Dogecoin [DOGE] holders fretting over their investments should read this

[ad_1]

- DOGE was one of the top memecoins in terms of social activity

- BabydogeSwap launched its new USDT/DOGE farm

Dogecoin [DOGE] recently made it to the news as it ranked second in the list of top meme coins in terms of social activity as per LunarCrush. This development demonstrates the memecoins’ popularity in the crypto industry yet again.

Read Dogecoin’s [DOGE] Price Prediction 2023-24

⚡️TOP #MEME Tokens by Social Activity

15 November 2022$QUACK $DOGE $FLOKI $SHIB #BABYDOGE $SHIB $FLOKIM $VINU $MILO $VOLT $PETS pic.twitter.com/tyPntL03ZK— 🇺🇦 CryptoDep #StandWithUkraine 🇺🇦 (@Crypto_Dep) November 15, 2022

Not only this, but DOGE’s price actions lately have also looked quite promising, as it was the only coin in the list of the top 10 cryptos in terms of market capitalization that was able to register over 2% weekly gains. At press time, DOGE was trading at $0.08959, 3% higher than the last day, with a market cap of over $11.7 billion.

Another positive development happened recently when BabyDogeSwap announced the launch of its new USDT/DOGE farm. The new farm went live with 3820% APR (annual percentage rate). It was also mentioned in the official tweet that the APR will be reduced as more liquidity is added.

USDT / $Doge farm is NOW LIVE with 3820% APR !

Stake now at pic.twitter.com/QyxSQLelKv

— BabyDogeSwap.com LIVE (@BabyDogeCoin) November 15, 2022

With such positive updates in the Dogecoin ecosystem, what should an investor expect from Doge during the last month of this year?

What metrics suggest

A part of the credit for this price hike also goes to Elon Musk, who again helped DOGE’s price move up by making a comment on the memecoin recently.

The last few weeks for DOGE looked pretty promising, as several on-chain metrics aligned with investors’ interests.

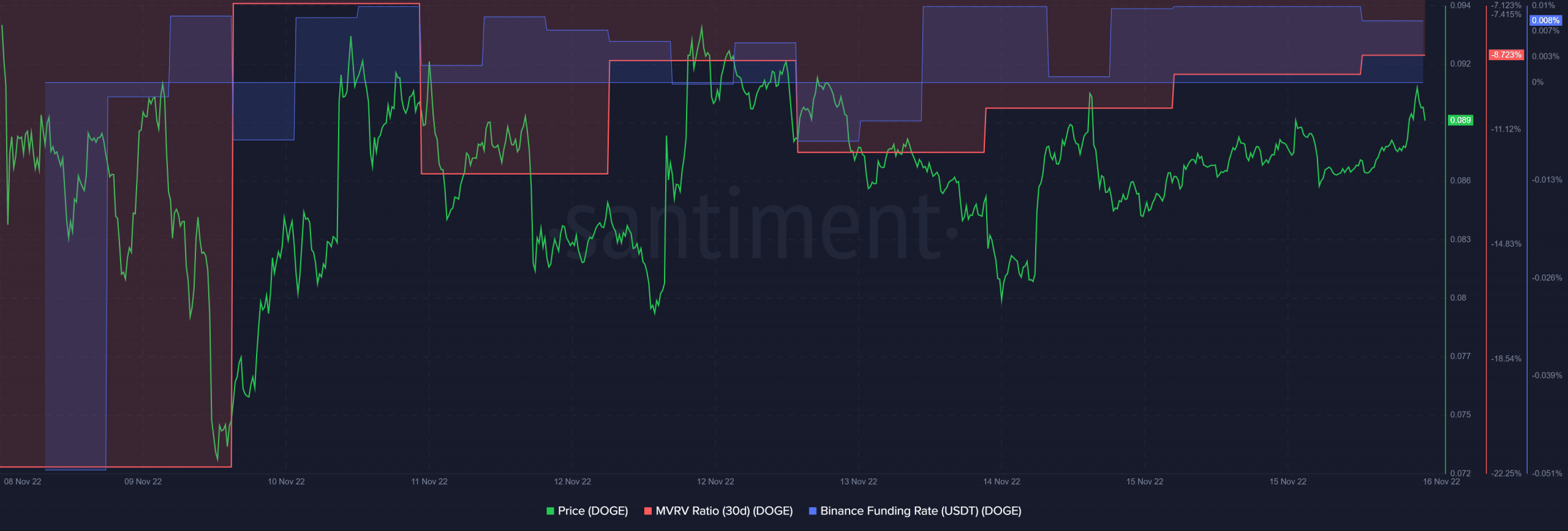

For instance, DOGE’s MVRV Ratio went up, which is a positive signal for the memecoin. Moreover, DOGE’s Binance funding rate also registered an increase, reflecting higher interest from the derivatives market.

Source: Santiment

Furthermore, CryptoQuant’s data revealed a massive bull signal for DOGE, as its Relative Strength Index (RSI) was in an oversold position, which increases the chances of a continued northward movement in the coming days. D

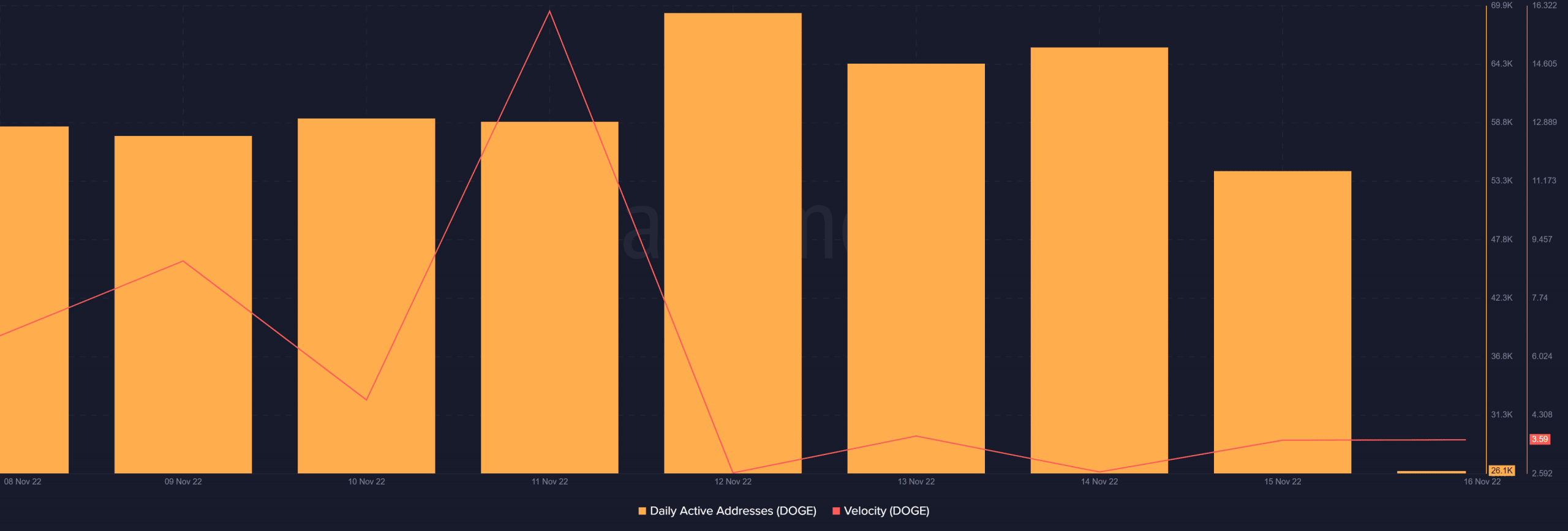

Dogecoin’s daily active addresses were also consistent over the last week, which is a positive signal. However, DOGE’s velocity gave a little bit of cause for concern as it went down sharply over the last week.

Source: Santiment

Will the bears step in?

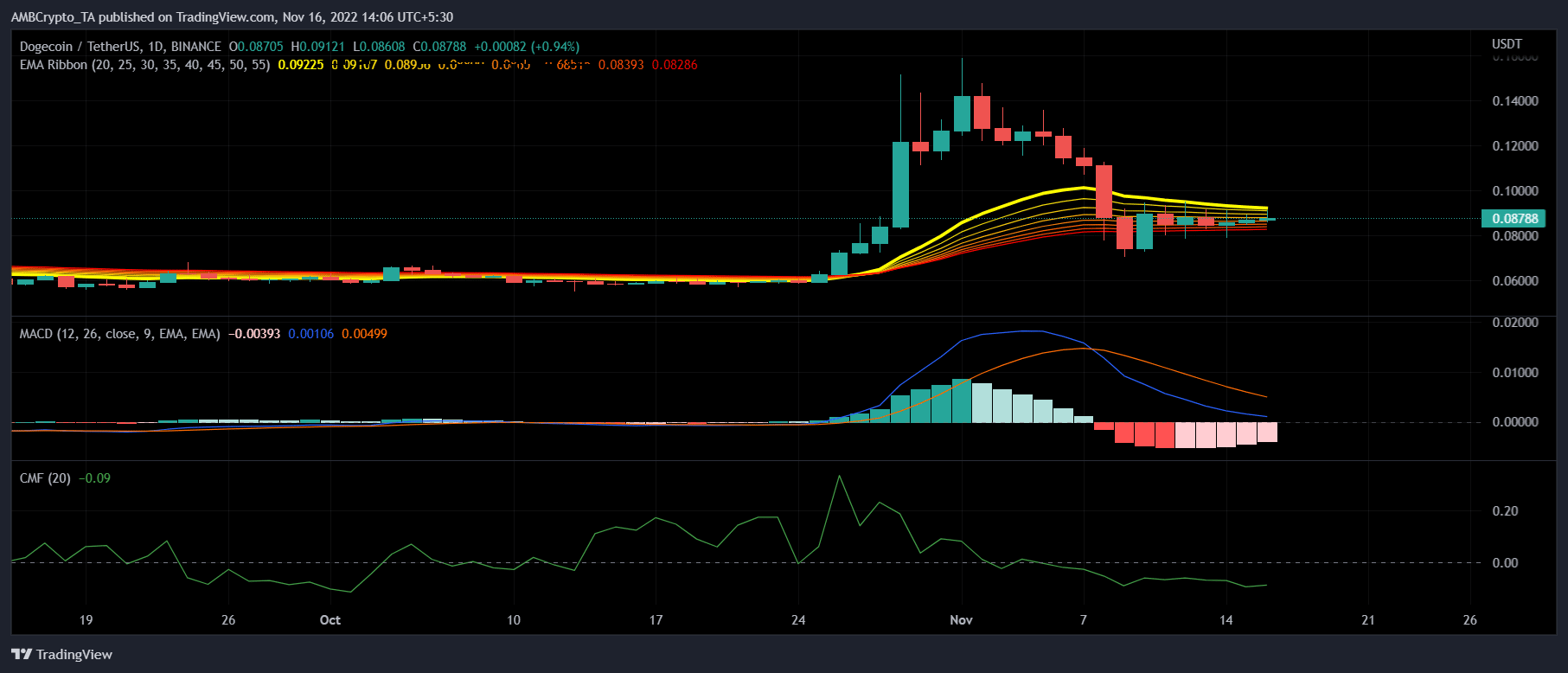

A look at DOGE’s daily chart gave a somewhat ambiguous notion, as a few indicators were in support of a price surge while the others suggested otherwise.

The Exponential Moving Average (EMA) Ribbon revealed that the bulls still had an advantage in the market as the 20-day EMA was above the 55-day EMA, but the possibility of a bearish crossover still remained.

The MACD’s reading revealed that the bears were leading the market. The CMF took a sideways path and was resting just below the neutral mark. Considering all the metrics and market indicators, there are possibilities of a further surge, but nothing can be said with certainty. Therefore, investors should be cautious before making a call on DOGE.

Source: TradingView

[ad_2]

Source link

Leave a Reply