Trump's Bill & Bitcoin: A Liquidity Squeeze?

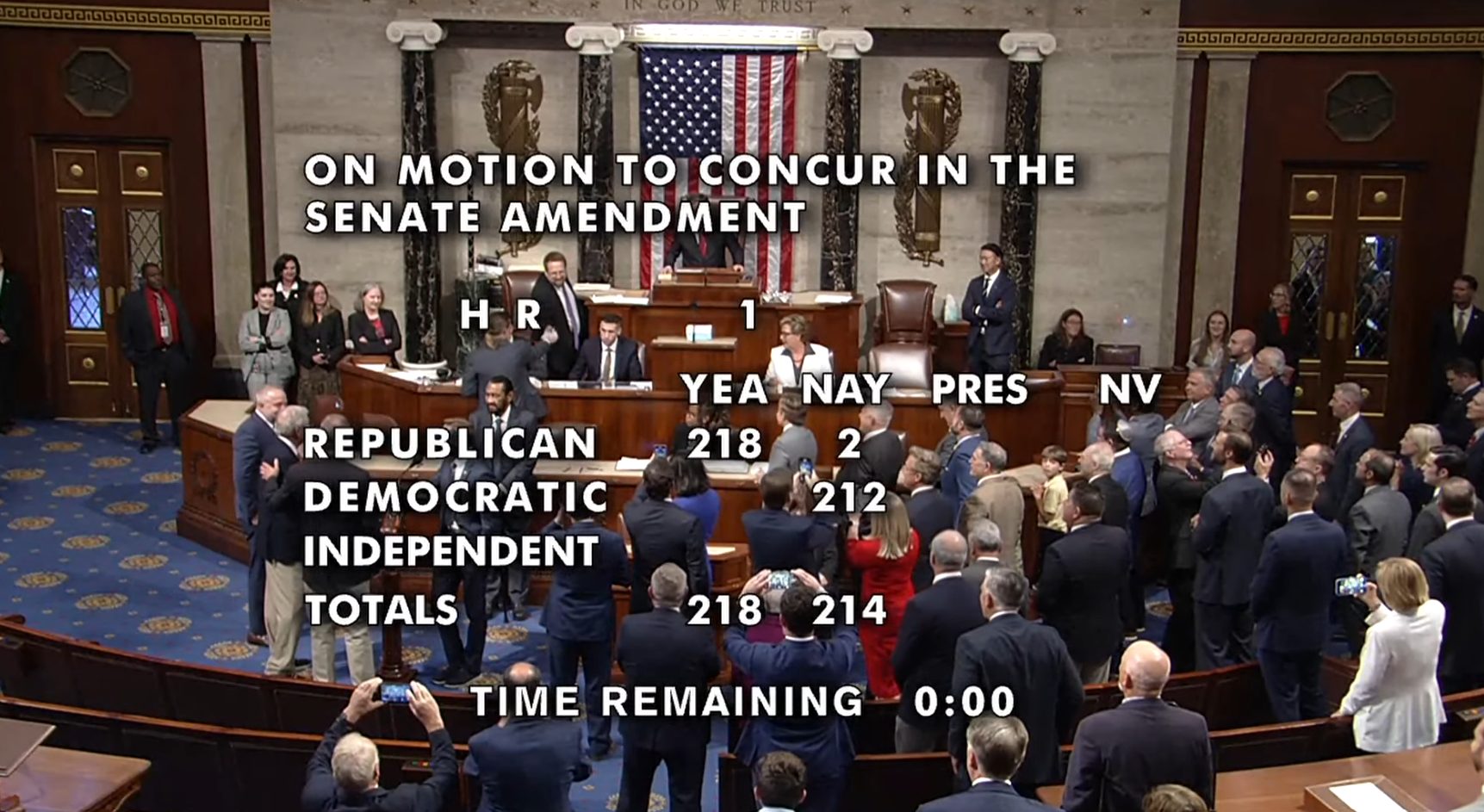

President Donald Trump's significant tax and spending bill, dubbed the “Big Beautiful Bill,” successfully navigated Congress, passing the House by a narrow margin of 218-214 on July 3rd. The Senate had previously approved the legislation. The bill, which now heads to President Trump for his signature, includes noteworthy provisions impacting various sectors. Key elements include:

- Tax cuts for individuals and businesses

- Increased discretionary spending

- Reductions in safety-net programs

Financial projections estimate the bill could inflate the national debt by $3.3 trillion over the next decade. Notably, proposed crypto tax amendments aimed at supporting stakers, miners, and digital asset holders failed to make it into the final version, despite efforts by Senator Cynthia Lummis and others. These amendments were ultimately excluded due to time constraints in the final negotiations.

Bitcoin's Potential Reaction

Arthur Hayes, a prominent crypto analyst and BitMEX co-founder, foresees a potential short-term impact on Bitcoin's price. He predicts the bill's passage and subsequent US Treasury actions could lead to a substantial liquidity squeeze. Specifically, the refilling of the Treasury General Account (TGA), estimated at nearly $500 billion, might temporarily drive Bitcoin's price towards a $90,000-$95,000 retest.

Despite this short-term volatility prediction, Hayes maintains a positive long-term outlook for Bitcoin. He believes successful market absorption of the bond issuance could maintain Bitcoin's price within the $100,000s. This event underscores the significant interplay between traditional finance and the cryptocurrency market.

Codeum offers comprehensive blockchain security solutions, including smart contract audits, KYC verification, custom smart contract and DApp development, and tokenomics and security consultation. We help blockchain projects navigate the complexities of the industry and build secure, reliable systems.