Solana (SOL) Price Plunges: Technical Analysis

Solana (SOL) Price Drop: A Technical Analysis

Solana (SOL) has experienced a sharp decline, falling below $120 – its lowest point since February 2024. This represents a 38% drop over the past month, indicating strong bearish momentum. This analysis uses technical indicators to assess the current market situation and potential future price action.

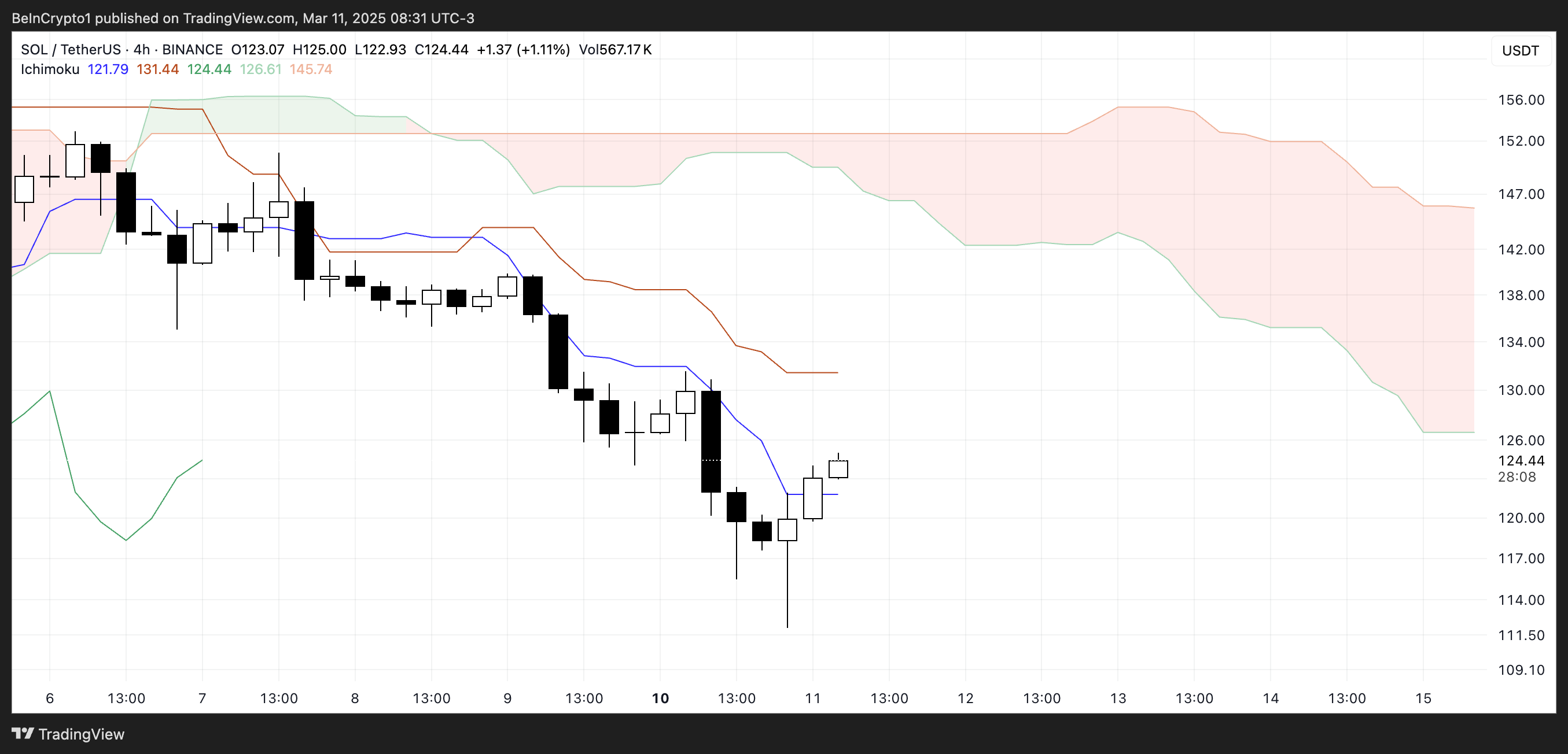

Ichimoku Cloud Shows Bearish Trend

The Solana Ichimoku Cloud indicates a bearish trend. The price is trading below both the Tenkan-sen (conversion line) and the Kijun-sen (base line), reinforcing the short-term bearish outlook. The red Kumo (cloud) further strengthens this bearish sentiment. Any potential recovery faces significant resistance around $130-$135.

A bullish reversal would require SOL to break above both the Tenkan-sen and Kijun-sen and ideally penetrate the cloud.

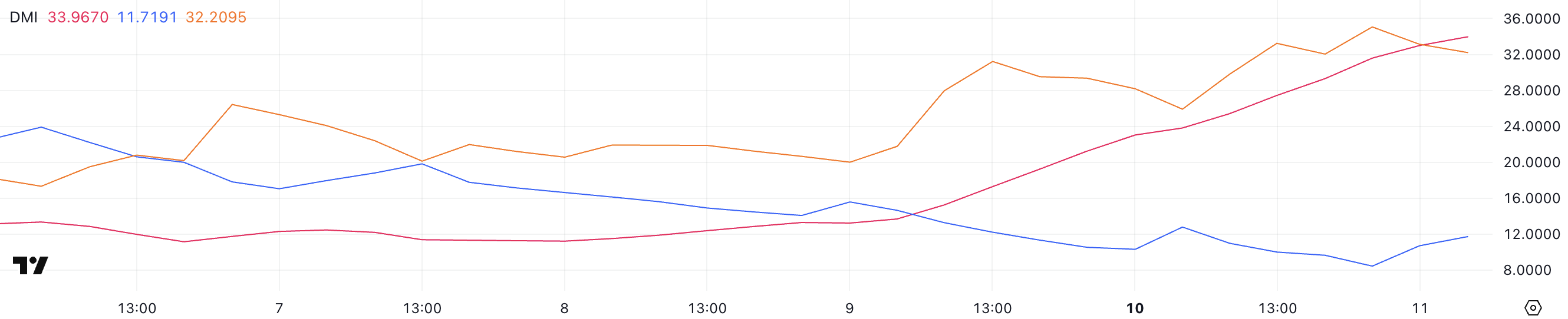

DMI Confirms Seller Dominance

The Directional Movement Index (DMI) shows the strength of the current trend. The Average Directional Index (ADX) is at 33.96, indicating a strong trend. The -DI (negative directional index) significantly outweighs the +DI (positive directional index), confirming seller dominance.

While a slight increase in +DI suggests minor buying pressure, the overall trend remains bearish until the +DI surpasses the -DI, or the ADX declines.

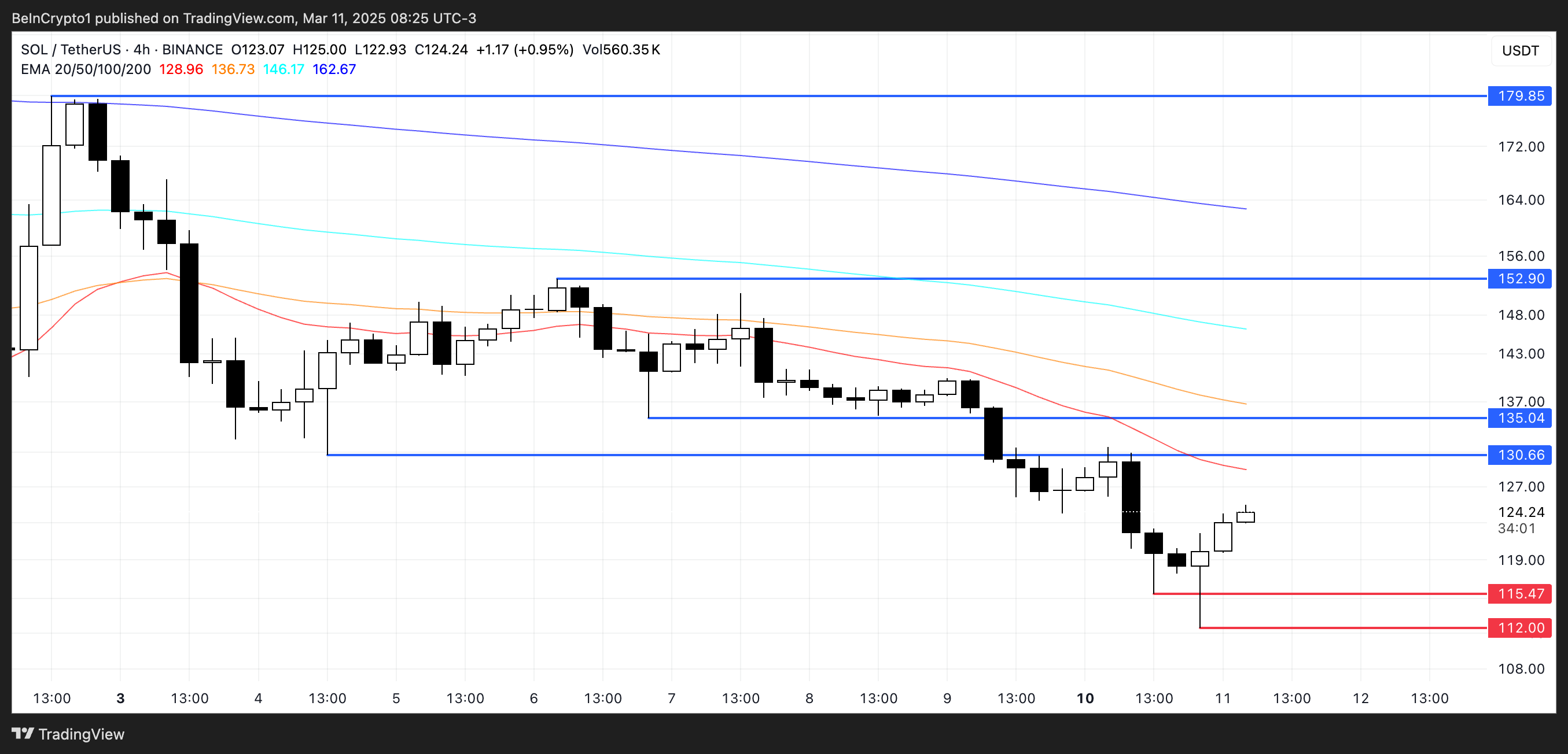

Will Solana Fall Below $110?

Exponential Moving Averages (EMAs) continue to display a bearish trend. A price rebound might face resistance at $130 and $135. Breaking above these levels could lead to a potential move towards $152.9 and potentially even $179.85. However, if the bearish trend continues, support levels at $115 and $112 could be retested. Failure to hold these levels could push SOL below $110.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Market conditions change rapidly. Conduct thorough research and consult a professional before making investment decisions.

Codeum offers blockchain security and development services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Contact us to learn how we can help secure your blockchain project.