Are Crypto Exchanges Faking Proof Of Reserves? CZ Warns Investors

[ad_1]

In the light of FTX crash, Binance CEO CZs initiative to disclose proof of reserves has forced other market players to do the same. While, exchanges have started declaring their proof of funds, crypto leaders are raising allegations over large exchange inflows and outflows.

What’s Going On At Crypto.com And Huobi?

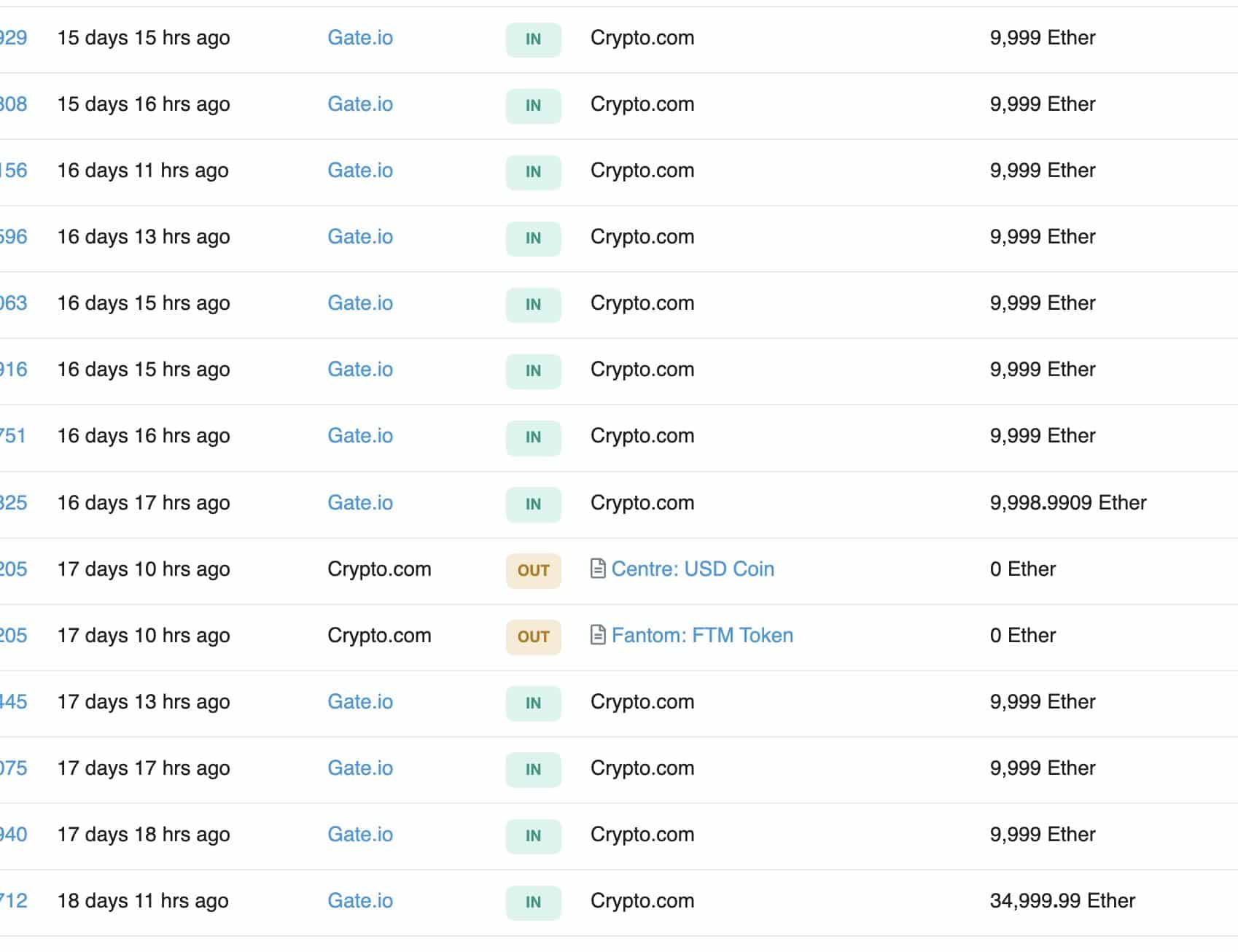

As reported by WuBlockchain 280,000 ETH worth nearly $400 million were transferred from a crypto.com cold wallet to a Gate.io address. The crypto twitter community soon reported a 285,000 ETH transfer back to crypto.com cold wallet from Gate[.]io. These transfers took place before crypto.com and Gate.io released their proof of reserves snapshot.

Source: Etherscan

Crypto.com CEO responded to allegations and said that these transfers were accidental. He added it was a mistake and the ethereum coins were planned to be transferred to another crypto.com cold storage. The ETH coins were by mistake transferred to a whitelisted address at Gate[.]io. He informed that transfer has been recovered back to crypto.com cold storage wallets.

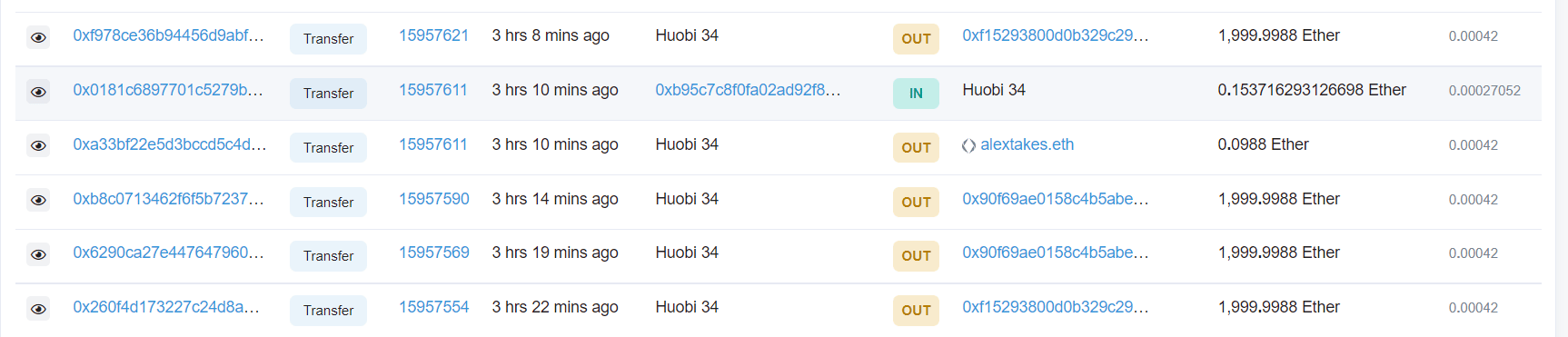

Another exchange reportedly involved in huge transfers before or after proof of reserves is Huobi. One of the Huobi wallets labelled as Huobi 34 transferred 10,000 ETH just after the proof of reserve snapshot. At the time of snapshot the mentioned wallet had 14,858 ETH while now there are only 4,044 ETH remaining.

Huobi has also come out with a statement citing the above transfer to an institutional investor. The team has reported that all reserves are now recovered and operating normally.

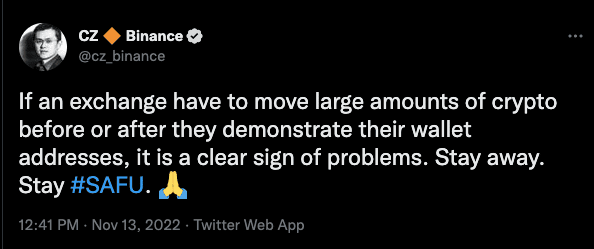

CZ Issues Warning For Investors, What’s Next?

Binance CEO CZ has released a warning for all crypto investors amid ongoing allegations of possible manipulation of reserves by exchanges. He informed investors that large movements of funds before or after release of proof of reserves by any exchange is a clear sign of problem.

As reported by CoinGape, FTX bankruptcy will impact many more crypto projects which were involved with FTX exchange and alameda research. Even Elon Musk has confirmed that he never believed Sam Bankman-Fried aka SBF had $3 billion that he was offering to Elon Musk for twitter acquisition.

SBF exchange and Alameda have invested in dozen of project that includes famous crypto projects like Aptos Labs, Near Protocol, paxos, Genesis digital assets etc. This makes it clear that FTX crisis is not over yet and many crypto firms are struggling to maintain their finances at the moment.

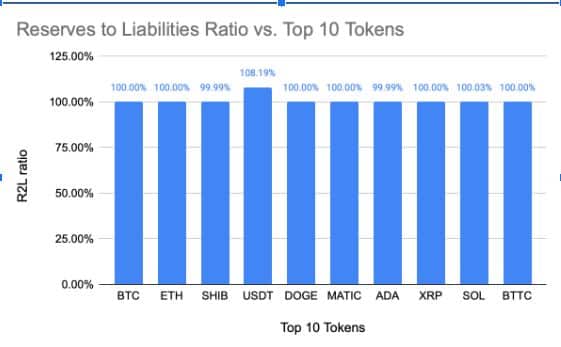

Are Proof Of Reserves Sufficient For Transparency?

Major Indian crypto exchange CoinDCX founder Sumit Gupta argued that proof of reserve provides only one side of the part as it is justification of asset value at any given instant. But what about the liabilities that exchanges hold? In his opinion proof of reserves without proof of liabilities in incomplete.

He proposed a solution called R2L ratio or Reserves to liabilities ratio,

“So let’s take it one step ahead and ensure this with Reserves to Liabilities (R2L) Ratio. Total assets owned (on/off chain) / Total liability & contingencies”

He shared a screenshot of R2L ratio for CoinDCX’s top 10 assets and announced that his exchange will publish R2L ratio position of the exchange periodically.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link

Leave a Reply