Bitcoin (BTC) Price Most Likely To Rise Above $22,400, Here’s Why

Bitcoin (BTC) price soars nearly 5% and surpassed the $20k level today after struggling to surpass the psychological level for weeks. Experts predict the BTC price could rally above the $22,400 level as this time it’s different. Whale accumulation, low trading volume in the traditional markets, fall in BTC supply on exchanges, and fall in the US dollar index are some factors influencing the Bitcoin rise.

Bitcoin (BTC) Price Awaits Bullish Momentum

Bitcoin (BTC) price has jumped nearly 5% in the last 24 hours, successfully pushing the price above $20k levels. The 24-hour low and high are $19,152 and $20,071, respectively.

The major factor driving the BTC price movements in the last few weeks is the US dollar index rising 20-year high of 114.78. However, the DXY index today dropped below 111 driving a slight recovery in the crypto market, as well as stock markets. In fact, the Credit Suisse situation is causing investors to take respite in Bitcoin.

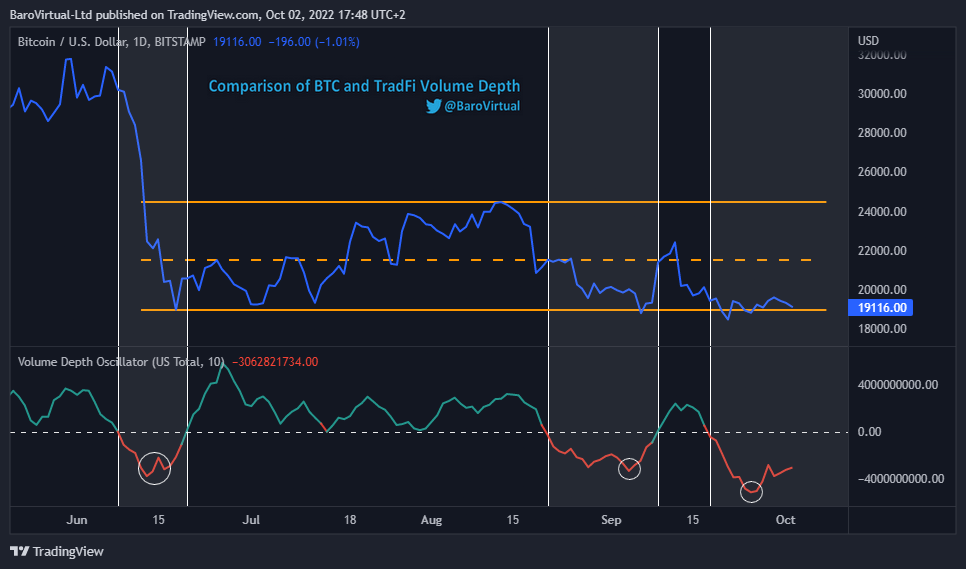

Bitcoin has a correlation with the U.S. equities market. Moreover, the price action of BTC and the trading volume of the stock market indicates a direct relationship. The US Stock Market Volume Depth oscillator determines the bullish and bearish scenarios for Bitcoin.

Every time the Market Volume Depth oscillator reaches below 0, the BTC price recovers from low levels. With TradFi market volume reaching low levels again, the BTC price may bounce to the $21,500-$24,500 range.

On-chain analytics platform Santiment reports a continuous fall in Bitcoin supply on exchanges. The Bitcoin supply on exchanges has now fallen to a four-year low, with only 9% of BTC on exchanges for the first time since 2018. It indicates traders’ confidence over a rise in BTC price, reducing the market-wide selloff risk.

Furthermore, Whale Alert data indicates an increase in Bitcoin (BTC) accumulation since the start of the month. In fact, over 30,000 BTC has been transferred from crypto exchanges to whale wallets in the last 3 days.

Crypto Analysts’ Outlook Over BTC Price

According to analyst Michael van de Poppe, Bitcoin price to continue moving towards $22,400, if it holds the crucial support of $19,600. Moreover, $19,300 is the perfect area to buy BTC for longs.

Popular analyst PlanB believes Bitcoin miners have already signaled a bull run as hashrate jumps again after weeks.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Leave a Reply