Solana (SOL) Price Up 5% Amidst Mixed Signals

Solana (SOL) experienced a significant price increase, rising over 5% in the past 24 hours. This boost brought its market capitalization to approximately $117 billion, with trading volume exceeding $6 billion. However, a closer look at technical indicators reveals a more nuanced picture.

Solana Price Analysis: A Mixed Bag

While the short-term price surge is encouraging, technical indicators present a mixed outlook. The Ichimoku Cloud displays uncertainty, and the BBTrend remains in negative territory. SOL has been consolidating between $225 and $239, with closely positioned EMA lines suggesting indecision in the current market trend. The coming days will be crucial in determining whether SOL breaks through resistance levels or faces further downward pressure.

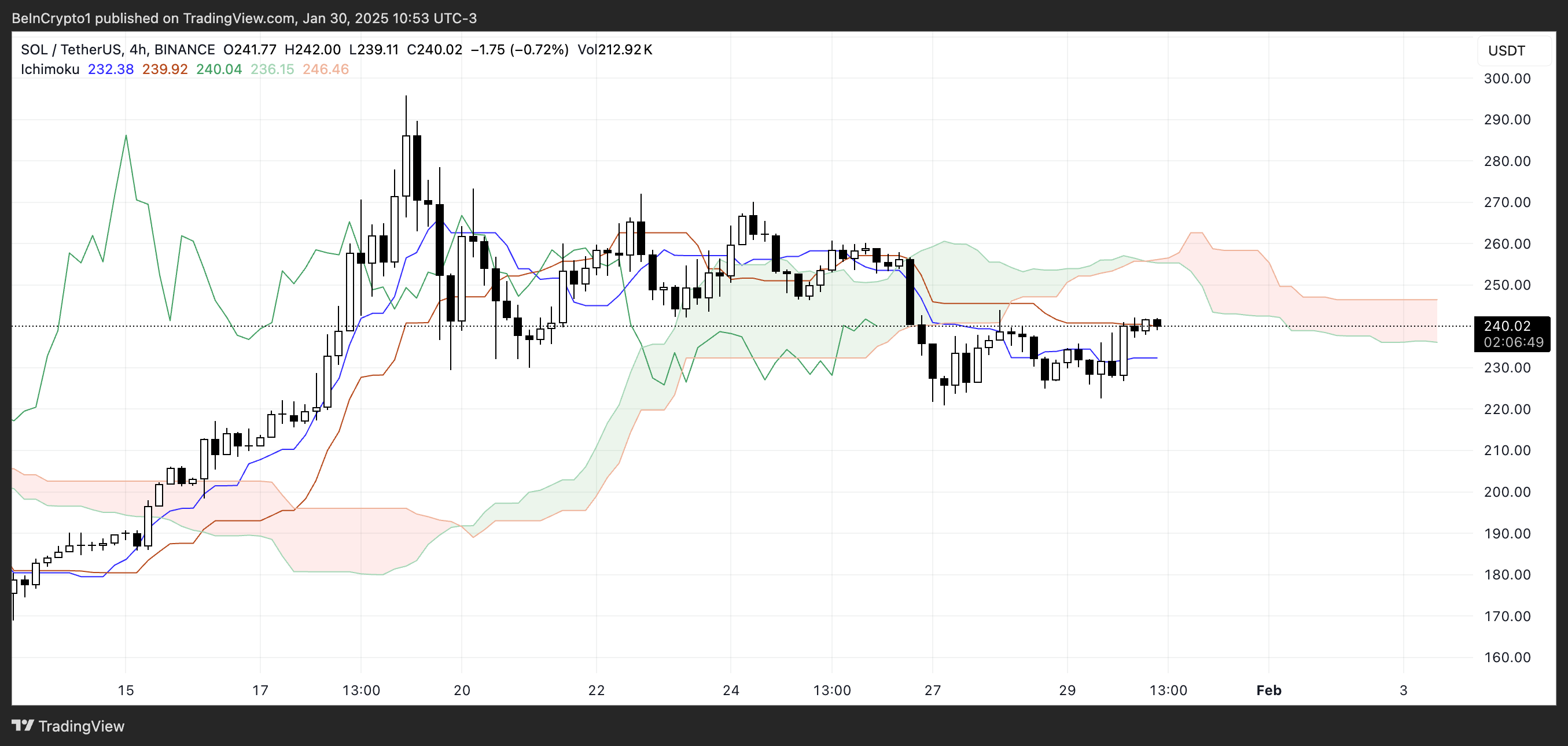

Ichimoku Cloud Analysis

The Solana Ichimoku Cloud presents a mixed market sentiment. The price is near the Kijun-sen (red) and Tenkan-sen (blue) lines. The upcoming cloud (Kumo) is red, hinting at potential bearish sentiment. The recent price movement within the cloud signifies indecision, with neither buyers nor sellers dominating. The Chikou Span (green) further emphasizes this uncertainty, suggesting a consolidation phase rather than a defined trend. The cloud's thickness suggests increased volatility, with the Tenkan-sen below the Kijun-sen, indicating weaker short-term momentum.

Source: TradingView

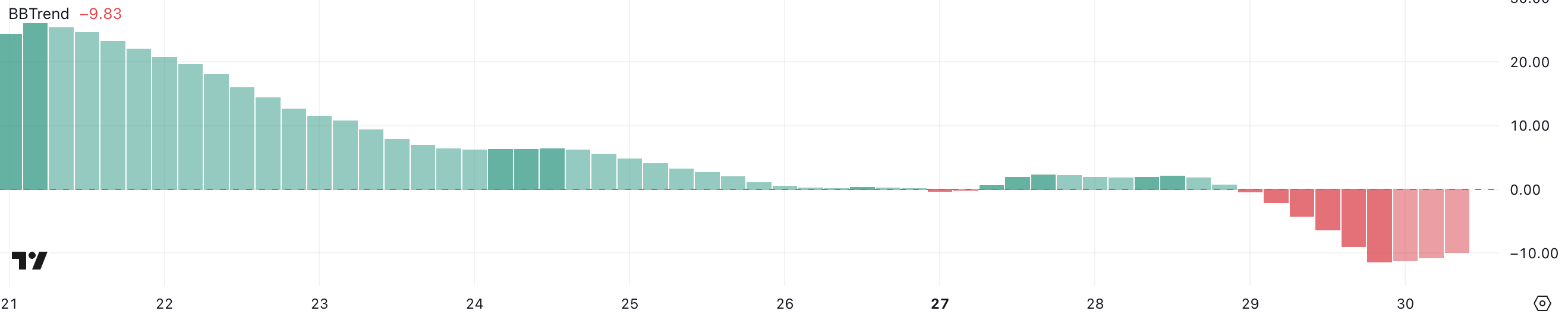

BBTrend Analysis

The BBTrend (Bollinger Band Trend) indicator shows bearish momentum, currently at -9.8. This negative reading, having reached a low of -11.3 earlier, suggests a strengthening downward pressure. A rise toward zero could indicate weakening bearish momentum or consolidation, while continued decline reinforces the potential for a sustained downtrend.

Source: TradingView

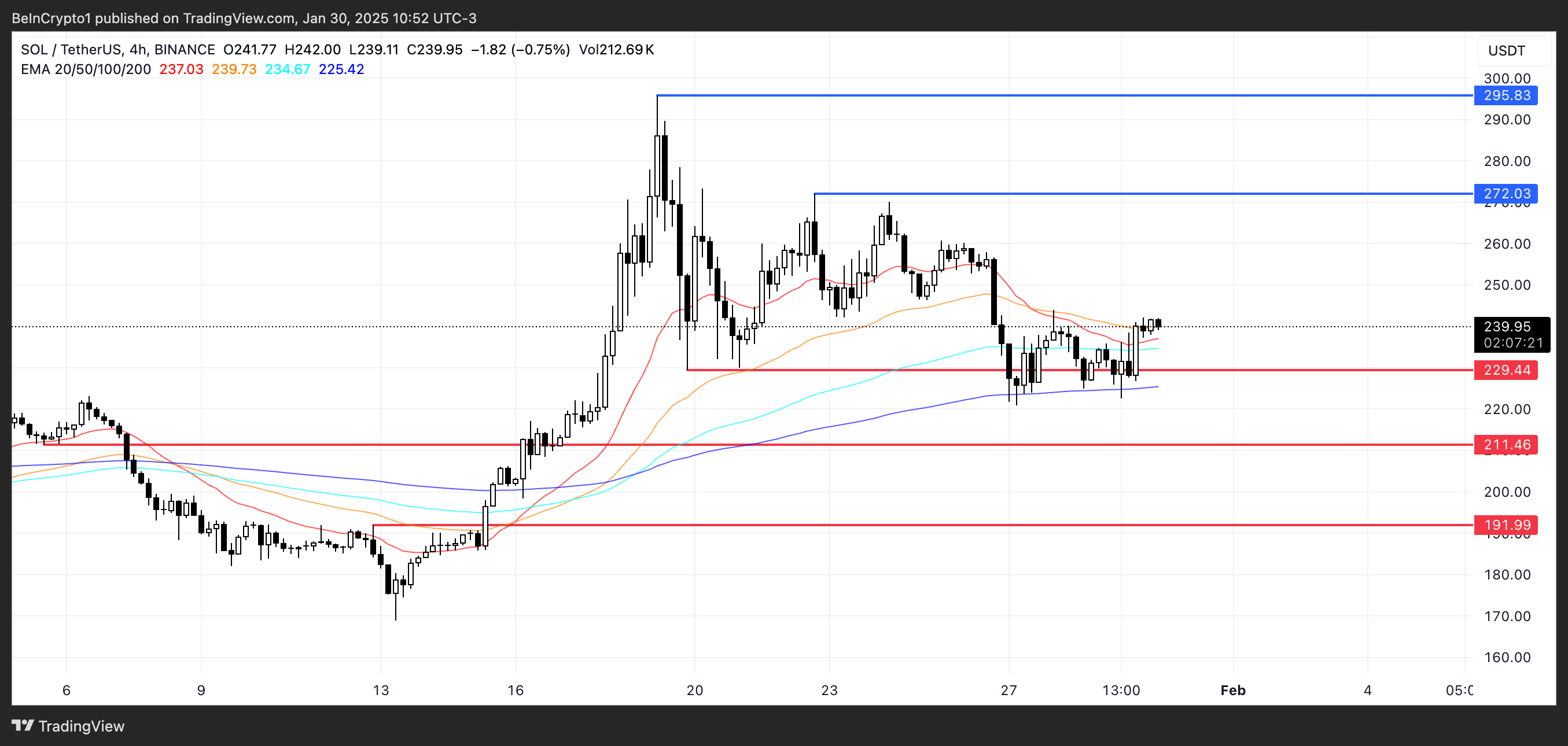

SOL Price Prediction: February Outlook

SOL's price consolidation between $225 and $239 continues, with no clear trend. A potential golden cross in the EMAs could signal upward momentum, potentially pushing the price towards $272 resistance and even $300. Conversely, failure to hold the $229 support could trigger a correction, potentially dropping to $211, or even lower.

Source: TradingView

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a professional before making investment decisions.

Codeum offers a range of services to enhance blockchain security, including smart contract audits, KYC verification, and custom smart contract development. Partner with Codeum for secure and reliable blockchain solutions.