Pepe set for breakout: What traders should keep an eye on

- Pepe consolidates as Bollinger Bands signal potential breakout.

- The funding rates turn green as whales accumulate.

Pepe [PEPE] has emerged as a memecoin with substantial potential for growth in Q4 2024. After a remarkable surge of over 1000% following its consolidation phase, PEPE has attracted significant attention.

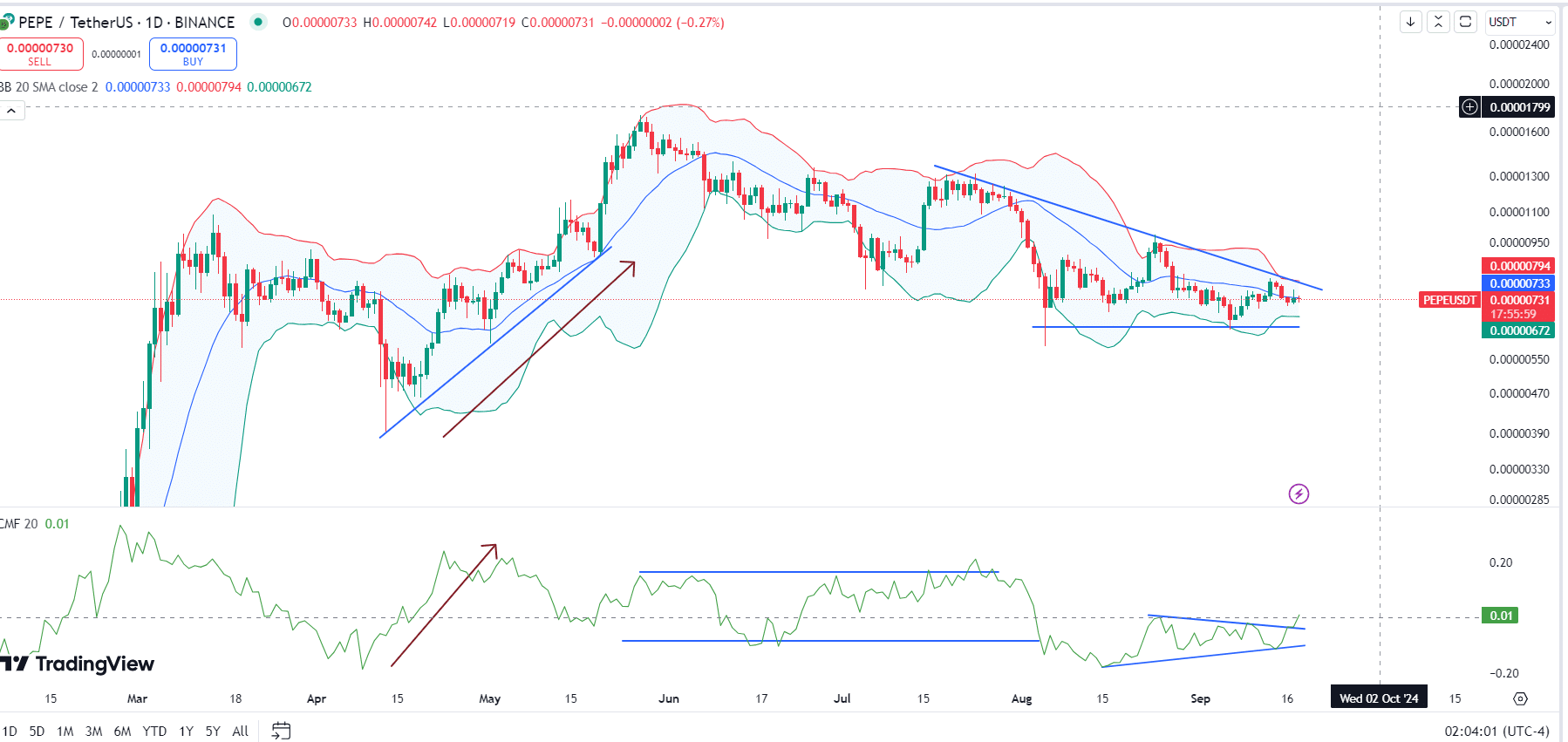

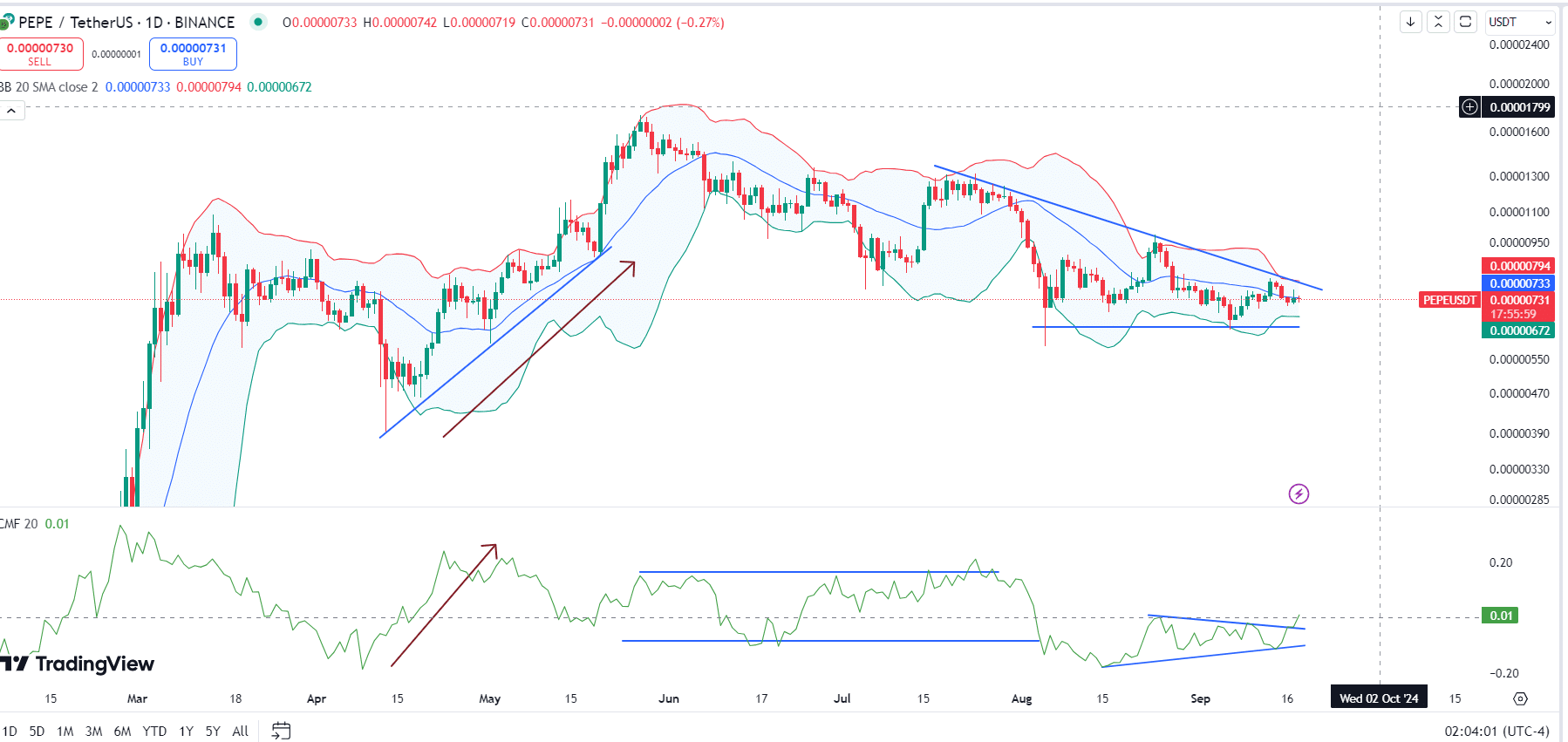

Initially trapped in a sideways market post-launch on the Ethereum blockchain, PEPE/USDT is now forming a triangle pattern.

This consolidation, combined with tightening Bollinger Bands, suggests that a breakout could be imminent. Traders are preparing for a potentially bullish end to the year, supported by historical trends.

Source: TradingView

It’s currently consolidating within a triangle pattern, with Bollinger Bands tightening. This pattern often signals a near-term breakout.

Historical data shows that such setups often precede significant price movements. The Chaikin Money Flow has also broken out of its wedge pattern, indicating that the accumulation phase is nearing its end.

As the CMF rises, buying pressure increases, suggesting that the memecoin could experience a significant surge.

The prolonged consolidation since May further supports the potential for a strong rally if market conditions favor altcoins.

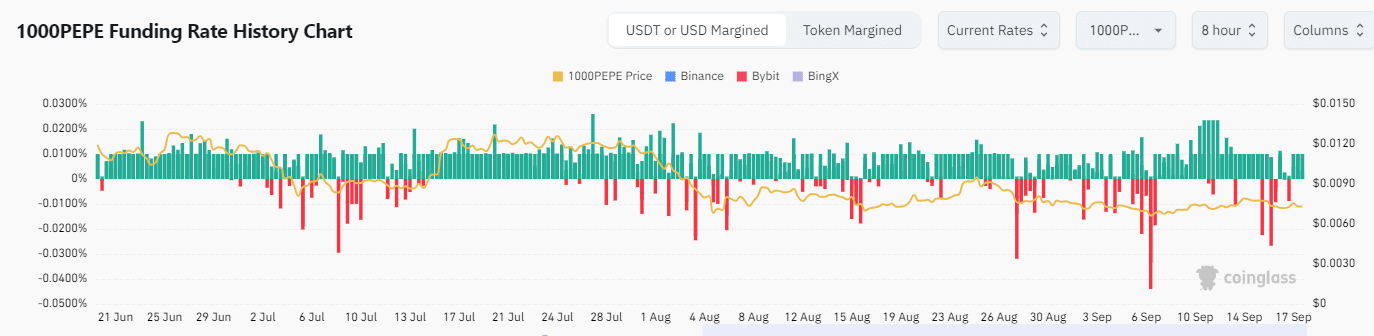

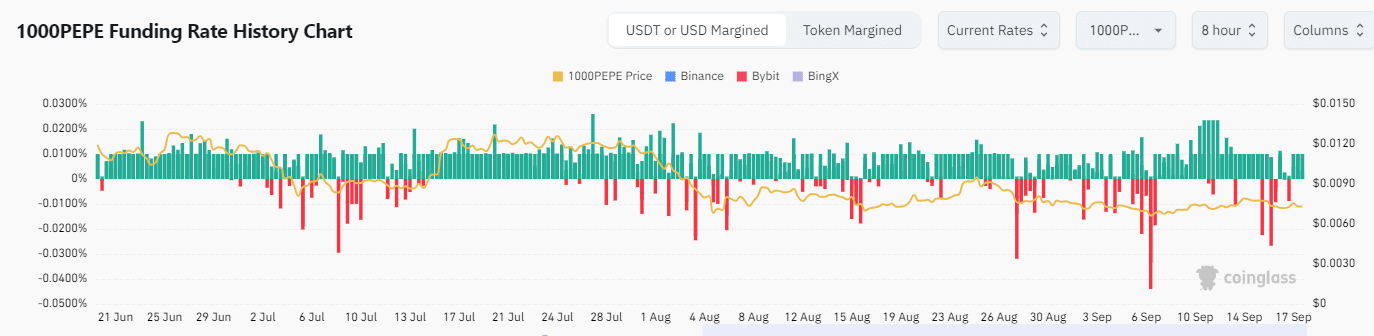

Pepe funding rates turn green

Funding rates have turned green, providing further support for a bullish outlook on Pepe memecoin.

When funding rates are green, it indicates that more traders are going long, reflecting a positive sentiment.

This situation means that long traders are paying short traders to keep their positions open. Such a trend often leads to increased asset demand and higher prices.

Source: Coinglass

However, it also raises the risk of liquidation for long positions if the market shifts.

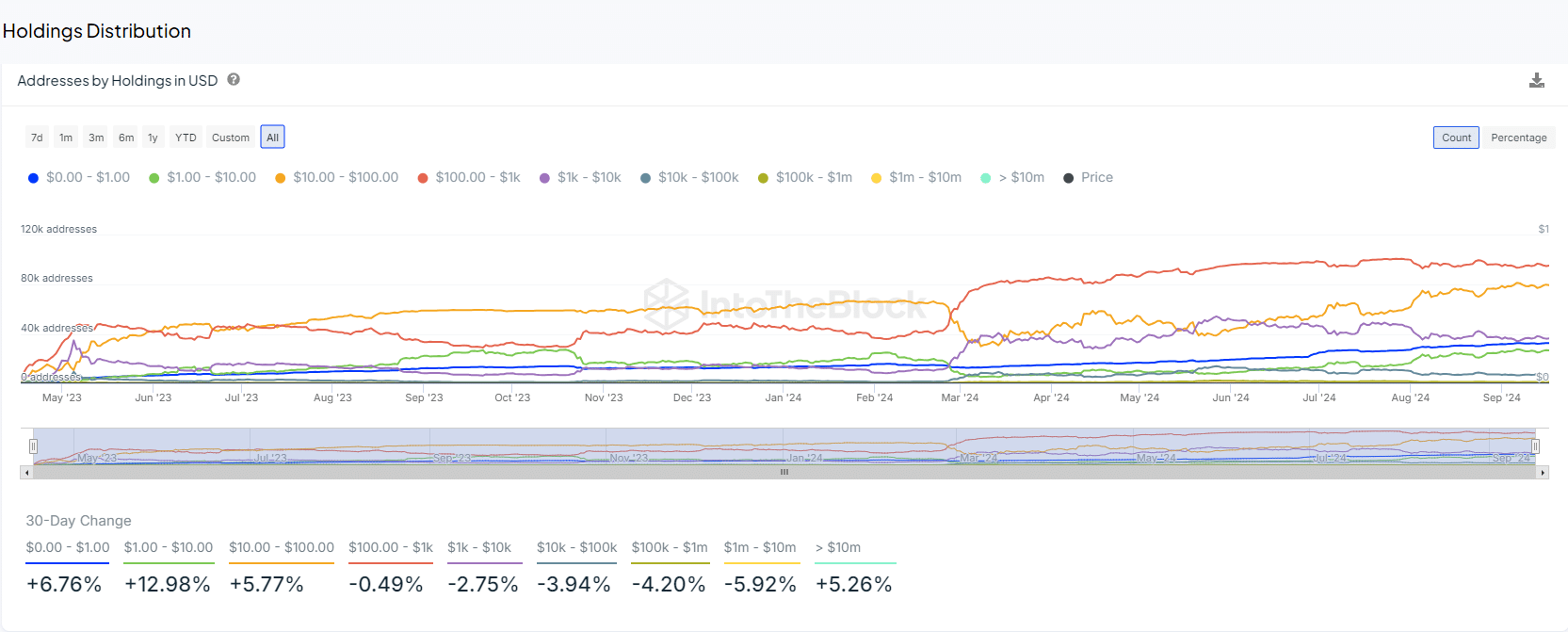

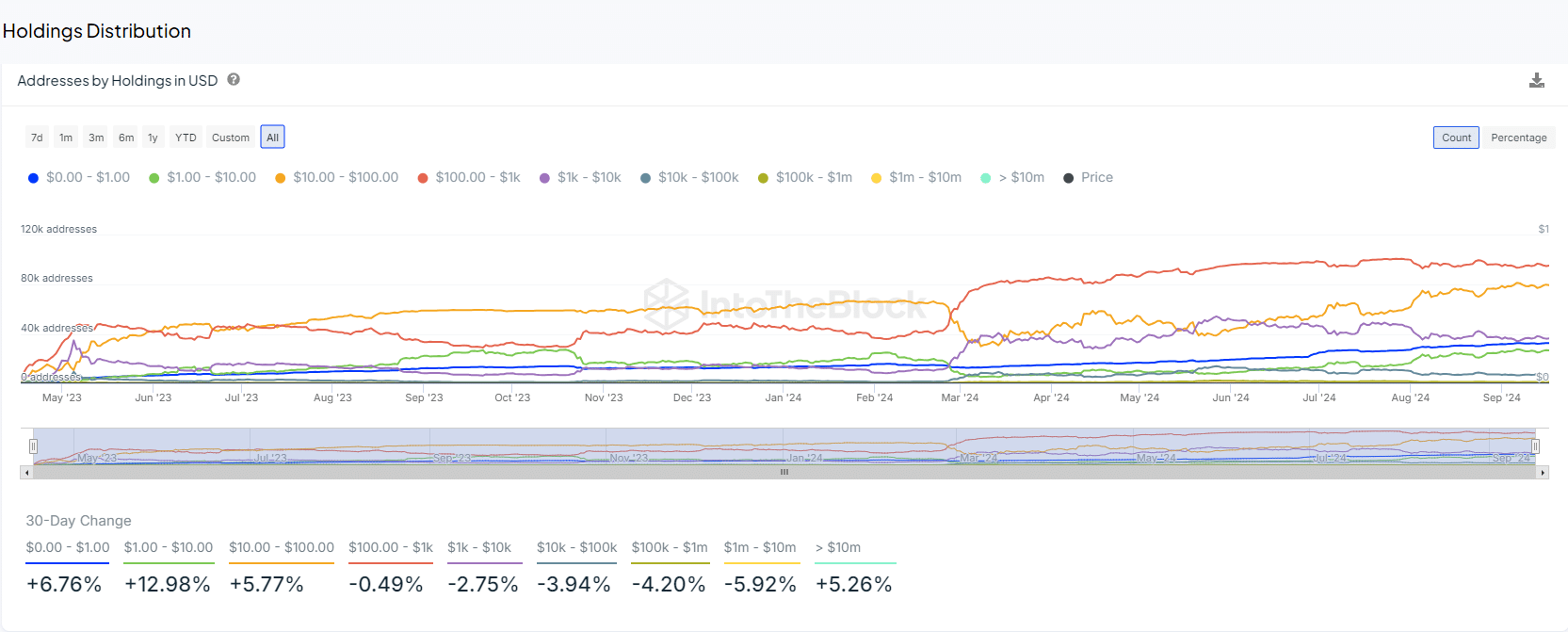

Address holdings and whales

Analysis of addresses by holdings in USD shows that whales continue to increase their positions. Traders holding more than $10 million worth of PEPE have risen by 5.26%.

While retail traders with smaller positions are also increasing, medium-sized traders have seen a slight decrease.

Despite this, the continued aggressive buying by whales signals strong confidence in PEPE’s potential.

Source: IntoTheBlock

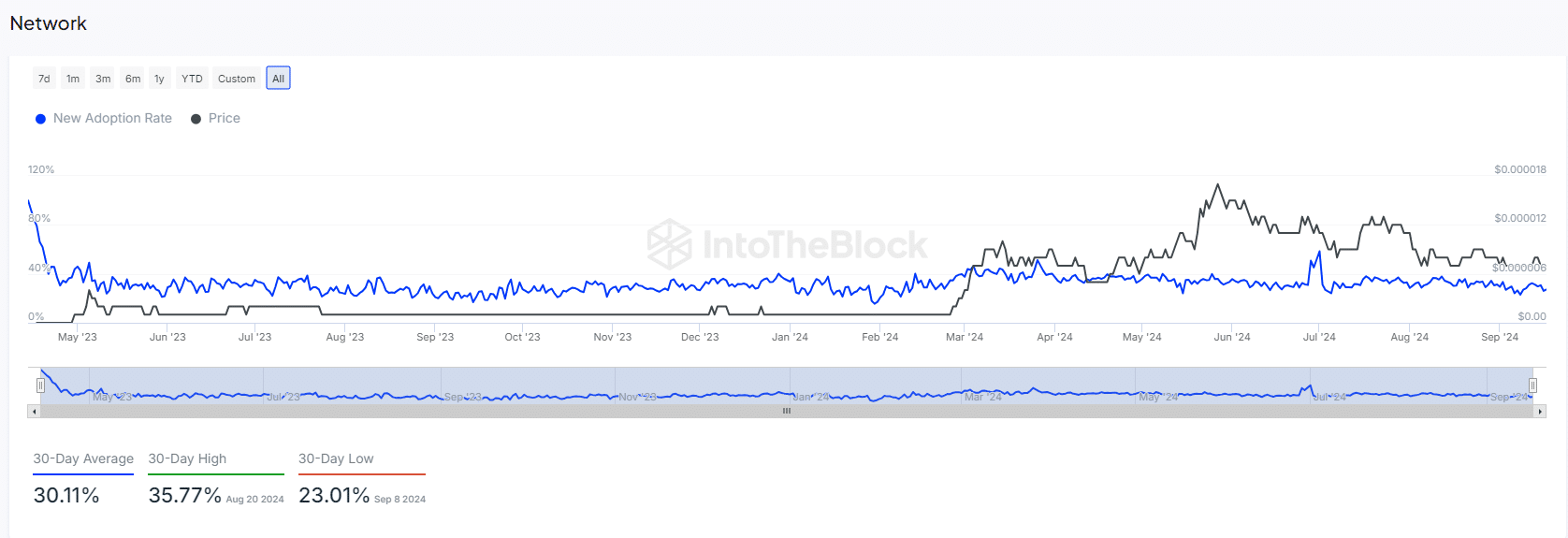

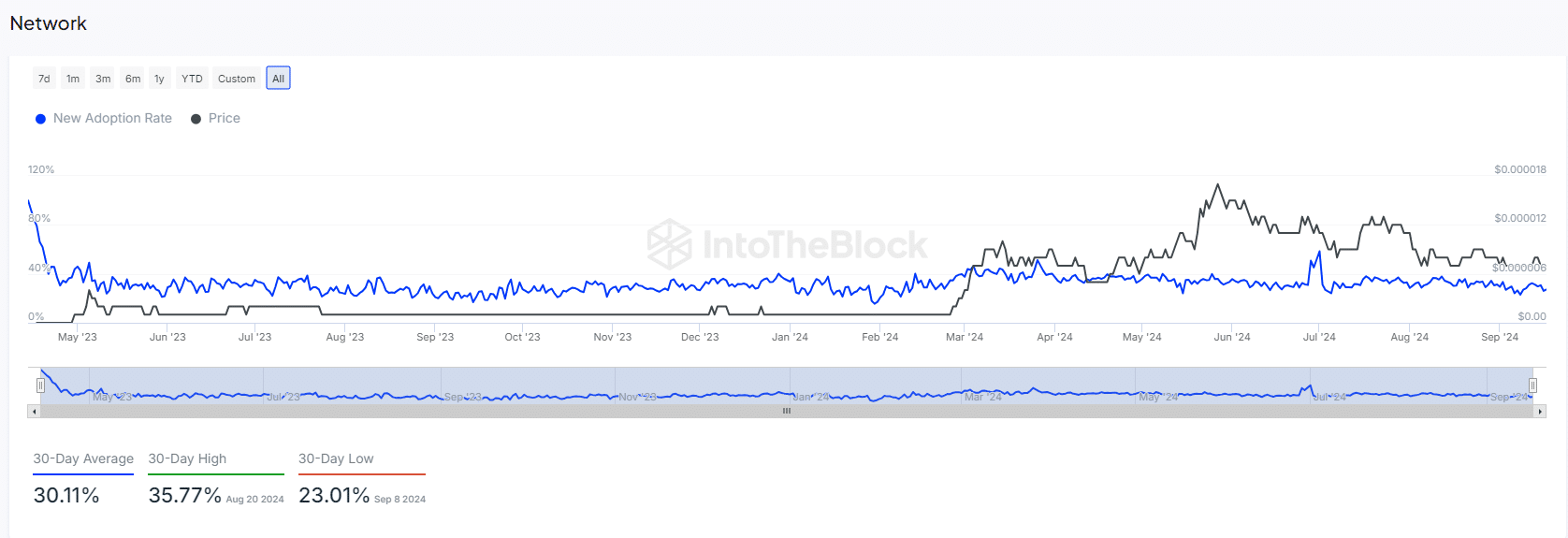

New adoption rate

The new adoption rate for Pepe stands at 26%, reflecting a stable trend without decline. This steady adoption rate indicates that more traders are getting involved, although the pace is not as rapid as some enthusiasts might hope.

Is your portfolio green? Check the Pepe Profit Calculator

Nevertheless, a constant adoption rate is generally bullish and suggests growing interest in PEPE.

Source: IntoTheBlock

Overall, PEPE is showing promising signs for a potential price increase. Key indicators, positive funding rates, strong whale activity, and a stable adoption rate all contribute to a bullish outlook as we approach Q4 2024.

Source link