Analyzing USDC’s falling utility post the Tornado Cash fiasco

[ad_1]

‘How tables have turned’ is one of the most common phrases used in this ‘niche’ yet the emerging world of cryptocurrencies.

USD Circle [USDC] witnessed the wrath of a dying utility after showcasing its will to rise to the #1 spot. So what went wrong for this stablecoin?

Circle of life

Circle’s stablecoin once rose to fame after it crossed Tether’s USDT by the number of daily transactions on the Ethereum [ETH] blockchain. It also registered a significant hike in its utility following the growing demand be it institutional or retail.

However, things might have gone against the stablecoin as USDC continues to see a grim scenario over the past month.

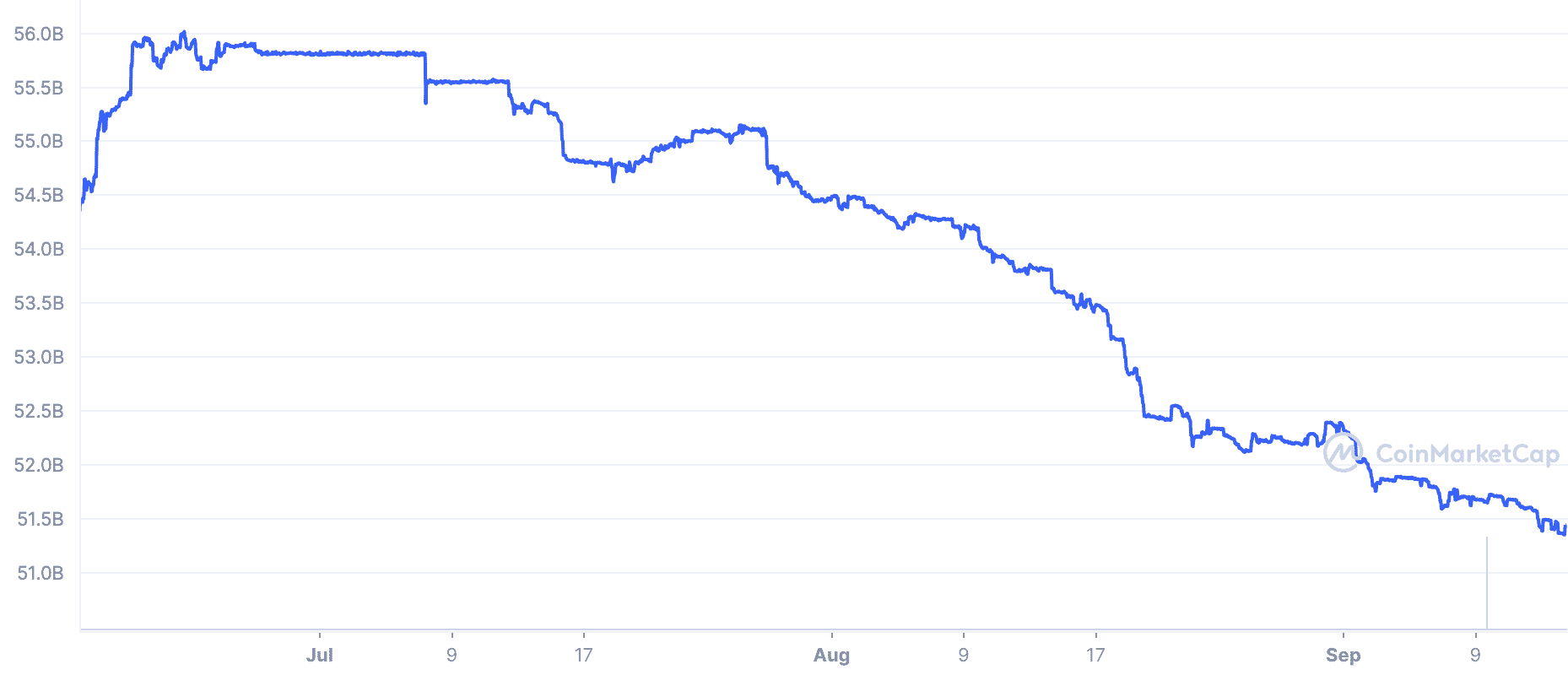

Data showed that USDC’s market supply had declined by more than 2% to stand at $51 billion on CoinMarketCap. In August, this number stood somewhere around the $54 billion mark. Here’s a three-month scenario for the aforementioned stablecoin.

Source: CoinMarketCap

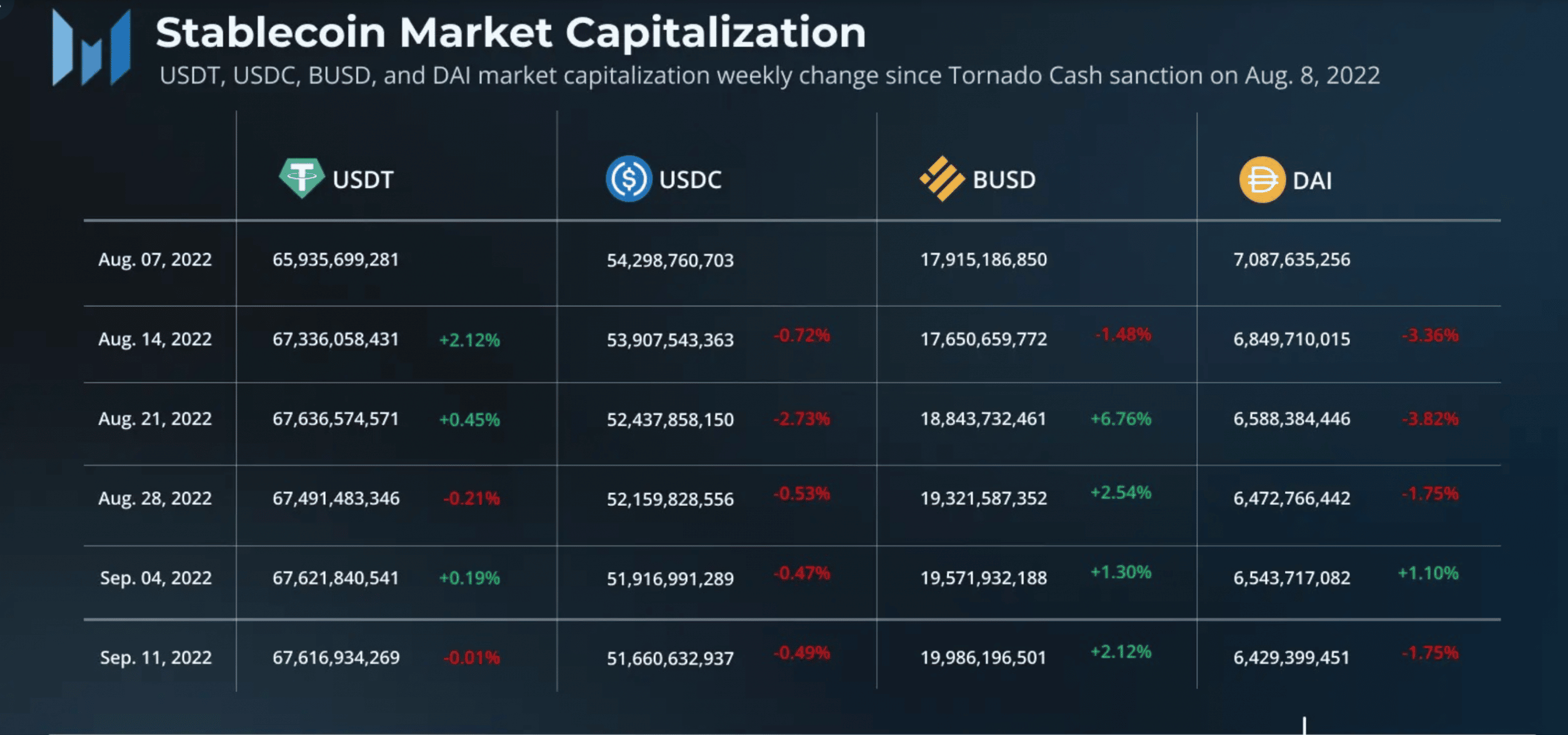

Besides, USDC’s utility also took a massive hit, as per deep analysis from Messari’s analyst, especially after the Tornado Cash sanction fiasco.

USDC issuer Circle began blocking wallets linked to Tornado Cash, which was sanctioned by the U.S.

It froze more than $70k USDC on wallets connected to sanctioned Tornado Cash. Ergo, compiling with U.S. regulator’s decision.

Source: Messari

Did it have any repercussions apart from a drop in market capitalization? Well, 100% yes.

Maker, the DeFi protocol behind the DAI stablecoin reduced its exposure to “centralized” stablecoins, such as Circle’s USD Coin (USDC). In fact, it doubled its debt ceiling on its staked Ethereum (stETH) vault.

Meanwhile, Binance announced it would be ending support for USDC trading pairs. Instead, the crypto exchange would auto-convert USDC deposits into BUSD.

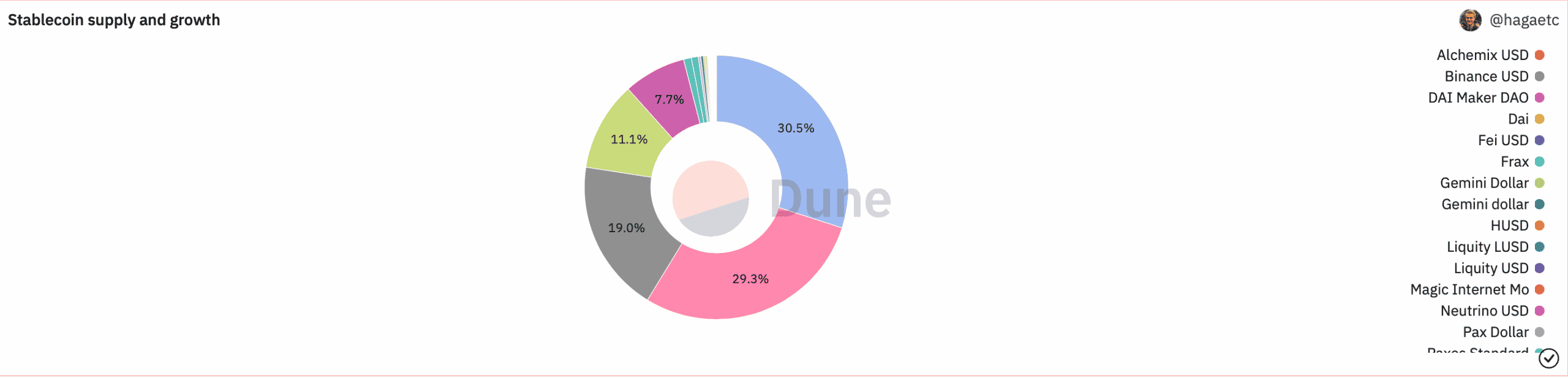

Moving on, USDC’s supply and growth took a hit as well. Once standing at more than 32% and challenging USDT, at press time, it stood at 29.3% in the market share.

Source: Dune Analytics

But that’s not it. Even dominant buyers/whales joined this anti-USDC party along with other guests. The percentage of USD Circle held by major wallet addresses dropped to its lowest point in almost two years.

In addition, USDC reserves revealed that the holdings dwindled for almost a week. After its value was around $4.45 billion on 17 August, its current one was worth $3.26 billion, representing a 4% decline from the last 24 hours. Other indicators too narrated a similar picture.

[ad_2]

Source link

Leave a Reply