Bitcoin (BTC) Price Holds Firm In Face of Global Market Slump, What’s Next?

[ad_1]

The Bitcoin (BTC) price witnessed a slight pullback on Tuesday, after the U.S. Bureau of Labor Statistics announced the consumer price index (CPI) inflation data for January. At 3.1% the CPI stood higher than the Street expectations of 2.9%. This led to a sharp correction on Wall Street with the S&P 500 Index dropping by 1.4%. This was the worst CPI-day performance by the S&P 500 after September 2022.

Bitcoin (BTC) Price Holds Firm

Bitcoin demonstrated notable resilience amidst turbulent global markets triggered by a robust US inflation report. This has further dampened the expectations of swift interest rate adjustments. Despite the global market upheaval, Bitcoin exhibited impressive stability.

Tony Sycamore, a market analyst at IG Australia Pty, said: Bitcoin showed “impressive resilience despite the overnight deterioration in risk sentiment”. However, he added that Bitcoin holds the possibility of correcting 10% from here and taking a dip under $40,000.

Bitcoin has found support from various sector-specific factors, including the introduction of dedicated US exchange-traded funds (ETFs) for the cryptocurrency. These ETFs, launched by prominent firms like BlackRock Inc. and Fidelity Investments, have collectively attracted approximately $3.3 billion in net inflows since their trading debut on January 11.

Furthermore, the anticipation surrounding the upcoming Bitcoin halving scheduled for April has contributed to bullish sentiment. This event, which will reduce the supply of Bitcoin, is historically perceived as a catalyst for price appreciation. Speaking to Bloomberg, Caroline Mauron, co-founder of digital-asset derivatives liquidity provider Orbit Markets, said:

“We expect the market to take a short pause here after a spectacular four-month-long rally, before the upcoming Bitcoin halving takes over the narrative”.

What’s Ahead for BTC?

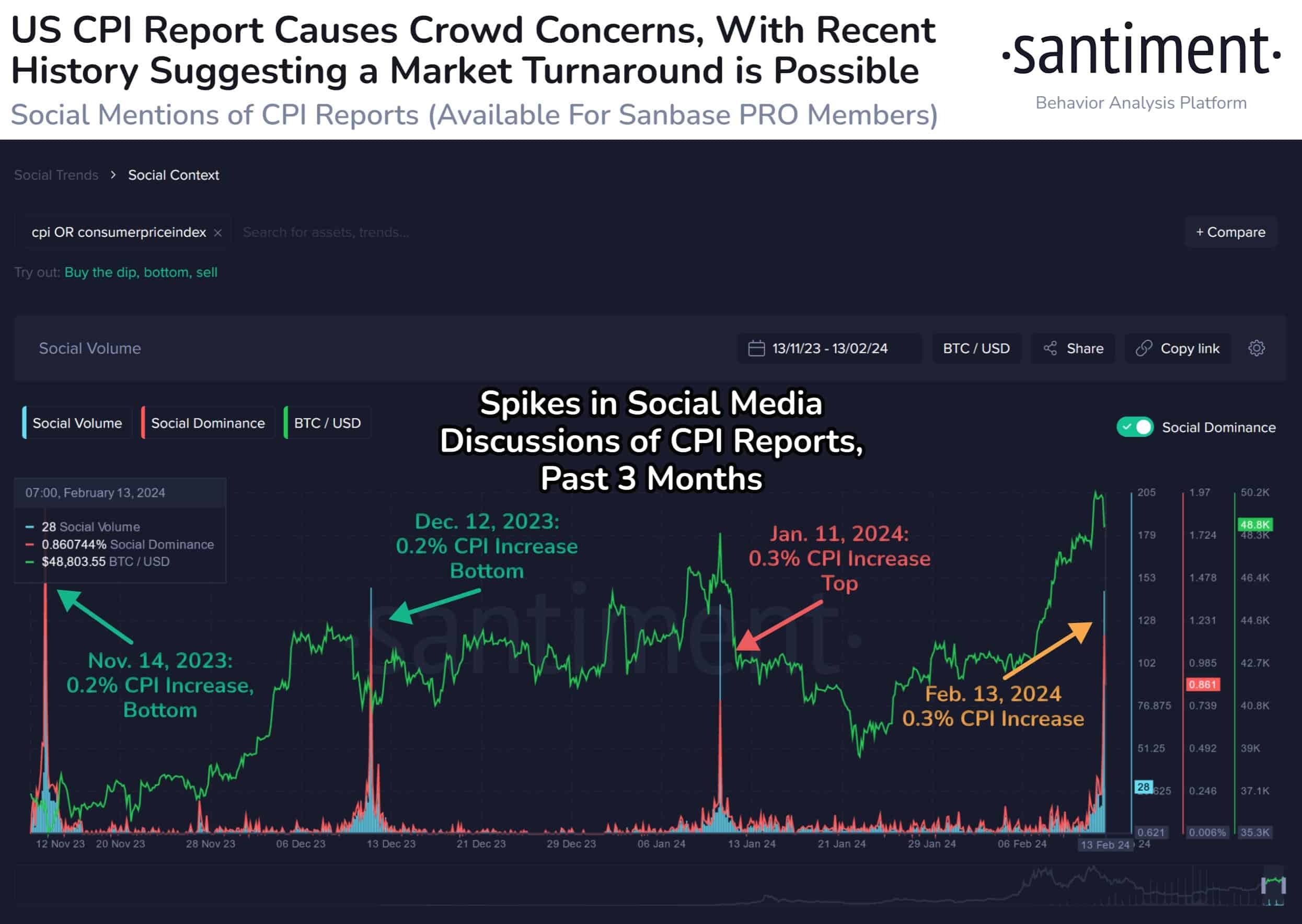

On-chain data provider Santiment reported that the BTC price reversal has sparked polarized sentiment among investors. This reversal prompts a shift in crowd sentiment, expected to become increasingly polarized in response to the market movement.

Analysts at Santiment predict that the mild retrace could lead to significant fluctuations in sentiment, with the potential for panic selling to justify dip-buying strategies. Such a scenario would likely coincide with a negative shift in sentiment among investors.

However, Santiment highlights an interesting trend, noting that the previous three months’ Consumer Price Index (CPI) reports have all coincided with significant mid-term turnarounds in the crypto market. This historical pattern suggests that despite short-term fluctuations, there may be broader market shifts on the horizon

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link

✓ Share: