Tesla's Bitcoin Sale: A Missed Opportunity?

Tesla's Bitcoin Bet: A Costly Decision

Tesla's early exit from a significant portion of its Bitcoin (BTC) holdings in 2022 appears to have been a missed opportunity. The electric vehicle giant could have realized substantial gains had it held onto its initial investment.

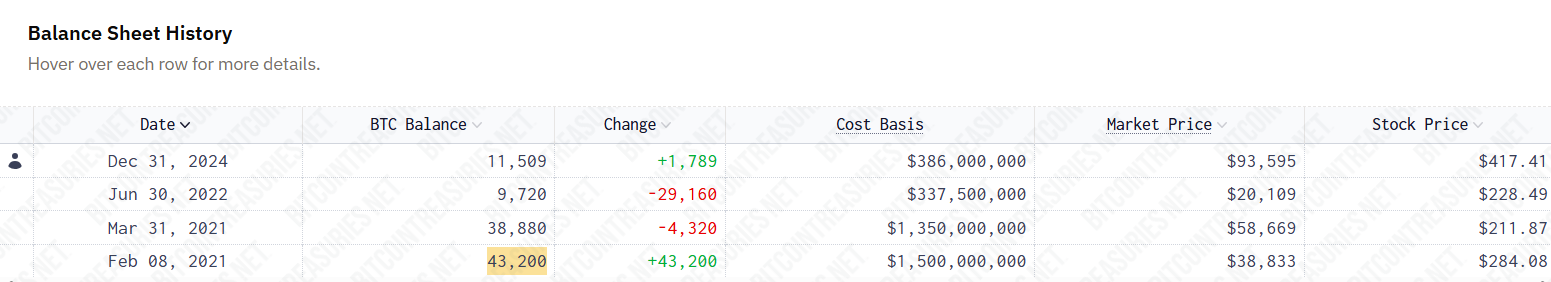

In early 2021, Tesla invested $1.5 billion in 43,200 Bitcoin as part of a treasury diversification strategy, according to data from BitcoinTreasuries.net.

Initially, Tesla accepted Bitcoin as payment for its vehicles but suspended this option due to environmental concerns related to Bitcoin mining's energy consumption.

Tesla began selling Bitcoin in March 2021, offloading 4,320 BTC when Bitcoin traded above $58,000. At the time, this seemed like a reasonable decision, as Bitcoin reached a high of $61,500 during that cycle.

However, by the end of June 2022, Tesla sold an additional 29,160 BTC, representing 75% of its remaining holdings. Bitcoin was trading around $20,000 at that time, later dropping to a yearly low of $16,500.

Bitcoin's Subsequent Surge

Since then, Bitcoin has experienced significant growth, driven by increased institutional interest and the introduction of Bitcoin ETFs. Grayscale's court victory over the SEC paved the way for spot Bitcoin funds in the U.S., further fueling the rally.

Bitcoin has since surpassed the $20,000 mark and reached a high of $122,000. Currently, Bitcoin is trading around $116,300.

Had Tesla maintained its initial holdings, those Bitcoins would now be valued at approximately $5 billion. The BTC that Tesla sold would be worth over $3.5 billion today.

Tesla currently holds 11,509 BTC, valued at around $1.4 billion, and has not made any adjustments to its Bitcoin portfolio since its last sale.

Meanwhile, Tesla's auto revenue has declined for the second consecutive quarter, and the company has fallen short of Wall Street's projections. The stock initially dropped 8% before rebounding 3.5%, but it is still down more than 21% year-to-date, according to Yahoo Finance.

Key Takeaways:

- Tesla missed out on billions in potential profits by selling 75% of its Bitcoin holdings too early.

- The company’s early Bitcoin sale coincided with challenges in its core auto business and impacted financial results.

Codeum provides blockchain security and development solutions, including smart contract audits to help businesses make informed decisions about their crypto investments.