TRON Network Growth Surges in January 2025: Implications for TRX Price

TRON Network Growth Surges in January 2025: Implications for TRX Price

TRON [TRX] experienced a significant surge in network activity during January 2025. However, this growth hasn't translated into a corresponding increase in TRX's price, which has remained relatively flat. Let's delve into the details and explore the potential reasons behind this disconnect.

TRX Price Action: A Sideways Trend

Following a substantial rally in Q4 2024, reaching a peak of $0.44, TRX reversed most of its gains. Since January 2025, the price has consolidated between $0.22 and $0.27, offering opportunities for swing traders but leaving many wondering about the future.

Technical indicators present a mixed picture. The Chaikin Money Flow (CMF) shows low capital inflows, and the Relative Strength Index (RSI) indicates muted demand, suggesting a continuation of the sideways trend in the short term. The upcoming FOMC meeting adds to market uncertainty, potentially prolonging this consolidation.

Source: TradingView

Massive Network Growth Despite Price Stagnation

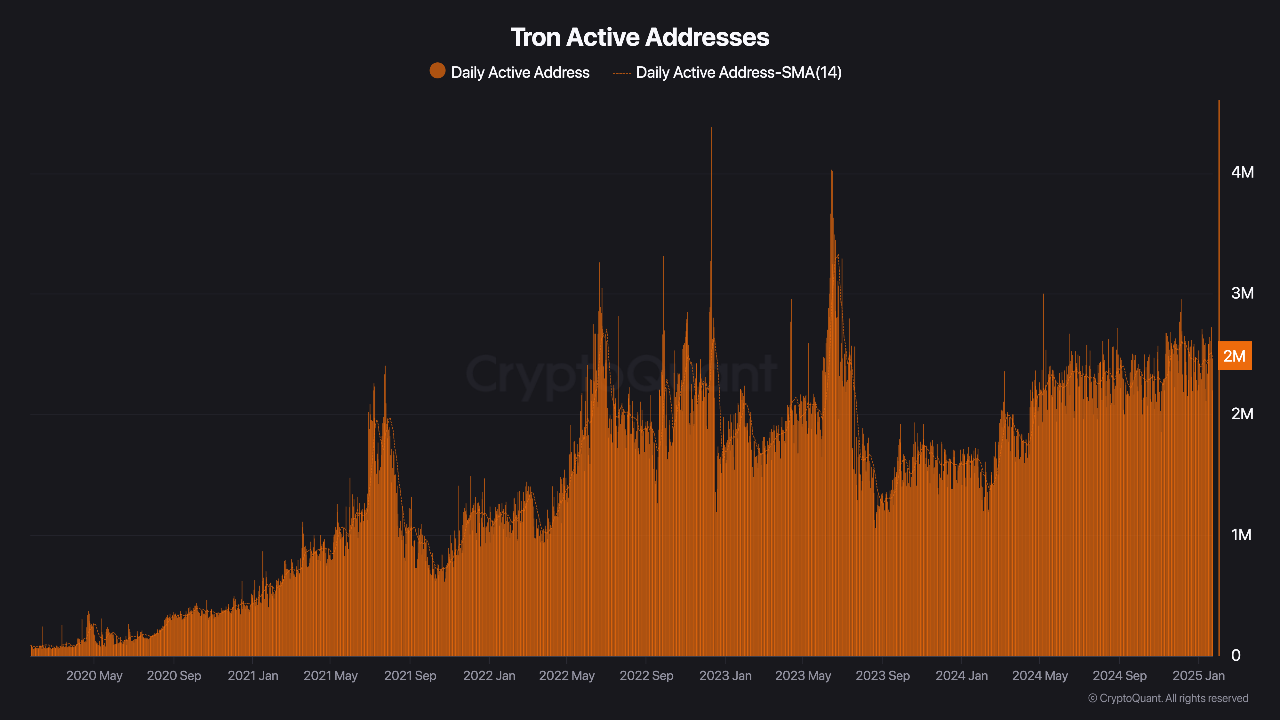

Despite the lackluster price performance, TRON's network has shown impressive growth. The number of active users has climbed to over 2 million, according to CryptoQuant analyst DarkFost. This surge is attributed to increased investor confidence, especially following the launch of the USDD 2.0 high-yield stablecoin.

A $3.6 trillion transfer on January 15th further underscores the network's robust activity. DarkFost notes that the steady increase in active addresses suggests TRON is successfully attracting new investors.

Source: CryptoQuant

This disparity between network growth and price action highlights the complexities of the cryptocurrency market. While fundamental indicators like network activity are positive, short-term price movements are influenced by numerous factors, including market sentiment and macroeconomic events.

Short-Term Outlook and Considerations

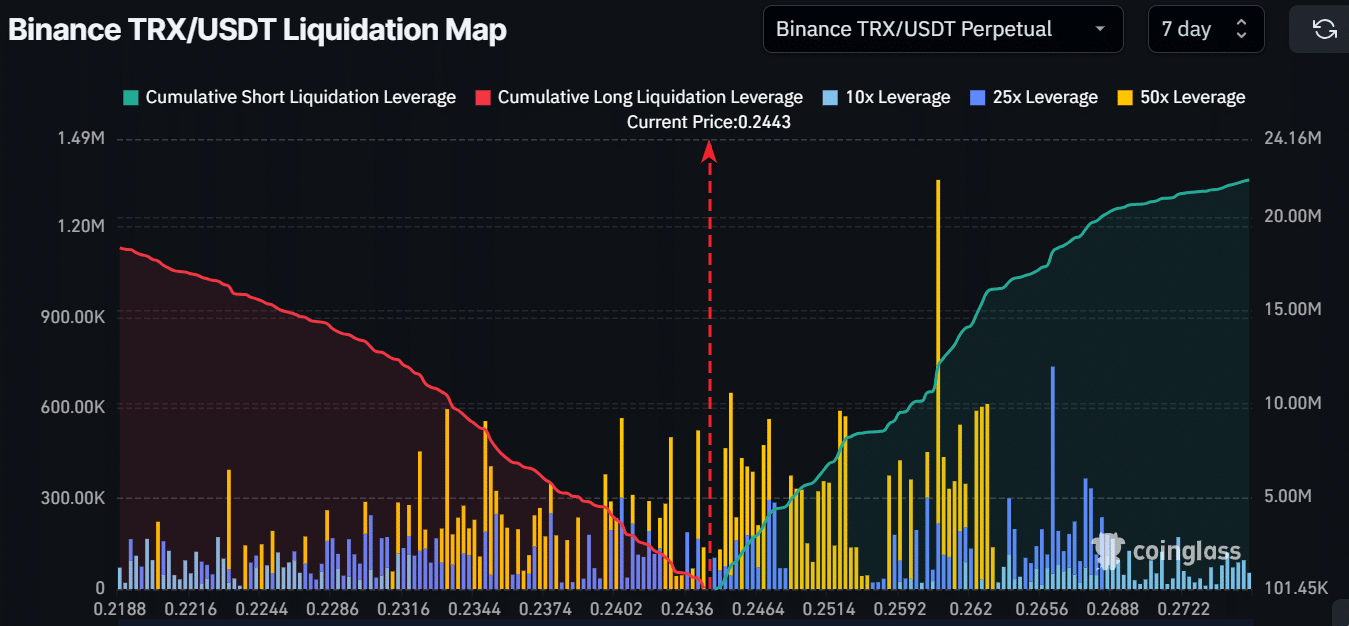

The short-term price outlook for TRX points toward continued consolidation within the $0.22 - $0.27 range. Liquidity appears relatively balanced within this range. A significant move could occur if either buyers or sellers manage to overcome the existing liquidity.

Source: Coinglass

Codeum provides comprehensive blockchain security and development services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Contact us to secure your blockchain project.