Solana (SOL) Rally Faces Headwinds: On-Chain Data Concerns

Solana's Price Momentum Slows

The Solana (SOL) price has experienced a slowdown after a strong performance in August. Over the past week, SOL has traded relatively flat, declining by 1.1% in the last 24 hours. However, monthly gains remain near 26%, and three-month gains are around 35.8%.

For investors hoping for a repeat of August's gains, on-chain data suggests caution. Key metrics indicate significant profit-taking and a weakening trend, raising concerns about Solana's ability to sustain its upward trajectory.

Profit-Taking Signals Potential Correction

On-chain analysis reveals that a high percentage of the Solana supply remains in profit. As of September 3, nearly 95% of SOL holders were in profit, nearing the six-month peak of 96.59% observed on August 8. Even at the time of writing, this figure remains elevated at approximately 87%. Such a high percentage of profitable holders increases the likelihood of sell-offs.

Historically, significant drops in the percentage of supply in profit have preceded rallies. For instance, when the profit supply fell below 54% on August 2, Solana's price was around $158.53. From there, SOL climbed to $214.51 by August 28, representing a gain of approximately 35%. This suggests that Solana's price tends to rally when fewer holders are sitting on substantial profits.

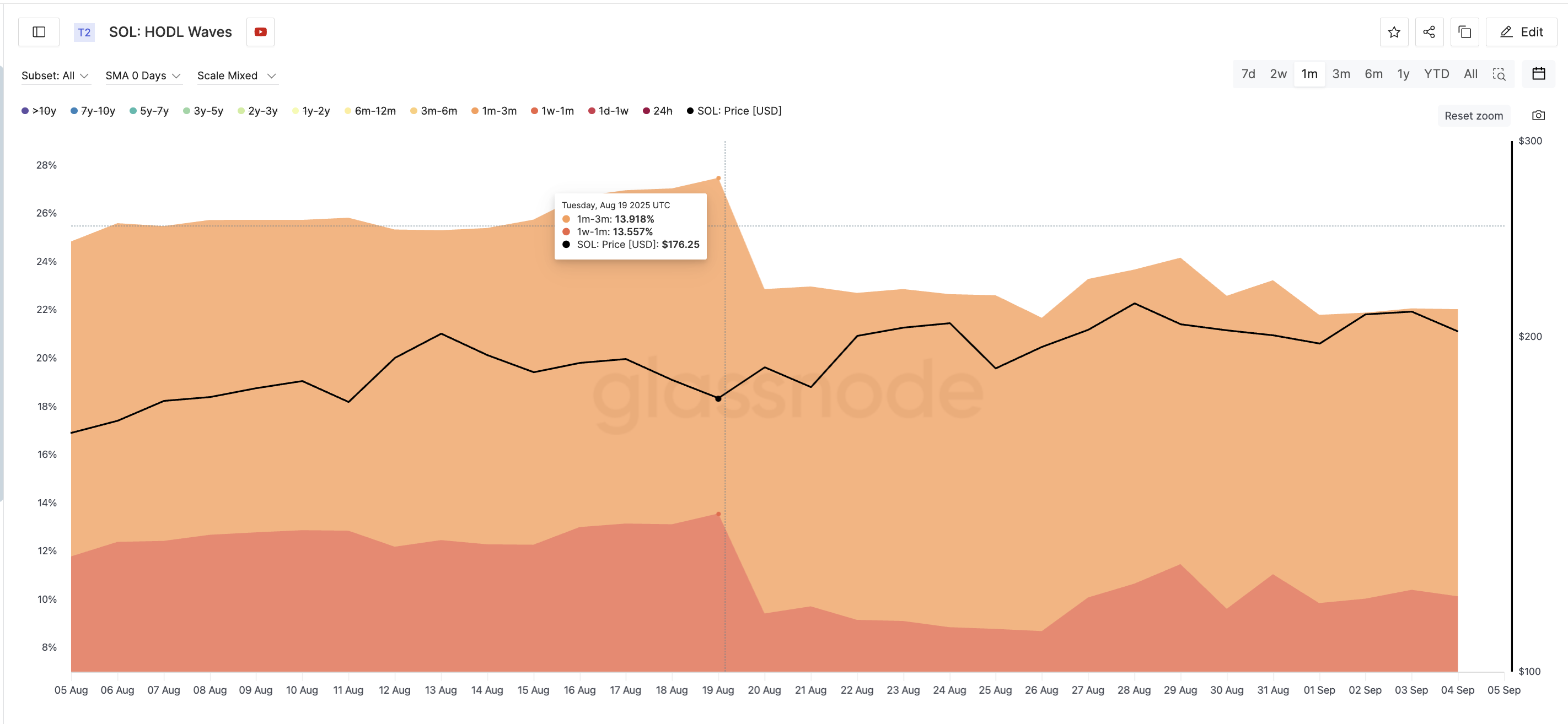

The HODL Waves metric further supports this observation. The metric, which tracks how long coins are held, shows that short-term holders (1 week–1 month and 1–3 months) peaked on August 19, when Solana's price traded near $176. These cohorts, which controlled about 27% of the supply, have since reduced their holdings to around 22%, indicating active profit-taking.

Diminishing Inflows Indicate Fragility

Solana's price chart shows strong resistance at $218. A decisive break above this level would confirm a breakout and invalidate the bearish outlook. However, weakening money flows are concerning.

The Chaikin Money Flow (CMF), a metric measuring buying and selling pressure, has decreased significantly. On July 22, when Solana hit a local high, the CMF stood at 0.31, signaling strong inflows. Since then, despite higher price highs, the CMF has fallen to -0.01.

This divergence indicates that large investors are not injecting significant new capital into SOL. Without substantial inflows, profit-taking faces minimal resistance, making rallies vulnerable and increasing the likelihood of a deeper pullback if key support levels fail.

Key support levels lie at $194, $186, and $173. While Solana's price is currently stable, a sustained recovery requires improved CMF readings. Blockchain security is always paramount, and Codeum offers smart contract auditing services for projects building on Solana or other blockchains, ensuring the integrity and security of their ecosystems.