WLFI's $1.5B Integration: Crypto Bridging to Public Markets

World Liberty Financial (WLFI) Integrates with NASDAQ-listed ALT5 Sigma

BitMart Research, the research division of BitMart Exchange, has released an in-depth report on World Liberty Financial (WLFI), focusing on its DeFi ecosystem, tokenomics, and its $1.5 billion integration with ALT5 Sigma (ALTD), a NASDAQ-listed company. WLFI's strategy revolves around the USD1 stablecoin, which has been deployed across Ethereum, BNB Chain, and Solana, extending into MemeFi, AI, and LSD protocols.

The partnership with ALT5 Sigma, drawing parallels with MicroStrategy's Bitcoin treasury approach, aims to connect crypto assets with traditional financial infrastructure. The report examines how WLFI's stablecoin infrastructure and strategic equity agreements could reshape institutional crypto adoption.

Project Updates

WLFI has developed a DeFi ecosystem around the USD1 stablecoin, expanding into lending, trading, payments, Meme, LSD, and AI sectors. The strategy involves three key phases:

- Establishing USD1 demand through lending and trading on major blockchains like BSC, Ethereum, and Solana.

- Integrating USD1 into emerging sectors like Meme and AI through strategic investments and partnerships.

- Securing long-term growth by investing in early-stage projects to drive USD1 adoption.

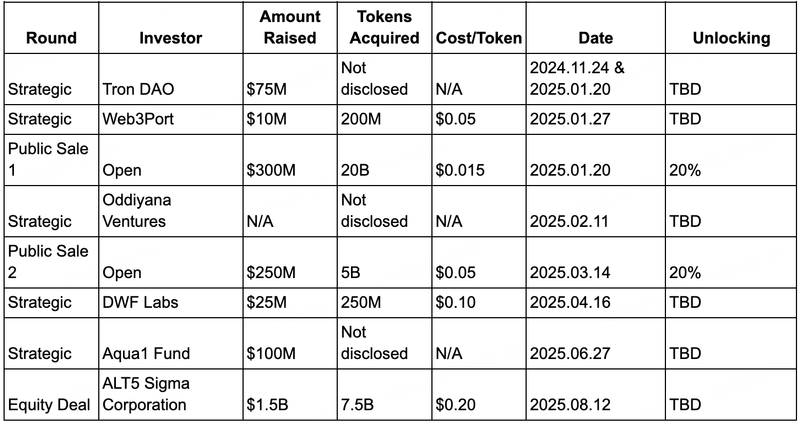

WLFI has completed multiple fundraising rounds, attracting investments from Justin Sun (Tron DAO), DWF Labs, Aqua1 Fund, and Web3Port.

A significant milestone is WLFI's partnership with ALT5 Sigma, involving a $1.5 billion purchase of WLFI governance tokens, acquiring approximately 7.5% of the total supply, with $750 million worth of tokens upfront. Eric Trump has joined ALT5 Sigma’s board, and WLFI CEO Zach Witkoff has become Chairman of the company.

WLFI Investment Rounds Overview

Tokenomics and Market Performance

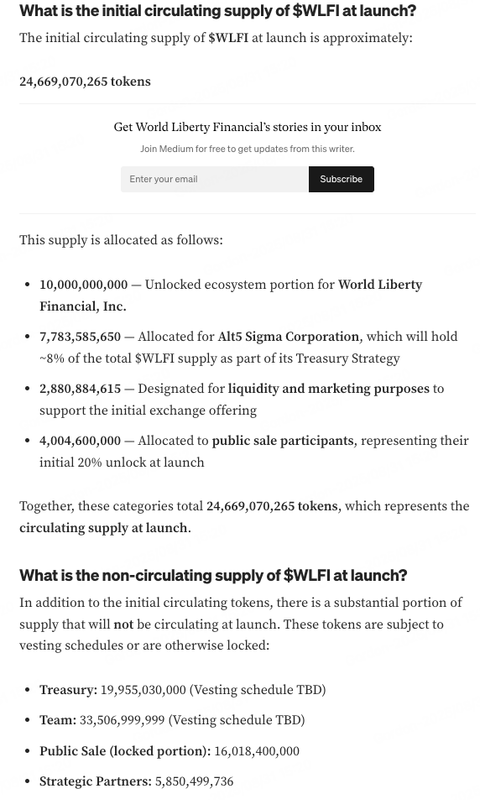

At the Token Generation Event (TGE), 24.67 billion tokens (24.6% of the total supply) were unlocked. Alt5 Sigma’s allocation is designated for strategic reserves and is not expected to circulate immediately. The actual circulating supply is estimated at 20% of public sales plus liquidity/marketing allocations.

Market Performance

WLFI launched on September 1st, peaking at $0.32 before correcting to $0.225 by September 2nd. This translates to an initial circulating market cap of $5.71 billion and a fully diluted valuation (FDV) of $23.1 billion.

- Public Sale 1 investors ($0.015 entry) saw potential gains of up to 20x.

- Public Sale 2 participants ($0.05 entry) achieved multiple returns at TGE.

ALT5 Sigma’s entry point at $0.20 serves as a psychological support zone. The token's price dynamics depend on unlock-driven sell pressure and potential token inflows from ecosystem allocations.

Ecosystem Development

DeFi

- Dolomite: A decentralized lending and margin trading protocol on Ethereum with USD1 integration.

- Lista DAO: A BSC-based lending and stablecoin platform with USD1 as collateral.

- StakeStone: A cross-chain LSD liquidity protocol partnering with WLFI for USD1-based staking.

Launchpads

- Lets.Bonk: USD1’s official Solana launchpad.

- Buildon: A Meme project on BSC developing a USD1-exclusive launchpad.

- Blockstreet: WLFI’s official launchpad.

- AOL: Meme token with plans for America.fun launchpad.

RWA & Stablecoins

- USD1: WLFI’s USD stablecoin launched in March, reaching >$2.4B market cap by September 1st.

- Chainlink (LINK): WLFI uses Chainlink CCIP for USD1 cross-chain interoperability.

- Ethena (ENA): Partnered in December for sUSDe integration.

- Ondo Finance (ONDO): USDY and OUSG added to USD1 reserves.

- Falcon Finance: WLFI invested $10M; USD1 enables minting of synthetic stablecoins.

- Plume Network: WLFI integrated USD1 as reserve collateral for pUSD.

Other Projects

- Vaulta: WLFI invested $6M; USD1 integrated as settlement asset.

- EGL1: Meme project winning a WLFI trading contest.

- Liberty: USD1-powered charity token on BNB Chain.

- U: Meme project with WLFI’s public wallet holding >45% of supply.

- Tagger: Decentralized AI data platform using USD1 for enterprise payments.

Conclusion

WLFI’s circulating supply has two possible scenarios: an optimistic one with ~6.88B tokens circulating, and a risk scenario where more tokens could enter circulation.

The future of WLFI relies on its USD1 ecosystem, driven by partnerships and new utilities. The ALT5 Sigma integration strengthens WLFI’s position within regulated finance.