Whale Selling: UNI, LINK, ONDO Dip After Tariffs

Recent market activity reveals a subtle shift in altcoin holdings by large investors (whales) following the recent tariff announcements. Uniswap (UNI), Chainlink (LINK), and Ondo Finance (ONDO) have all seen a decrease in the number of wallets holding significant token amounts (10,000-100,000). While not a dramatic sell-off, the coordinated nature across these assets suggests a cautious approach or short-term repositioning.

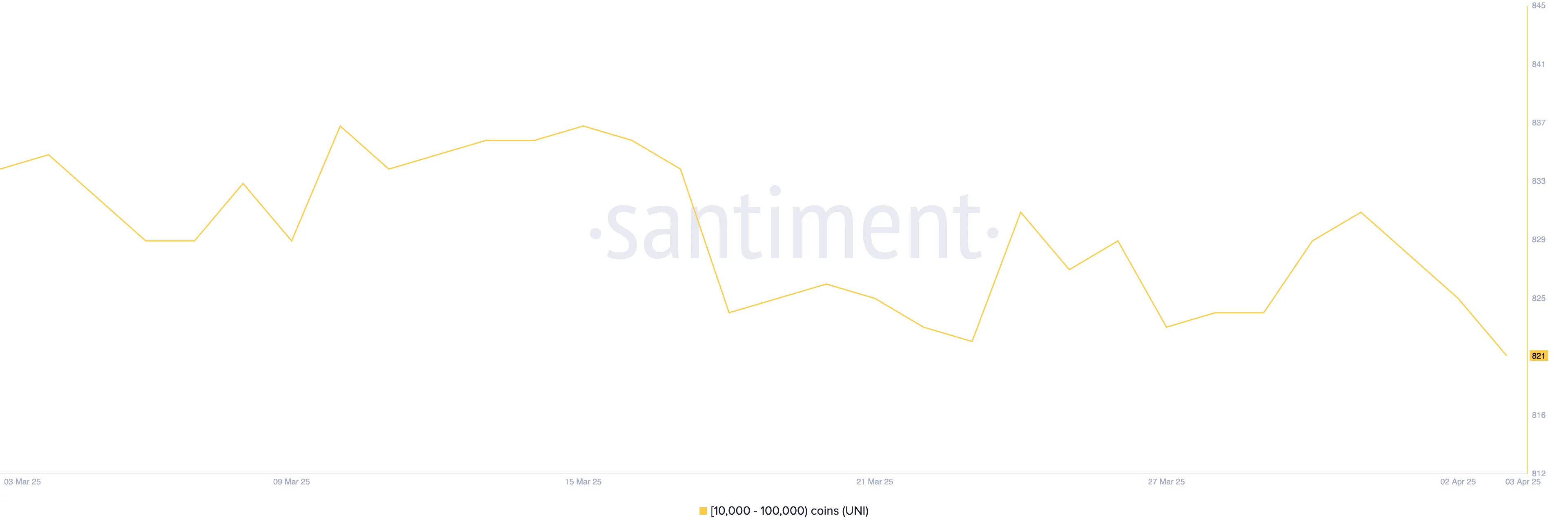

Uniswap (UNI)

The number of UNI addresses holding between 10,000 and 100,000 tokens has been steadily decreasing. Between April 2nd and 3rd alone, this group shrank from 825 to 821. This decrease, while seemingly small, reflects a broader cautionary sentiment among major UNI holders. The current price trend is bearish, with potential drops towards $5.50 or lower. However, a price reversal could lead to resistance testing at $5.97, and a potential upward push to $6.23.

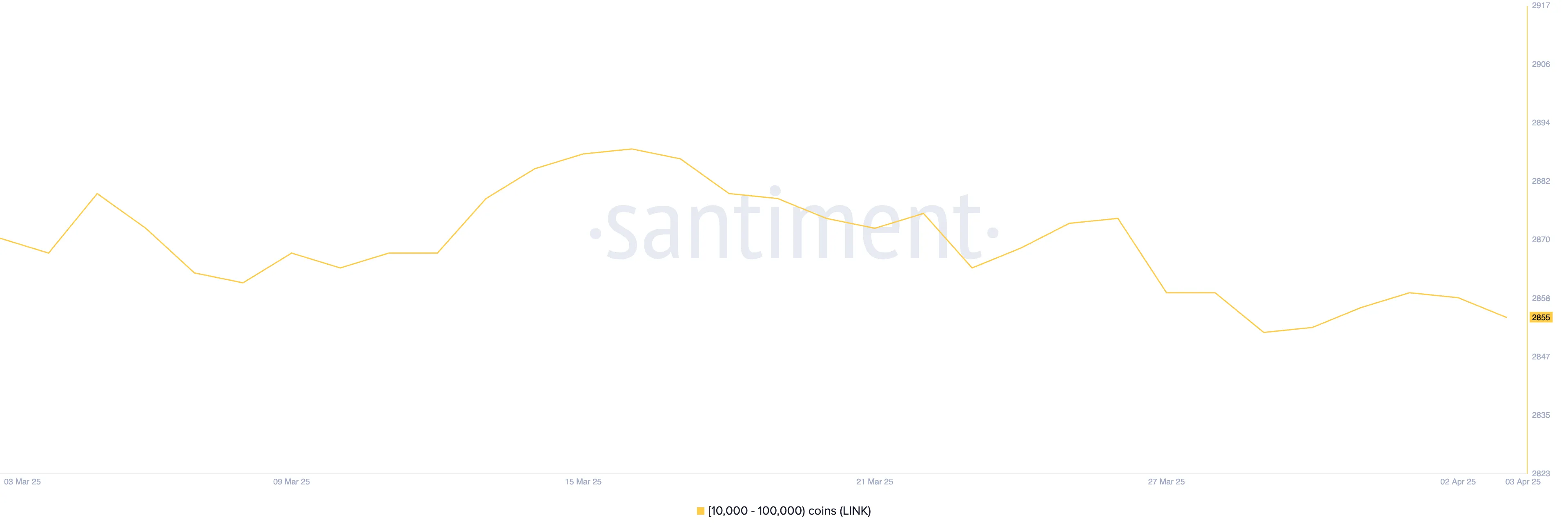

Chainlink (LINK)

Following the tariff news, the number of LINK whale addresses (holding 10,000-100,000 LINK) saw a minor decline from 2,859 to 2,855. However, preceding this was a period of accumulation (March 29th-April 1st), suggesting prior confidence. This recent dip could represent profit-taking or caution during market correction. Currently, LINK is at a critical juncture. A deeper correction could push the price below $12 for the first time since November 2024, with support at $11.85. Conversely, a bullish reversal could test resistance at $13, potentially opening the door for a move to $13.45.

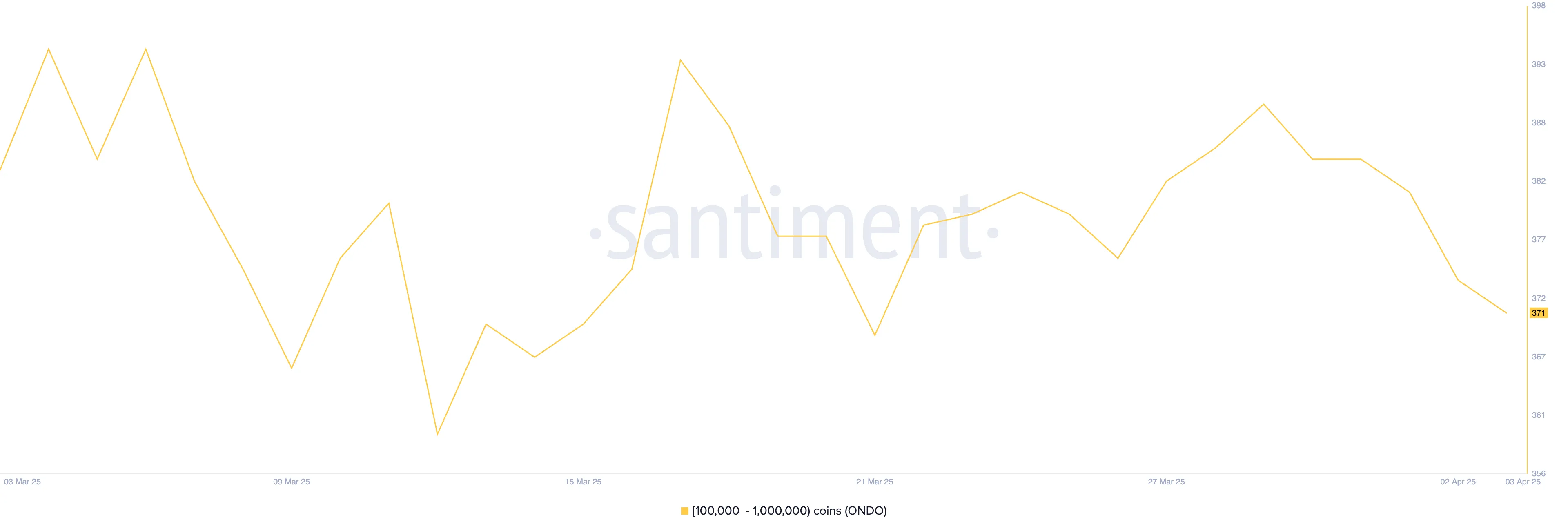

Ondo Finance (ONDO)

Ondo Finance mirrors Chainlink’s pattern. Between March 26th and 29th, whale accumulation increased the number of addresses holding 10,000-100,000 ONDO from 376 to 390. However, post-tariffs, this number decreased to 371. This subtle drop might signal a pause in bullish sentiment. The current price sits at a crucial point. Regaining bullish momentum could drive the price through $0.82 resistance, potentially reaching $0.90-$0.95. Conversely, continued bearish pressure could test support levels at $0.76 and $0.73.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Market conditions are volatile. Conduct thorough research before making any investment decisions.