XRP Price Analysis: February 2025 Outlook

XRP Price Analysis: February 2025 Outlook

XRP experienced a more than 3% drop in the last 24 hours, signaling slowing momentum. The RSI dipped below 40, indicating weakening strength. Notably, whale activity remains stagnant, suggesting large holders aren't accumulating. EMA lines approach a potential death cross, potentially leading to further price declines if selling pressure increases.

However, a breakout above key resistance levels and a return to strong bullish momentum could propel XRP towards $4 by February. Let's delve into the details.

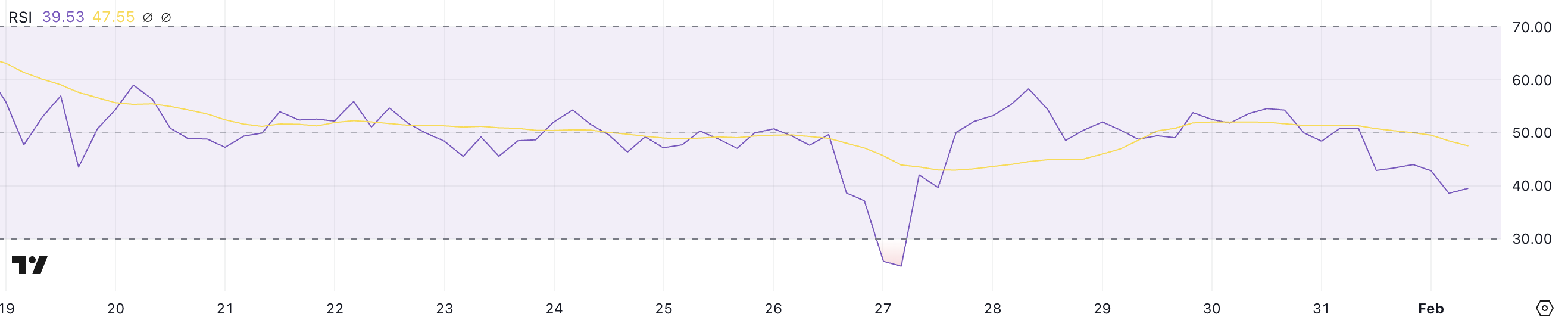

XRP RSI: Neutral Territory

The XRP RSI currently stands at 39.5, staying within a neutral range since its January 28 peak at 58. An RSI above 70 suggests an overbought market, while levels below 30 indicate oversold conditions. A reading between 40 and 60, as we currently see, points to market consolidation.

The current RSI near the oversold zone hints at weak momentum, potentially leading to further price drops unless buying pressure increases. To approach $4, the RSI needs to rise above 50, signifying renewed strength. Positive ETF developments or the resolution of the SEC lawsuit could trigger this.

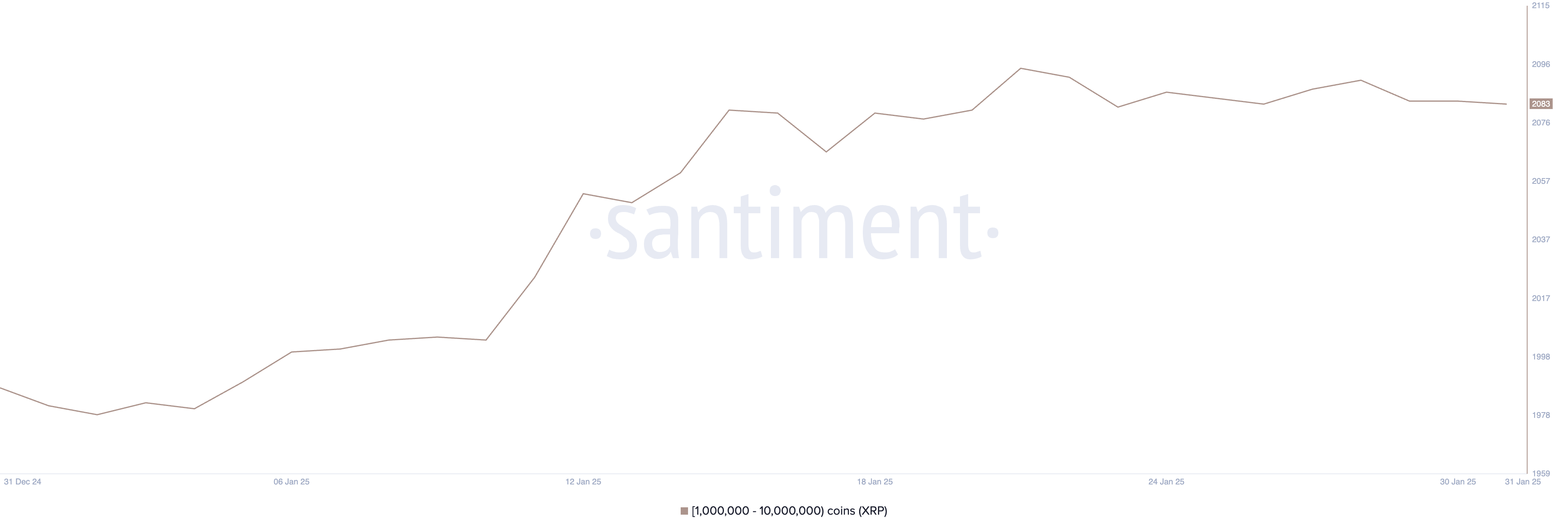

Whale Activity: Sideways Movement

The number of XRP whale addresses (holding 1 million to 10 million XRP) has remained flat since January 21, fluctuating between approximately 2,082 and 2,095. Whale accumulation usually precedes significant price increases, impacting market liquidity and sentiment. A rise in whale addresses signifies growing investor confidence, while a decline suggests reduced conviction.

For XRP to hit $4, renewed whale accumulation, mirroring early January's surge, is crucial. During that period, a price jump from $2.41 to $3.4 coincided with a rise in whale addresses.

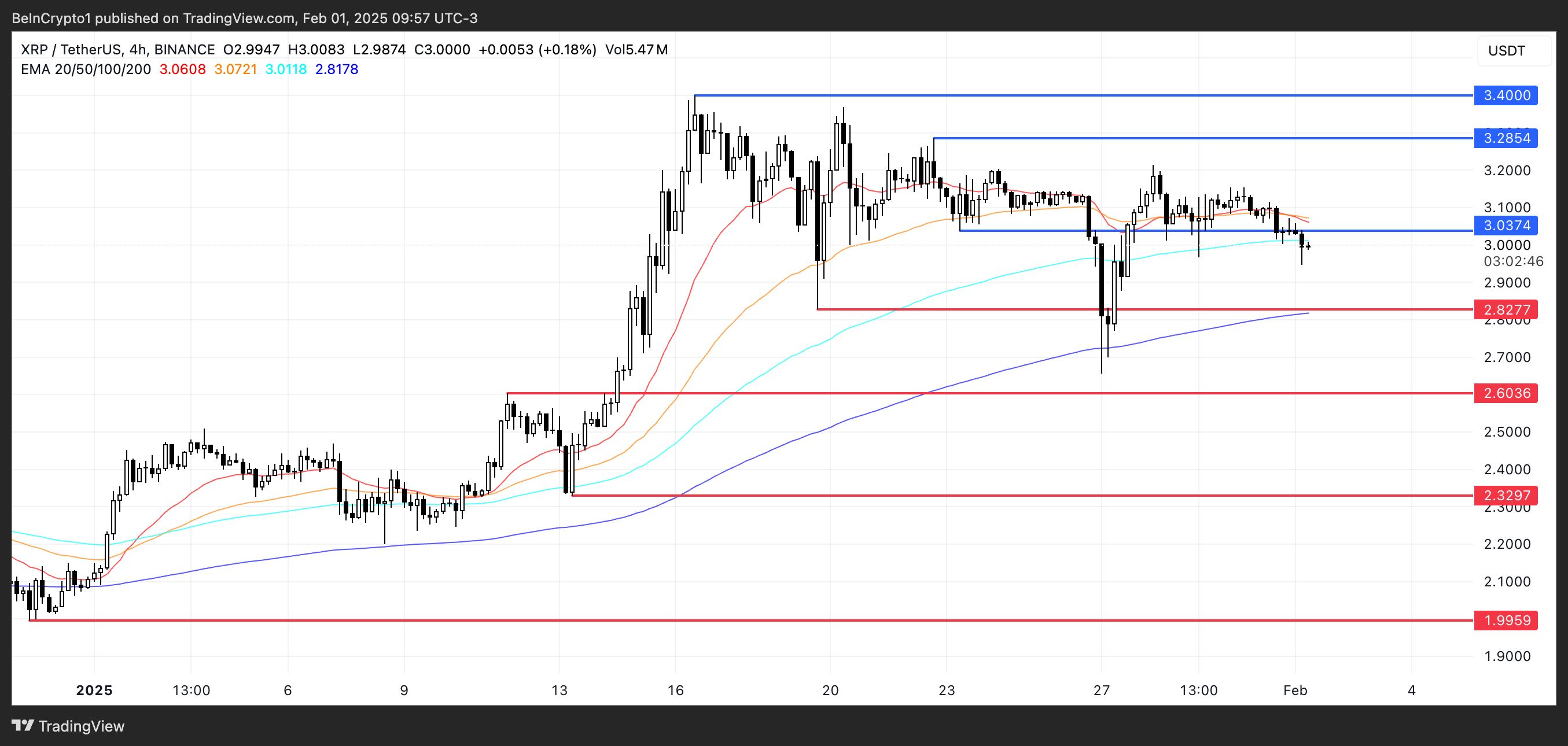

XRP Price Prediction: Potential for $4?

The impending death cross in XRP's EMA lines suggests potential downward momentum. This could see the price testing support at $2.82. Failure at this level might lead to further drops toward $2.6 and $2.32, and potentially even as low as $1.99 in a worst-case scenario.

Conversely, breaking the $3.03 resistance could reignite bullish momentum, pushing the price towards $3.28 and $3.4. A successful breakthrough of these levels could pave the way for a test of $4, a potential 33.3% increase from current levels.

Disclaimer: This analysis is for informational purposes only and not financial advice. Market conditions change rapidly. Conduct thorough research and consult a professional before making any investment decisions.

Codeum provides comprehensive blockchain security and development services, including smart contract audits, KYC verification, custom smart contract and DApp development, and tokenomics consultation. We partner with launchpads and crypto agencies to deliver secure and reliable blockchain solutions.