Trump's Tariff Threat Shakes Crypto Markets

Trump's Tariff Threat Shakes Crypto Markets

US President Donald Trump's announcement of a potential 50% tariff on all European Union imports, effective June 1st, sent ripples through the cryptocurrency market. The previously bullish momentum experienced a sharp correction, reflecting growing uncertainty among investors.

Trump cited persistent trade imbalances and regulatory hurdles as justification for the tariffs, accusing the EU of unfair trade practices detrimental to US businesses. This action follows a recent US-China trade agreement that had briefly stabilized the crypto market.

Market Reaction: Liquidations and Shifting Sentiment

Bitcoin experienced a notable drop, falling to $108,000 after the announcement, down from a session high of $111,000. While it partially recovered to around $109,000, it remained under pressure. The broader crypto market saw a 4% decline within 24 hours.

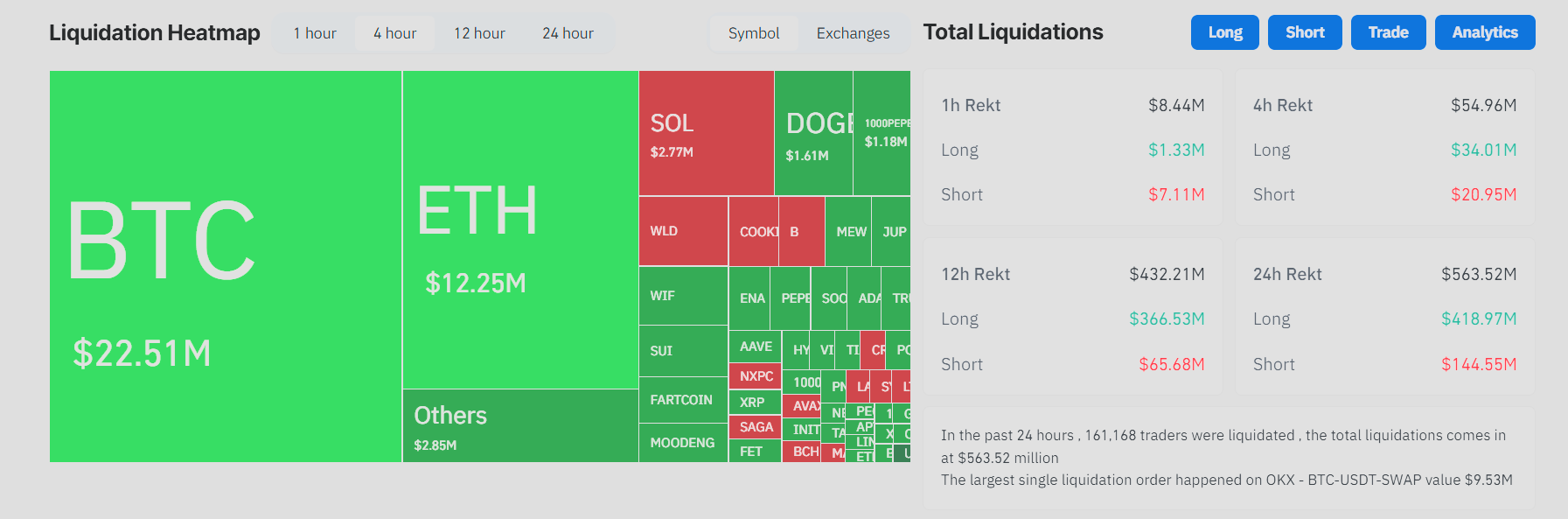

Data from Coinglass revealed $64.13 million in crypto liquidations over four hours. $34.05 million came from long positions, and $30.09 million from short positions. Bitcoin alone accounted for $24.4 million in liquidations, with Ethereum at $15.16 million.

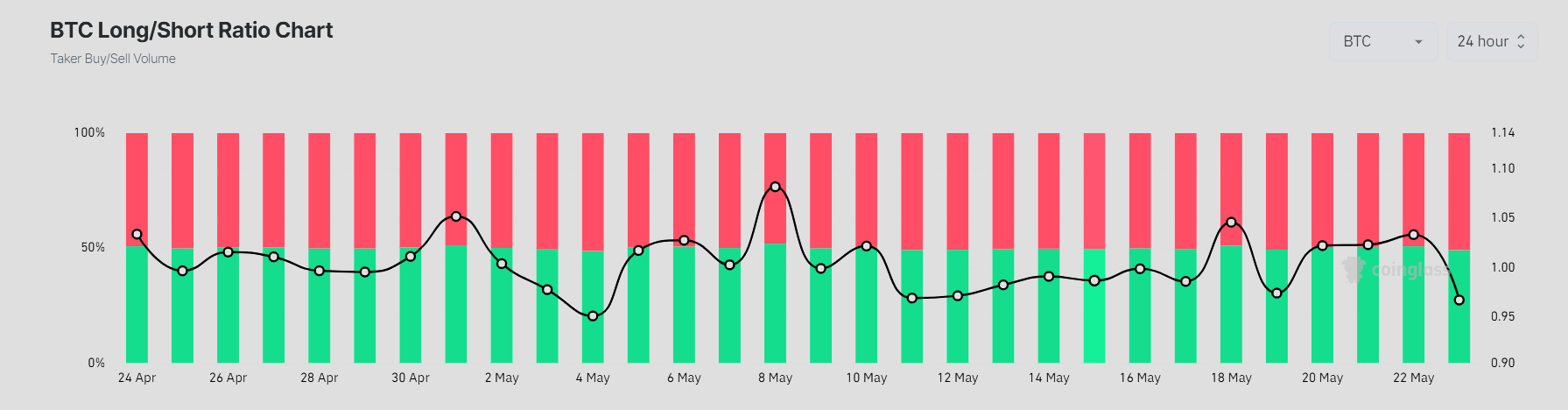

Bitcoin's long-short ratio hovered near parity, indicating significant short-term uncertainty. This contrasts with the previous day, when long positions held a dominant 54%.

- Solana, XRP, and various altcoins also experienced sharp volatility.

- Altcoins showed a greater wipeout of long positions, suggesting retail investors were particularly affected.

The following images show Bitcoin's price chart and the long-short ratio:

Growing Concerns About Macroeconomic Volatility

The earlier US-China trade deal had briefly eased macroeconomic uncertainties and boosted the crypto market. However, Trump's EU tariff threat reignited concerns about broader economic disruption. European stock indices fell significantly, and US tech stocks also faced selling pressure.

Analysts warn that this tariff announcement could escalate into a wider trade dispute, creating further headwinds for crypto and other risk assets. The market awaits the EU's response and any potential negotiations.

The crypto liquidation heatmap reveals a market grappling with downward pressure and attempts at upward retracement. Within 24 hours, 162,419 traders were liquidated, totaling $567.65 million. This demonstrates that even crypto, often considered a hedge against traditional market stress, is vulnerable to significant global policy shocks.

Codeum offers comprehensive blockchain security solutions, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Contact us to secure your blockchain project.

Disclaimer: This article provides information and analysis and does not constitute financial advice. Conduct thorough research before making any investment decisions.