TST Token Crash: Whale Dump Causes 40% Plunge

TST Token Crash: Whale Dump Causes 40% Plunge

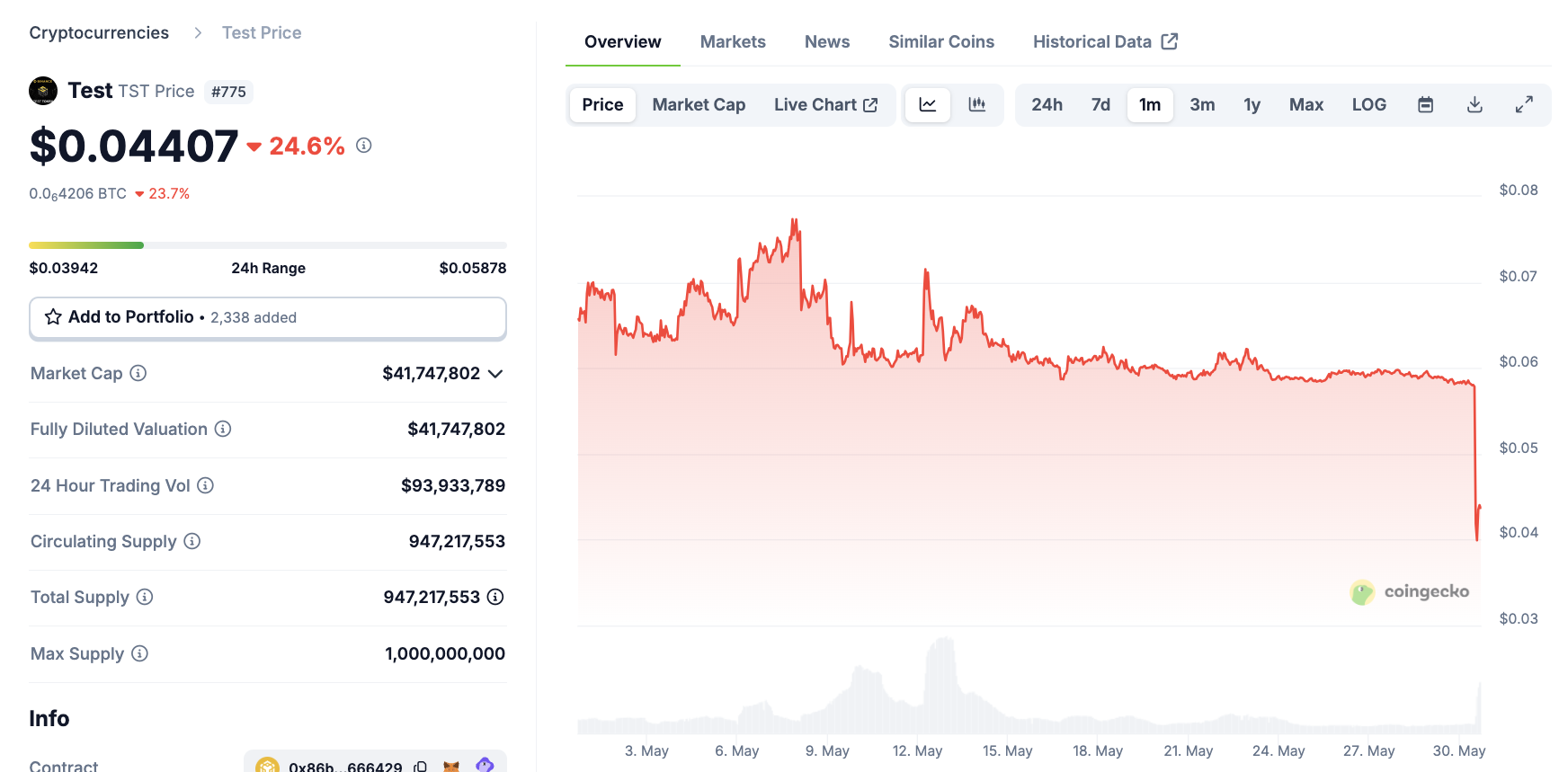

The Test Token (TST) experienced a dramatic 40% price drop after an anonymous whale sold $6-7 million worth of the token. This significant sell-off, representing a substantial portion of the token's $55 million market cap, sent shockwaves through the crypto community.

Social media quickly buzzed with speculation, with some users wrongly accusing Changpeng "CZ" Zhao or other Binance insiders of orchestrating the dump. While understandable given the sudden price movement, such accusations without evidence are unproductive and harmful.

TST Whale Causes Price Shock

TST, initially created as a demonstration of meme coin creation, unexpectedly gained traction as a speculative asset. This incident, however, has left many investors reeling.

Coinglass data reveals a more than 800% increase in 24-hour trading volume, directly attributable to the whale's actions. Most of this activity occurred on Binance's spot and futures markets, highlighting the whale's efficient exit strategy. The market cap plummeted by almost $20 million almost instantly.

The incident has sparked intense debate and finger-pointing, particularly concerning the whale's identity and the acquisition of such a significant TST holding (over one-tenth of the total supply). CZ, Binance's founder, has faced similar accusations in the past, fueling speculation further.

"Binance and CZ keep dumping on their users... Another scam shilled by CZ went down almost 50%. Binance has been milking their users...," one user claimed.

It's crucial to emphasize that no evidence links CZ or Binance to this event. Nevertheless, the incident highlights the inherent risks within the volatile meme coin market and underscores the need for caution.

The situation echoes previous controversies, such as the ACT crash, further fueling distrust in the meme coin space. Without concrete evidence, current accusations against Binance remain unsubstantiated.

Until further investigation, including potential blockchain analysis, reveals the whale's identity, the crypto community must remain vigilant and focus on responsible trading practices. The meme coin market remains exceptionally risky, and baseless accusations only add to the uncertainty.

Codeum's blockchain security expertise can help mitigate similar risks in future projects. Our services, including smart contract audits, tokenomics consultation, and development, help build secure and robust blockchain projects.