Stellar (XLM) Dips: Bearish Signals Emerge

Stellar (XLM) experienced a price drop of more than 5% on Thursday, bringing its market capitalization down to $8 billion. Technical indicators are flashing strong bearish signals, raising concerns about further price declines.

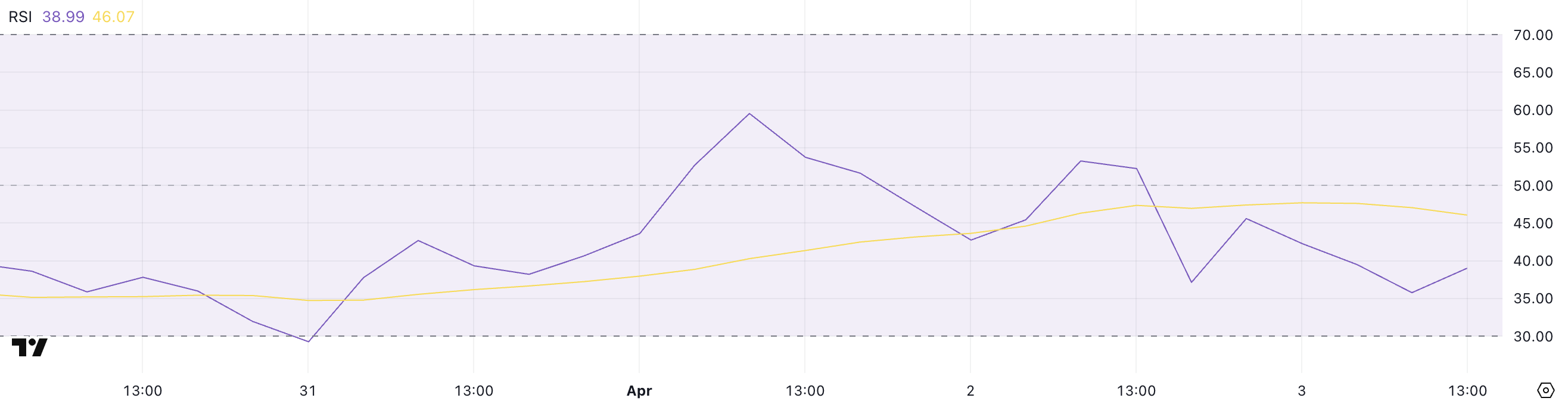

XLM RSI Shows Seller Dominance

Stellar's Relative Strength Index (RSI) plummeted to 38.99, a significant drop from 59.54 just two days prior. This indicates a notable shift in momentum, with sellers gaining control. While not yet in oversold territory, the RSI below 50 suggests weakening buying pressure and increased downside risk. A continued fall could lead to further price drops unless buying pressure increases.

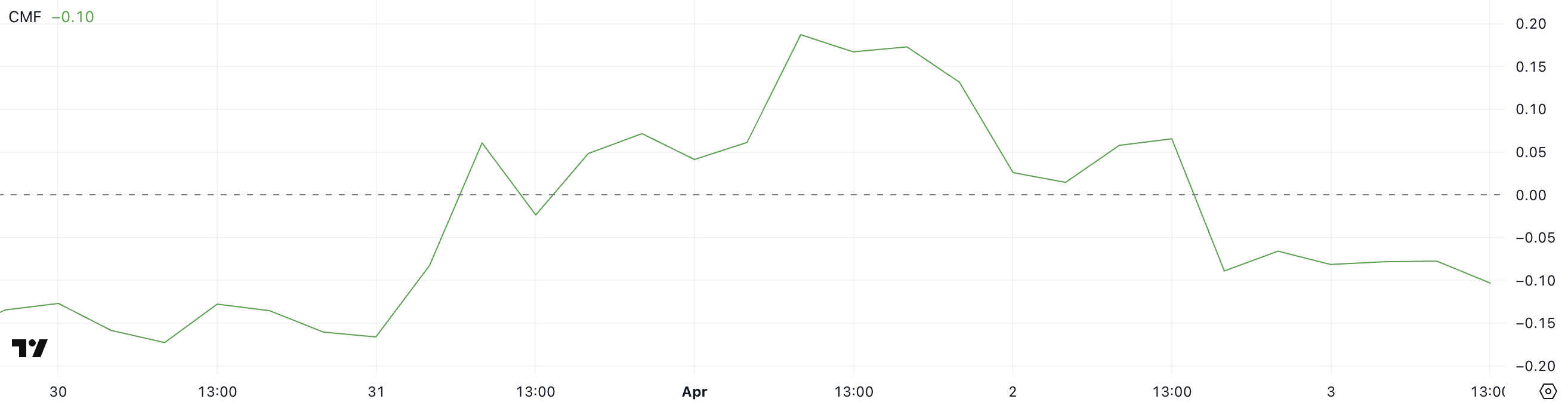

CMF Shows Significant Capital Outflow

Stellar's Chaikin Money Flow (CMF) experienced a sharp decline to -10, down from 0.19 just two days earlier. This negative CMF indicates significant selling pressure and capital outflow. Unless buying volume increases, XLM could face further weakening.

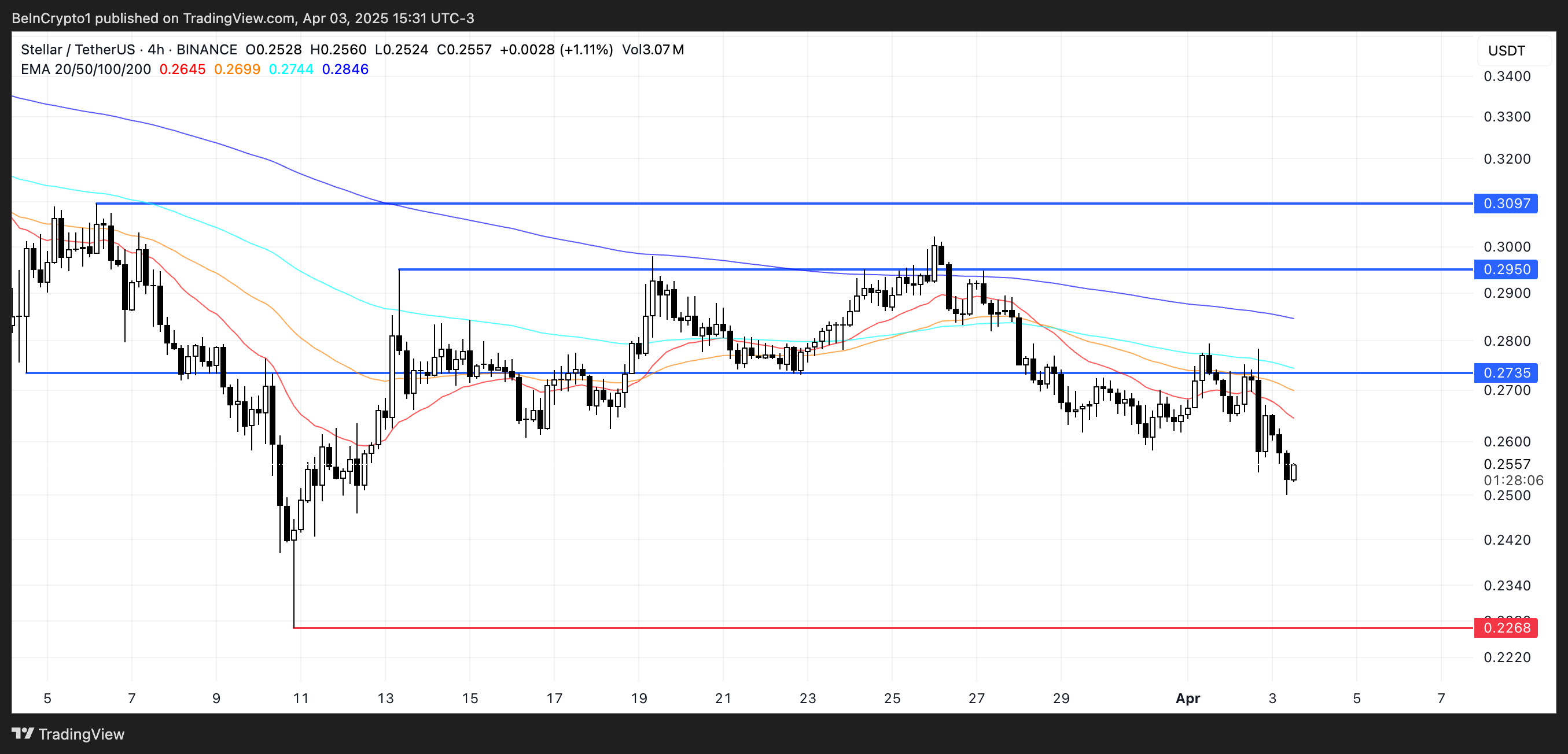

Potential for Five-Month Lows

Technical analysis suggests XLM could test critical support around $0.22, potentially falling below $0.20—a level unseen since November 2024. While a reversal is possible with resistance at $0.27, $0.29, and $0.30, it would require a significant shift in market sentiment and increased buying pressure.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Market conditions are volatile. Conduct thorough research before making any investment decisions. Codeum provides blockchain security and development services, including smart contract audits, KYC verification, and custom development. For secure and reliable blockchain solutions, consider partnering with Codeum.