WLFI Price: Whale Accumulation Suggests Rebound Potential

WLFI Price Rebound Hinges on Key Support Levels

World Liberty Financial (WLFI) is currently trading near $0.21, marking a 12% decrease in the past 24 hours. Since its peak of $0.33 on September 1, the WLFI price has corrected by approximately 37%.

While the price decline may raise concerns, on-chain data reveals significant whale accumulation and a potential rebound level based on liquidation maps.

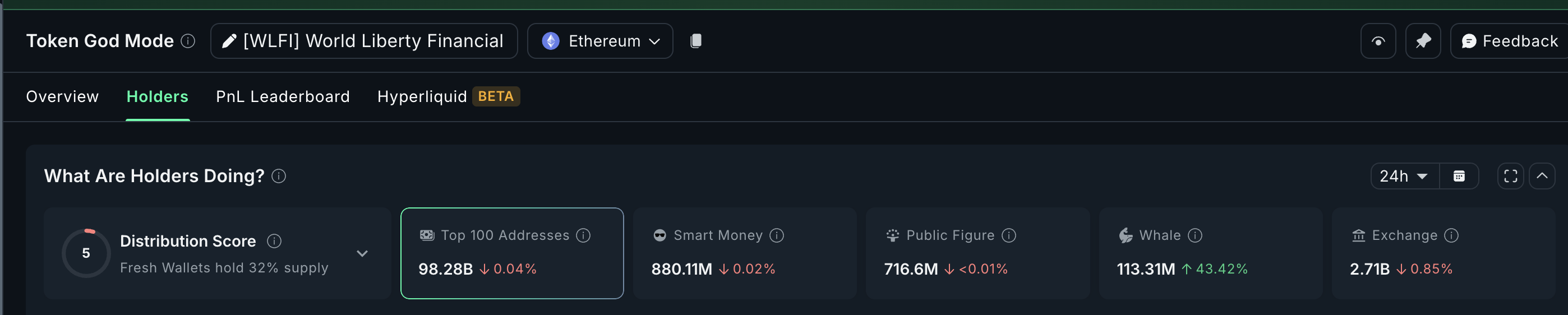

Whale Accumulation Persists Despite Dip

Despite the price correction, whale wallets have substantially increased their WLFI holdings. Over the last 24 hours, whale balances rose by 43.42%, from 79.01 million to 113.31 million WLFI. This translates to whales acquiring approximately 34.30 million tokens, valued at roughly $7.2 million based on current prices.

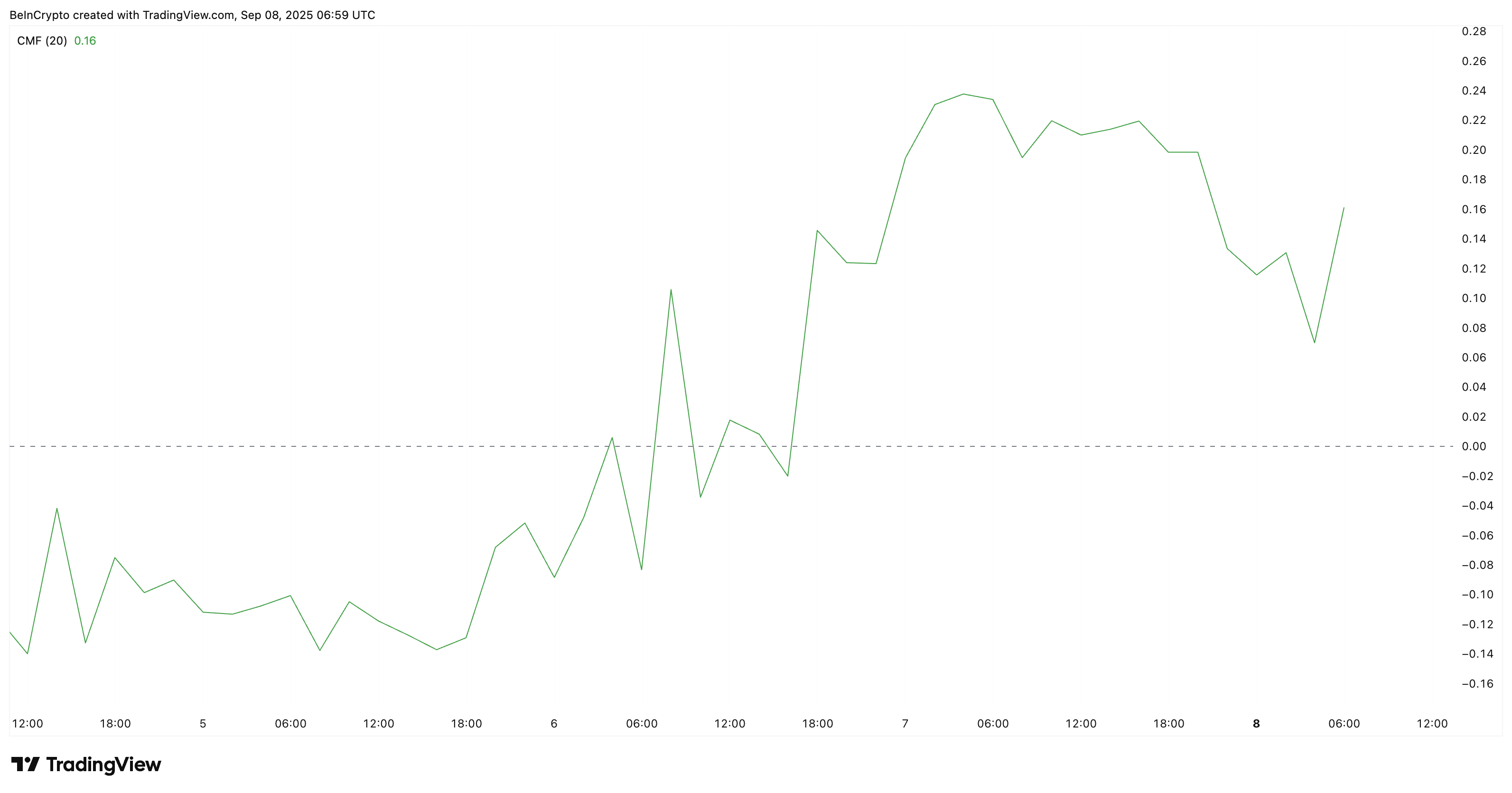

The Chaikin Money Flow (CMF), a key indicator of money flow, remains positive at +0.17, further supporting the presence of whale accumulation. A CMF above zero suggests that large investors are actively injecting capital into WLFI.

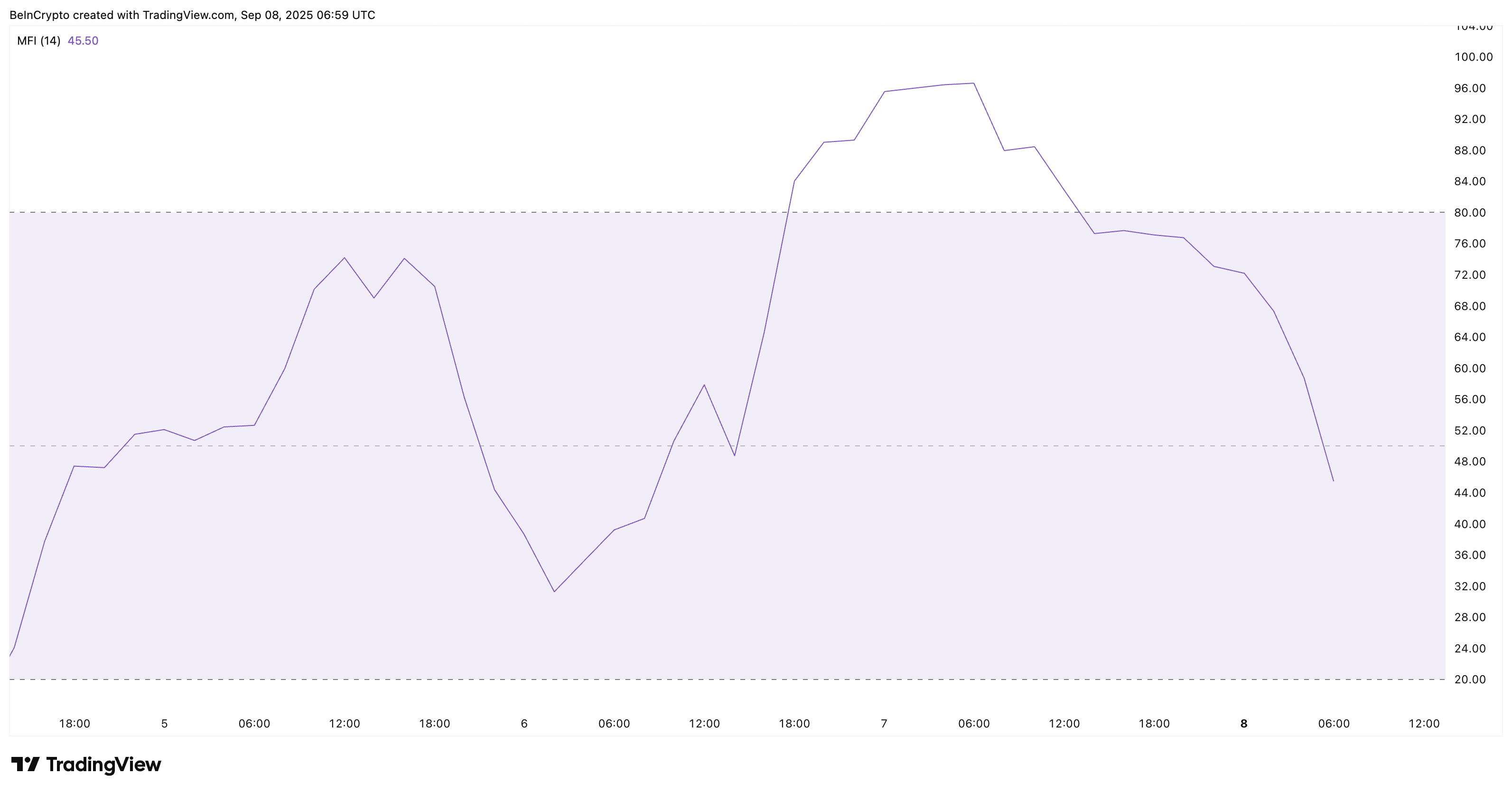

However, the Money Flow Index (MFI) on the 2-hour chart shows a decline, indicating that smaller traders aren't aggressively buying the dips. This suggests that while whales sustain overall inflows, short-term rebound strength may be tempered.

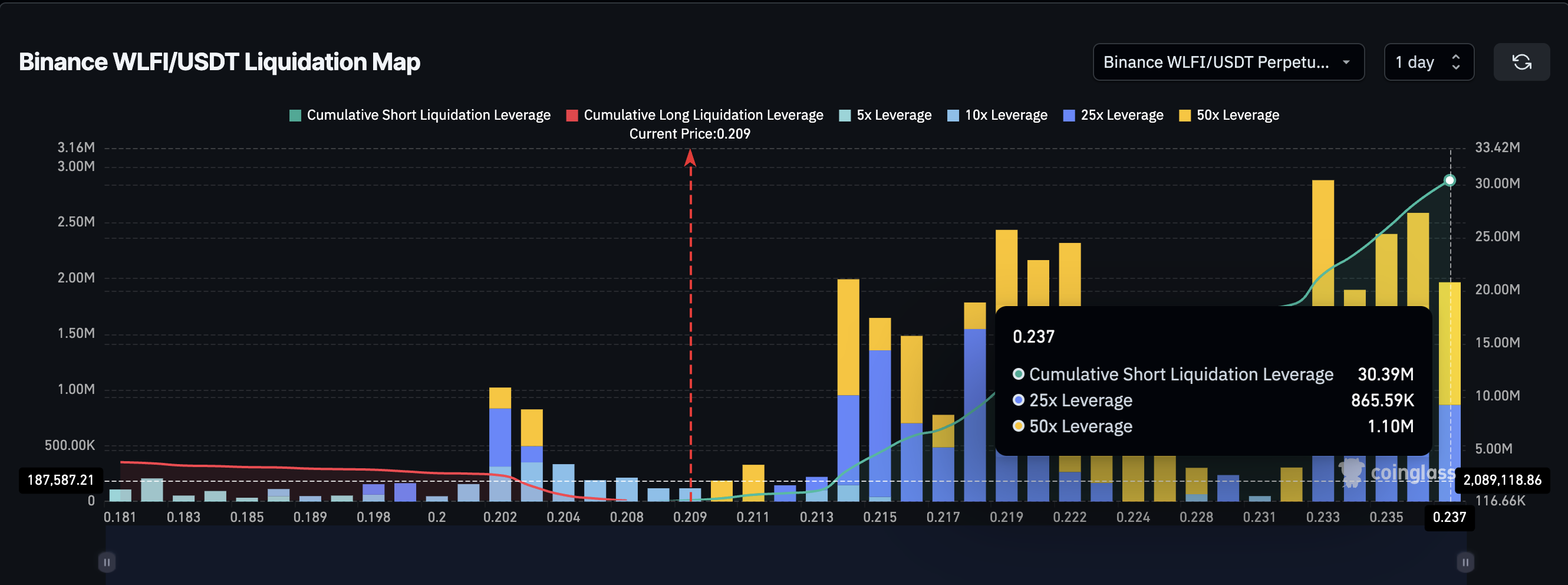

$0.18: A Critical Support Level Emerges

Liquidation maps indicate that a significant liquidation cluster for long positions exists at $0.18. This level aligns with existing support on the price chart, making it a crucial support zone. The market currently leans heavily short, with over $30 million in short positions stacked up against approximately $4 million in long liquidations.

If WLFI drops to $0.18, it is anticipated that buyers may strongly enter the market, potentially triggering a rebound. The substantial short liquidations could amplify the strength of any subsequent bounce.

WLFI Price Action: Watching the Rebound Zone

WLFI is currently trading just above $0.20, which is acting as short-term support on the 2-hour chart. If the token can maintain this level, the buying pressure from whales could propel it back towards $0.22, which represents the next key resistance level.

A successful break above $0.22 could set the stage for WLFI to test $0.24 and potentially higher levels. The alignment of the $0.18 liquidation cluster with chart-based support highlights the importance of this level as a rebound zone. If WLFI can hold above $0.20 and avoid falling below $0.18, the probability of a bounce increases. Failure to maintain these levels, however, could lead to further downward pressure.