Trump's Tariffs: Bitcoin's $2T Market Cap Faces Headwinds

President Trump's expanding tariff plan is causing significant market volatility, impacting both traditional assets and the cryptocurrency market. Initially targeting Canada, Mexico, and China with a 10% import tax, the strategy has broadened, leaving investors apprehensive about the future.

Bitcoin's Market Position

With a total crypto market cap exceeding $3 trillion and Bitcoin (BTC) commanding a 60% share, the impact of Trump's policies is amplified. Even slight BTC price fluctuations could severely affect other cryptocurrencies. While a long-term strategy is advisable, many investors are focused on short-term gains, causing shifts in capital allocation.

- Bitcoin’s market value has surpassed $2 trillion, increasing the potential impact of Trump’s tariffs.

- With gold and the dollar rising sharply, is a major cryptocurrency sell-off imminent?

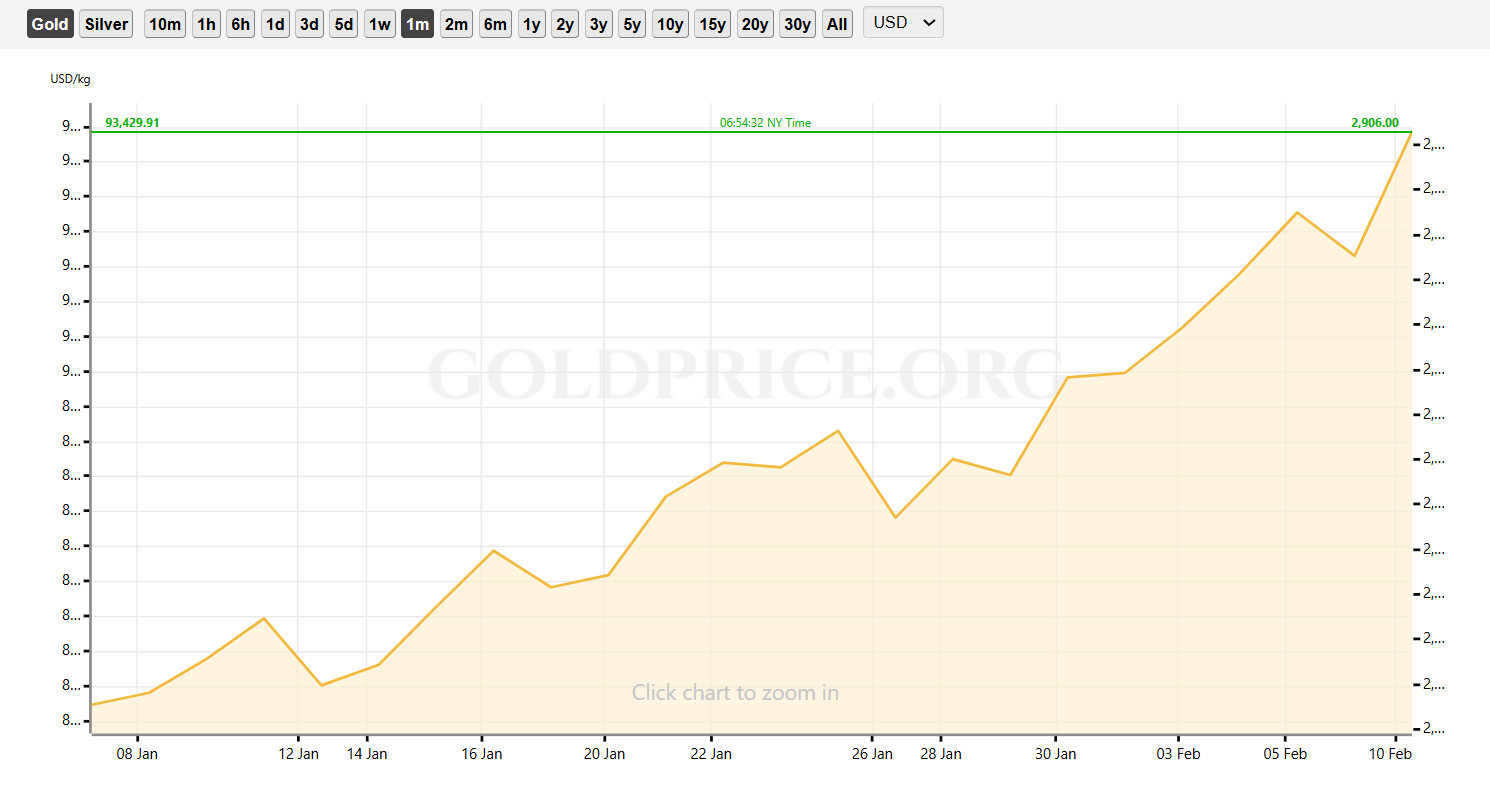

Gold's Surge and Bitcoin's Dip

Gold is currently perceived as a safe haven asset, experiencing a 247.18% increase in valuation over 30 days, with a significant portion of that increase (4%) occurring in February alone. In contrast, Bitcoin has seen a 4% decline during the same period, though it has experienced a quick recovery. This highlights Bitcoin's classification as a 'risk asset' in this environment.

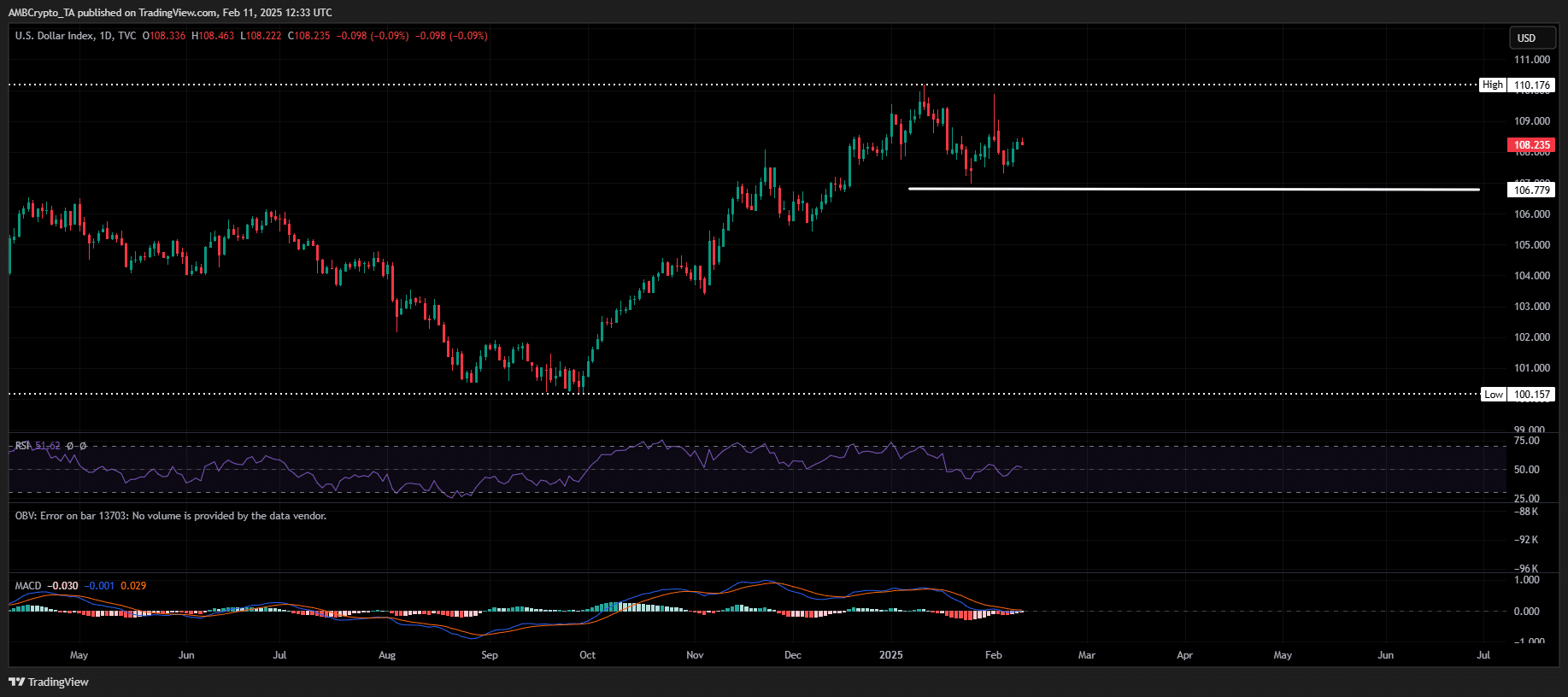

The Dollar's Influence

The U.S. dollar index (DXY) has recently climbed back above 108 following Trump's 25% tariff on key metals. This is a crucial metric to watch as historically, the DXY and BTC prices have an inverse relationship. A rising DXY often puts pressure on Bitcoin.

Remember the situation in mid-December? When the DXY last reached 108, Bitcoin dropped 15% in just two weeks to $89,000.

Assessing the Long-Term Outlook

The current market sentiment suggests a potential shift from long-term holding strategies to short-term profit-seeking. This trend, coupled with macroeconomic factors, presents both challenges and opportunities in the cryptocurrency space. Navigating this requires careful monitoring of key indicators and a well-defined risk management strategy.

Codeum offers a range of services to help navigate these complexities, including smart contract audits, KYC verification, and custom smart contract and DApp development. We can also provide valuable tokenomics and security consulting to help you mitigate risks and ensure the long-term success of your blockchain project. Partner with us today for secure and robust blockchain solutions.