XRP: Whale Activity Hints at Potential Price Rebound

XRP is currently trading at $2.83, down 2.67% over the last 24 hours and extending its weekly losses to approximately 7.5%. Despite this downturn, the token is still up over 30% in the last three months, indicating a sustained uptrend. On-chain and technical indicators suggest a possible rebound. Whale behavior, exchange flows, and momentum readings all point to a potential recovery, prompting the question: Can XRP still push above $3?

Whale Patience Evident in Exchange Inflows

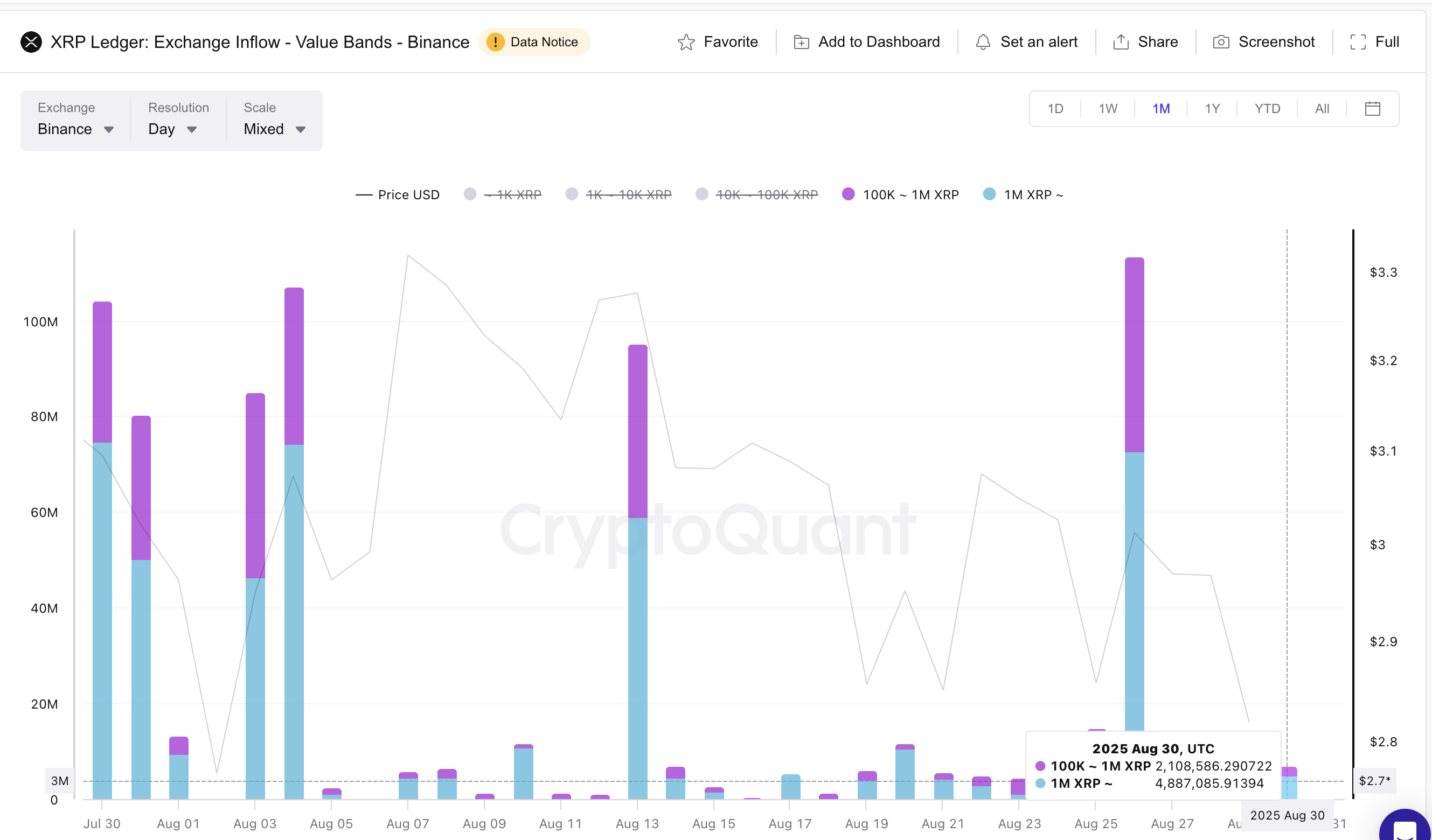

Exchange inflow value bands, which track the amount of XRP flowing into exchange wallets based on transaction size, provide an initial signal. Typically, large inflows suggest whales are preparing to sell, while declining inflows imply they are holding.

Since August 26, Binance has seen a sharp decrease in large-value band inflows. Transactions between 100,000 and 1 million XRP fell almost 95%, from approximately 45.6 million XRP to just 2.1 million XRP by August 30. Inflows exceeding 1 million XRP dropped by nearly 93% during the same period.

This substantial decrease suggests reduced selling pressure from large holders, potentially strengthening support for XRP.

Taker Buy-Sell Ratio Suggests Possible Market Bottom

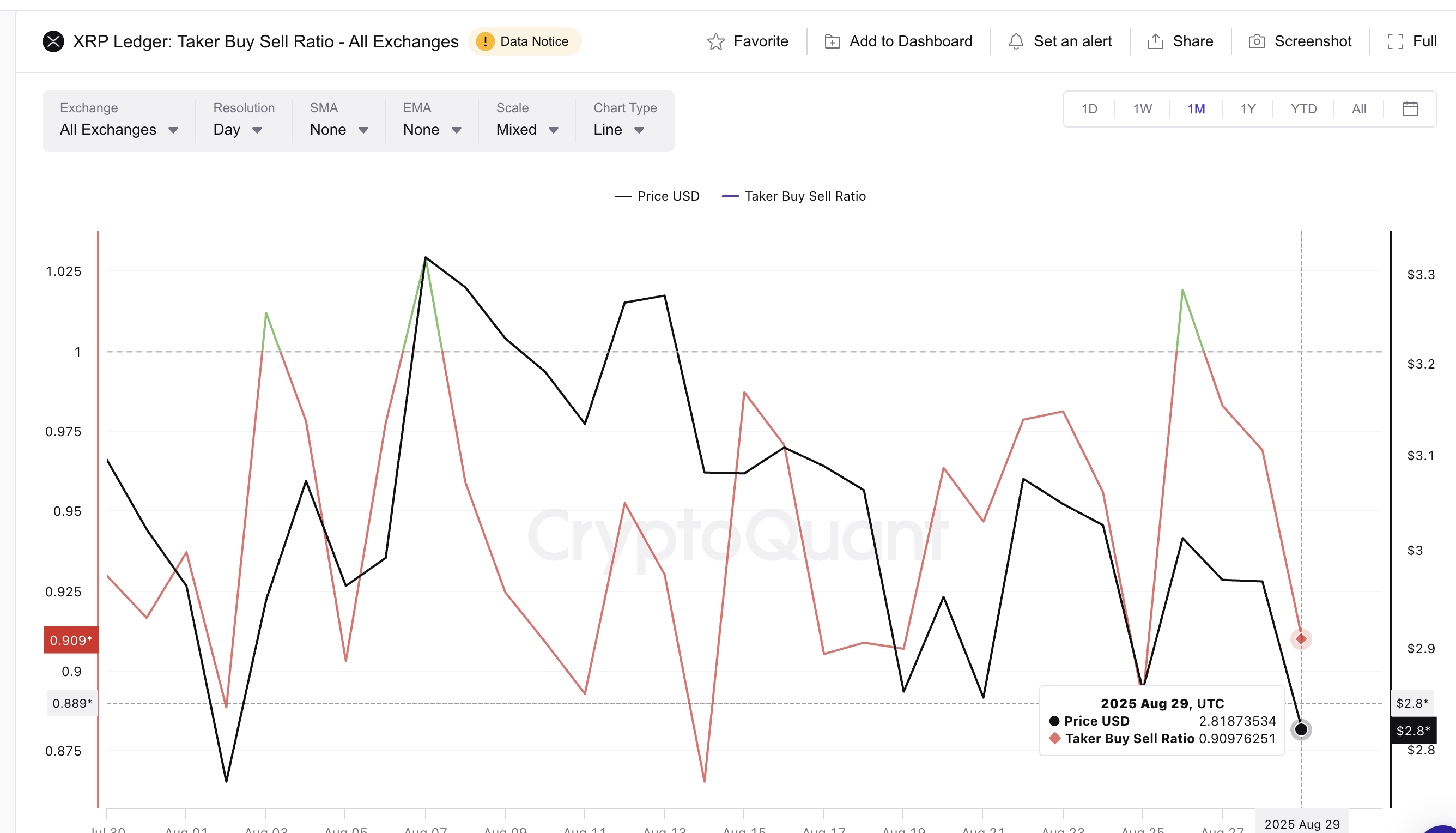

The Taker buy-sell ratio offers another critical insight. This ratio indicates whether market participants are aggressively buying or selling. A value above one suggests strong buying, while a value below one indicates stronger selling pressure.

Currently, the ratio is at 0.90, indicating more selling pressure. This might seem bearish, especially since retail traders often dominate this metric. However...

Historical data from August reveals that dips below one in the taker buy-sell ratio often coincided with local market bottoms. For example, on August 2, the ratio dropped to 0.88, and XRP climbed almost 20% in the following weeks. A similar pattern occurred on August 19. The current reading is near these levels.

This suggests that the apparent bearish retail sentiment might be setting the stage for another rebound. Combined with decreased whale exchange inflows, this divergence could pave the way for upward price movement.

XRP Price Prediction: Key RSI Levels

Technical analysis further supports the potential rebound. A bullish divergence has emerged between the Relative Strength Index (RSI) and price action.

While XRP's price made a lower low between August 19 and August 29, the RSI made a higher low during the same period. This divergence suggests weakening downside momentum, reinforcing the possibility of a recovery.

The initial price target to watch is $2.84. A daily close above this level could trigger a move toward $2.95 and then the $3.00 mark. A decisive break above $3.33 would confirm a broader bullish trend. However, a daily close below $2.72 would invalidate the bullish scenario.