XRP Price Analysis: Consolidation or Correction?

XRP Price Stagnation: A Deep Dive

Recent weeks have seen XRP's price consolidate, failing to gain significant momentum despite positive developments like the SEC lawsuit dismissal. While these catalysts were expected to boost XRP's value, experts like Temujin Louie, CEO of Wanchain, suggest they haven't impacted utility or adoption, leaving the price largely unchanged.

The anticipation surrounding XRP ETFs also plays a role in this volatility. However, the market's enthusiasm for crypto ETFs appears to be waning, with each new approval generating less excitement than the last, according to Louie.

XRP's Historical Patterns

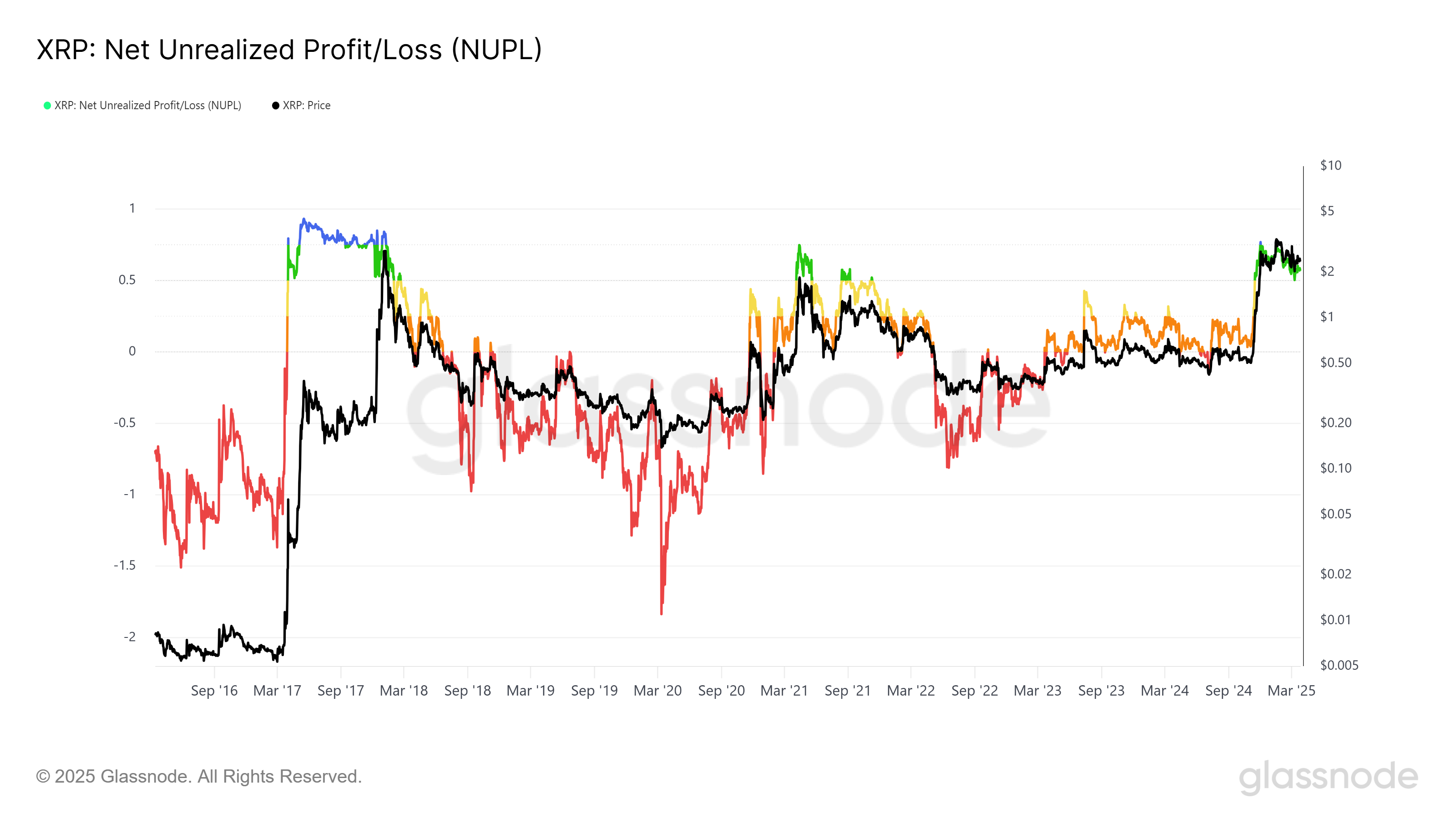

XRP's Network Utilization and Profit/Loss (NUPL) indicator reveals a saturation phase, similar to a nine-month period in 2017 preceding a significant price surge. This historical parallel raises the possibility of a future price correction.

Further mirroring Bitcoin's past, XRP's price action has been influenced by the broader crypto market, with Bitcoin's ascent potentially overshadowing gains for altcoins. Hank Huang, CEO of Kronos Research, notes that investors favor Bitcoin's perceived stability over altcoins, hindering XRP's potential for a breakout.

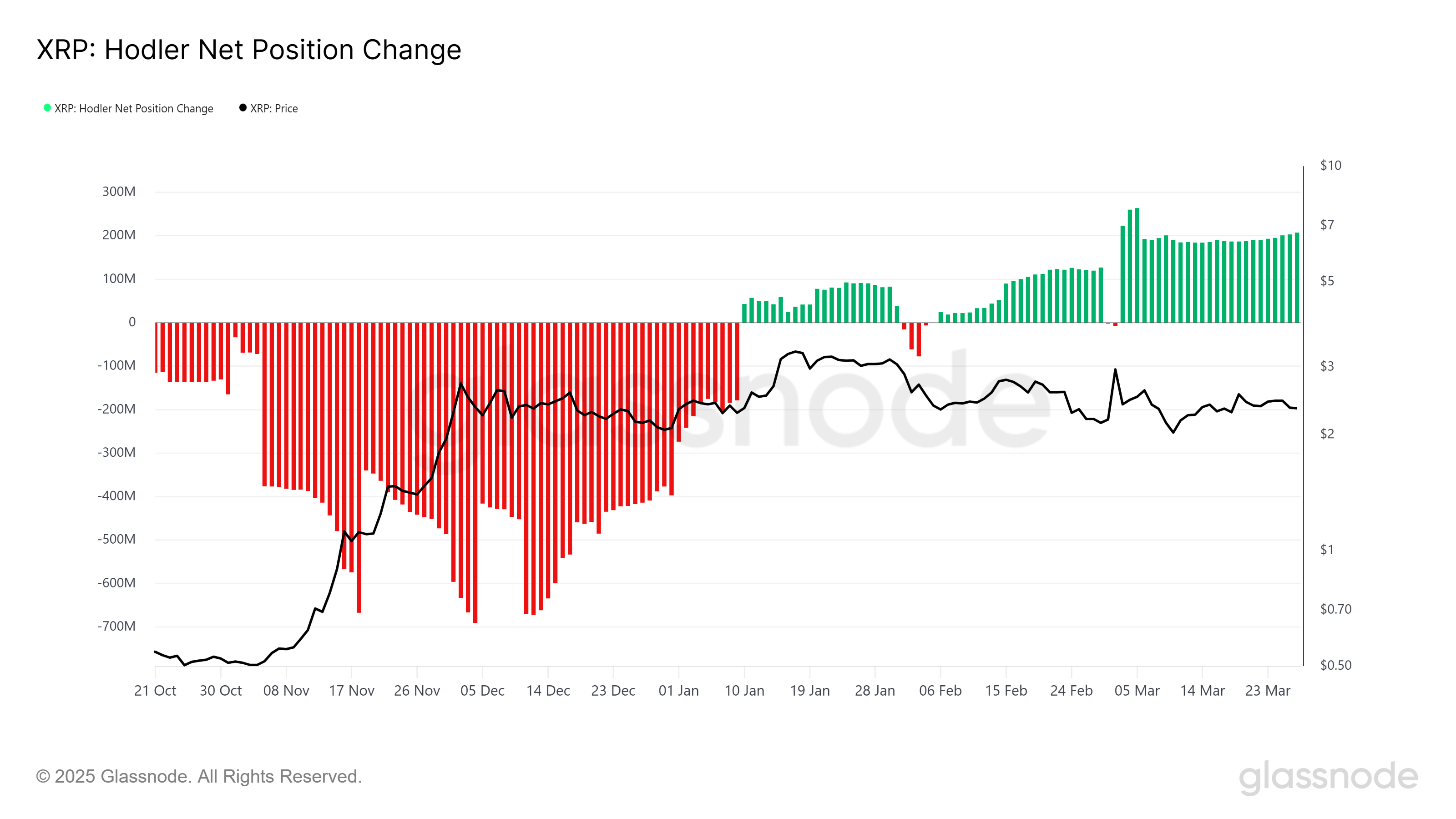

Despite the stagnation, the Hodler Position Change metric shows that long-term holders (LTHs) are accumulating XRP, indicating confidence in its future value. This accumulation could buffer against significant price drops and potentially trigger a price surge when market conditions improve.

Will XRP Overcome Key Resistance?

Currently trading around $2.20, XRP has repeatedly failed to break the $2.56 resistance level. Breaking this level would be crucial for a sustained price increase, potentially opening the path towards $2.95, $3.00, and even its all-time high. Failure to break through could lead to a decline towards $2.02 or lower.

Codeum's Note: Navigating the complexities of the crypto market requires careful analysis. Codeum provides comprehensive blockchain security solutions, including smart contract audits, tokenomics consultation, and DApp development, to help projects mitigate risks and build secure, thriving ecosystems. Contact us today to learn more.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Market conditions are subject to change. Always conduct your own research.