XRP Whale Accumulation Signals Potential Price Reversal

XRP Price Pullback and Whale Accumulation

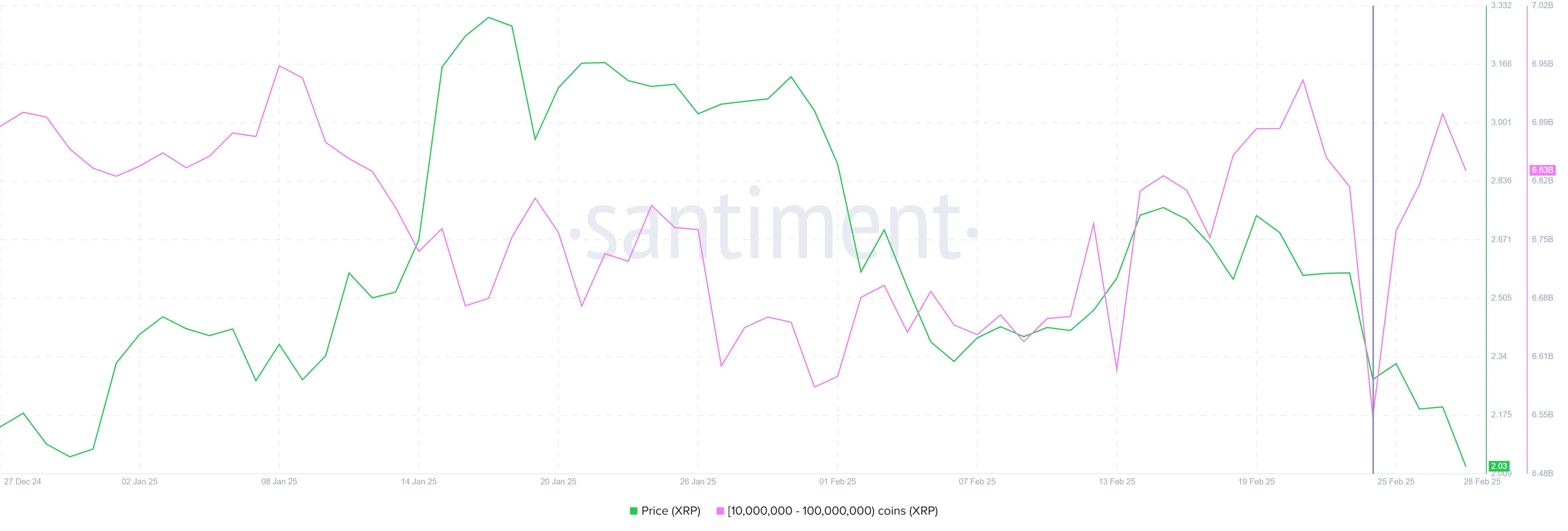

XRP recently experienced a price correction, mirroring a broader bearish trend in the cryptocurrency market. However, significant XRP accumulation by whales hints at a potential price reversal. Historical data suggests that this activity could precede a rally.

Bullish Signals from XRP Whales

Whale addresses holding 10 million to 100 million XRP have acquired over 300 million XRP (approximately $609 million) in recent days. This follows prior profit-taking at higher prices, indicating renewed confidence in XRP's future.

This buying behavior during a market downturn is a strong indicator of positive sentiment. Whales often act as market movers, and their actions suggest an expectation of future price appreciation.

Oversold RSI: A Technical Indicator

XRP's Relative Strength Index (RSI) is currently in oversold territory, a significant technical signal. This is the first time in seven months the RSI has reached such low levels. Historically, these oversold conditions have triggered XRP price reversals, with one past instance leading to a 47% rally.

This suggests a potential price rebound. If the trend holds, XRP could reach $2.98.

XRP Price Analysis and Potential Targets

XRP is currently trading at $2.03, down 24% in the past week, but holding above the $1.94 support level. A successful breach of the $2.33 resistance could initiate a rally.

A bullish reversal, supported by technical indicators and whale activity, could propel XRP towards $2.33, potentially reaching $2.70 and even $2.95. However, failure to break $2.33 could result in price stagnation between $1.94 and $2.33.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Market conditions are subject to change. Conduct thorough research and consult a professional before making investment decisions.