BNB retests 2022 lows as investors remain rattled

[ad_1]

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- BNB has eased into a key demand zone on the weekly timeframe chart.

- CVD spot increased alongside an improvement in OI.

Binance Coin [BNB] continued to bleed out after the US SEC lawsuit on 5 June. At the time of writing, BNB had depreciated by 15% in the past seven days, according to CoinMarketCap, trading at $236 at press time.

How much are 1,10,100 BNBs worth today?

However, Binance’s legal battle isn’t over just yet. The US SEC is seeking restraining orders to freeze Binance’s assets. Although the exchange has asked the court to deny the restraining order, the ongoing showdown could further affect BNB’s value.

A drop to June 2022 lows – Is there an end in sight?

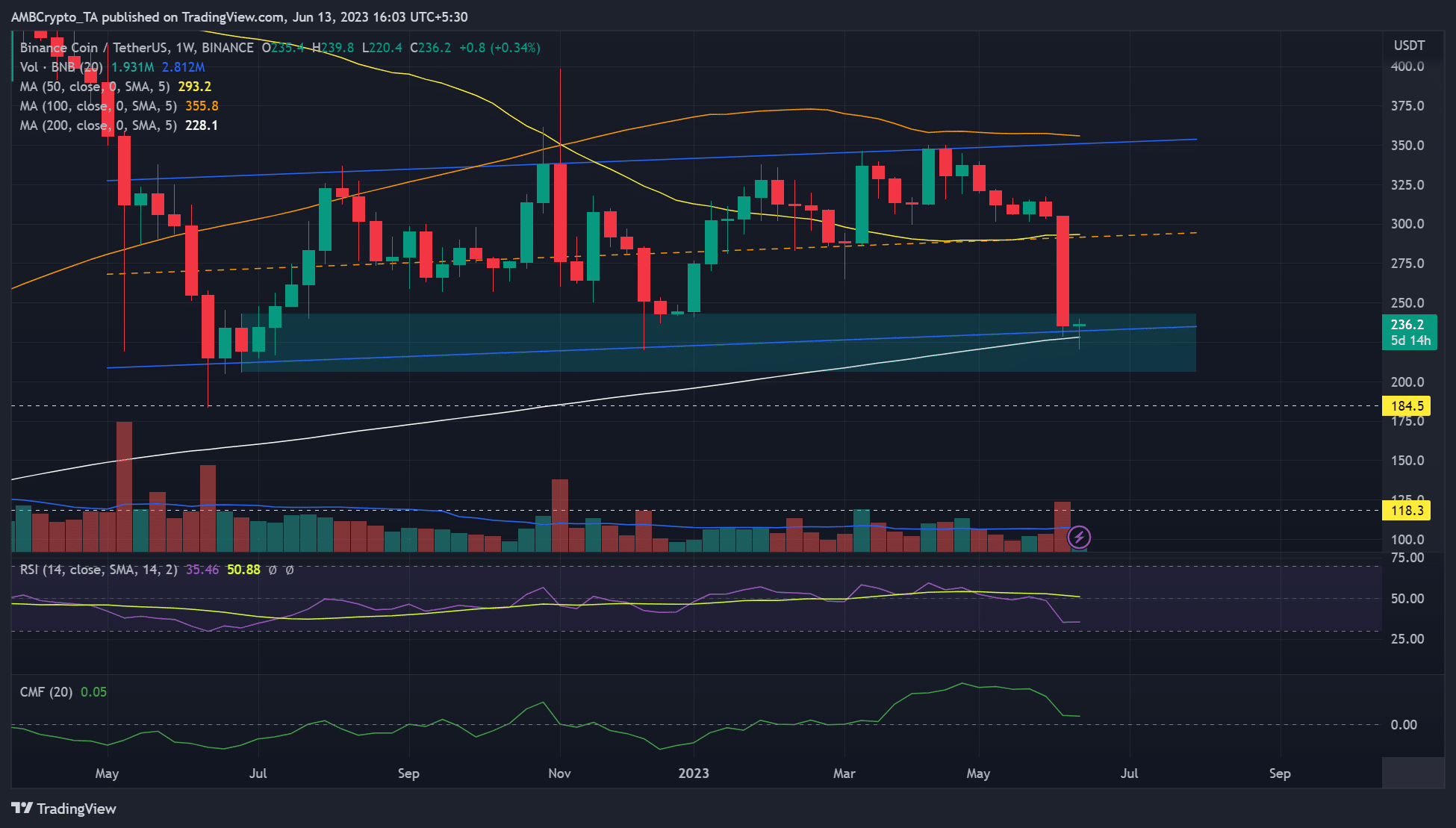

Source: BNB/USDT on TradingView

The weekly timeframe chart showed that BNB’s plunge has hit June/December 2022 lows. During the December 2022 FUD (fear, uncertainty, and disinformation) around Binance’s proof of reserves, BNB tanked to $220.

The $220 level aligns with a bullish order block (OB) of $206 – $243 (cyan) on the weekly chart formed on 27 June 2022. In addition, it coincides with the range low of a parallel channel (blue) and the 200-MA (Moving Average).

So, it could make the $206 – $243 zone (cyan) a strong bullish stronghold. Unfortunately, it could crack if Binance’s legal woes worsen in the next coming days/weeks. A drop below the confluence area could ease at $184 or $118.

Conversely, BNB could attempt to reverse the losses and target the mid-range ($293) if the demand zone doesn’t crack. The level also aligns with the 50-MA.

In the meantime, the RSI (Relative Strength Index) flattened in the lower range – suggesting selling pressure eased. Similarly, the CMF (Chaikin Money Flow) moved sideways slightly above the zero mark – denoting capital outflows from BNB subsidized.

CVD and OI improved

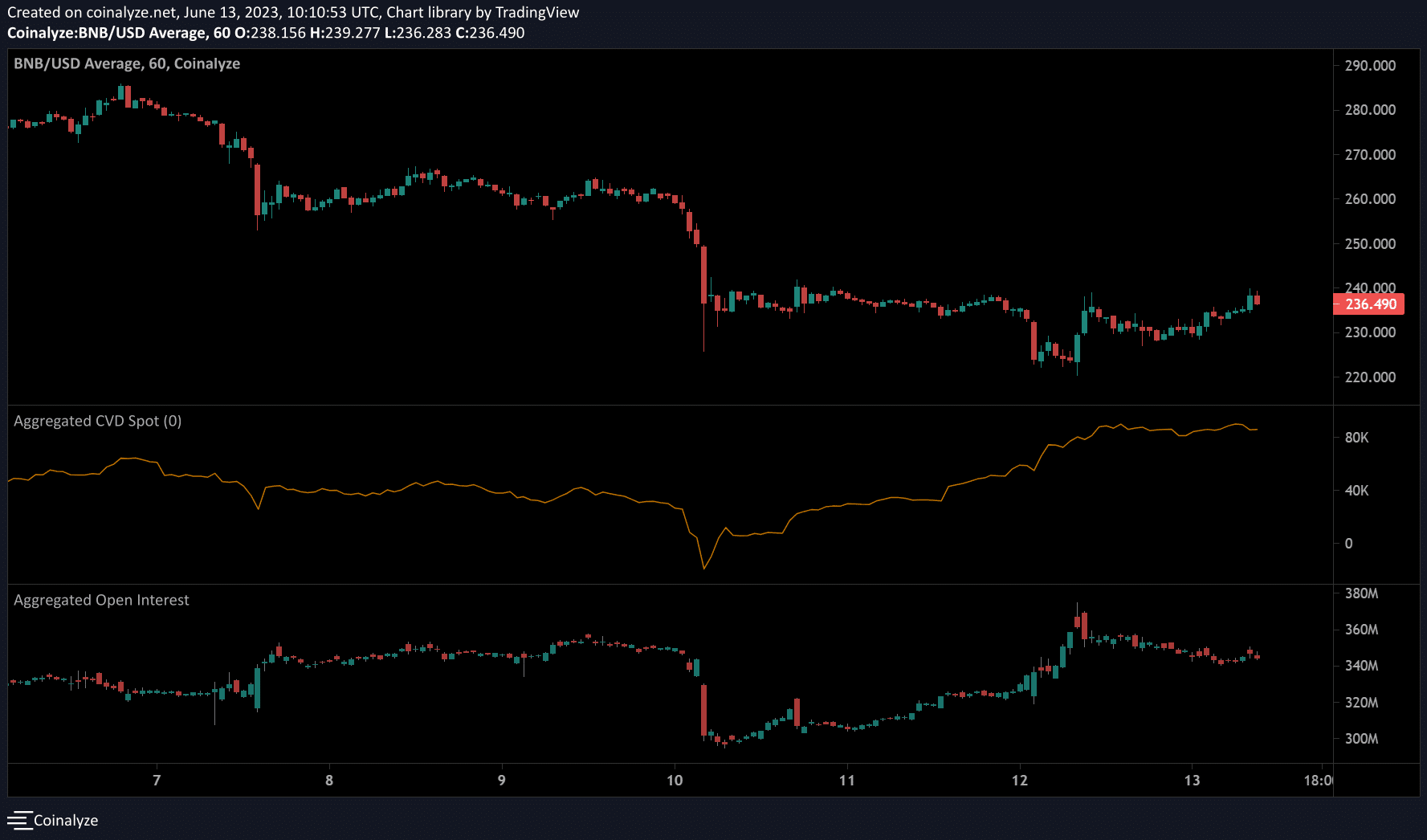

Source: Coinalyze

Based on Coinalyze’s 1-hour timeframe, a rising CVD (Cumulative Spot Delta) was observed – denoting buyers fighting for control from 10 June.

Read Binance Coin’s [BNB] Price Prediction 2023-24

In addition, the OI (open interest) rates improved from 19 June, rising from <$300 million to >$340 million at the time of writing. Although this suggests bulls could defend the demand zone of $206 – $243, the outcome depends on the lawsuit and BTC price action.

Besides, according to Defi Llama, Binance Exchange recorded over $2.7 billion in outflows over the past seven days. It suggests some investors remained rattled by the ongoing lawsuit.

[ad_2]

Source link

Leave a Reply