Sidelined investors could enter near the lower levels to capitalize on the positive sentiment.

As of publication time, ETH/USD is trading at $1,877, down 1.13% for the day. The 24-hour trading volume has declined by 17.34%, totaling $15.88 billion according to CoinMarketCap data. A decline in price with receding volumes is a sign of weakening of downside momentum.

- Ethereum price extends downside for the third straight day.

- Crucial support near $1,850 is vital for bulls to sustain.

- The momentum oscillator warns of aggressive bids.

Ethereum price enters into a consolidation phase

On the daily chart, the Ethereum price analysis implies an impeding correction provided some conditions are met.

The formation of the ‘Spinning top’ on Thursday followed by a series of red candlesticks promotes the current lower price action.

Currently, the price is held near the crucial support zone of $1,850-70, if the bulls failed to hold the level on the daily basis the gates will be open for further lower levels. Bulls need more buying participation in successfully flipping the support into the resistance zone.

A daily close below $1,850 could fall up to the 100-day exponential moving average at $1,759.

On the other hand, a spike in buying orders could push back into a higher trajectory. A candlestick above $1,900 could be a sign of the bulls gaining control.

The Moving Average Convergence Divergence (MACD) indicator is currently bullish, as can be seen in the green color of the histogram. Moreover, the oscillator points at the preceding bullish momentum as expressed by the tops of the histogram.

Also read: Ethereum’s Upsurge Continue Post Merge?

ETH price action has set a swing high of $2,000 in the previous week. ETH has been making higher highs and lower lows forming a classic bullish channel. However, the bulls are taking a breather near the higher levels.

Conclusion:

Ethereum price analysis tells the extended consolidation. As the downside is capped near the crucial support level. We expect ETH/USD to make rounds near the lower levels until confirmation arises.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Close Story

[ad_2]

Source link

Leave a Reply