Solana Price Plunges Below $200

Solana (SOL) has dropped below the crucial $200 support level, mirroring a broader cryptocurrency market downturn triggered by Bitcoin's recent fall. This price decline is accompanied by substantial selling pressure, as evidenced by significant outflows from SOL spot markets.

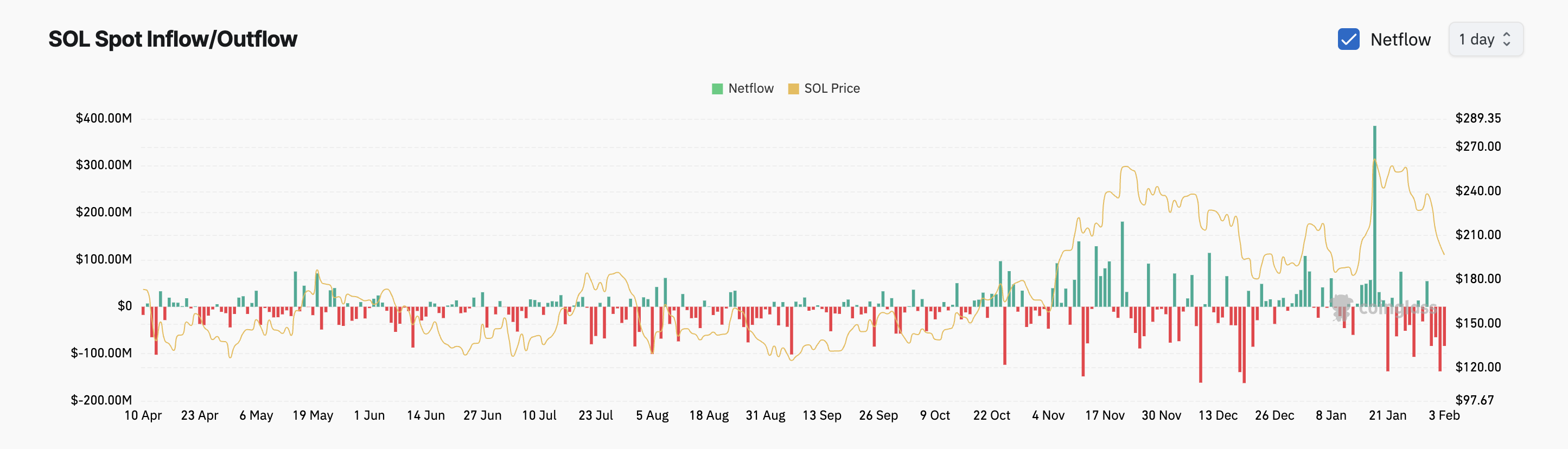

Solana Spot Market Outflows

Over the past three days, $367 million in SOL has flowed out of spot markets, according to Coinglass. This sustained outflow reflects a decrease in demand and indicates bearish sentiment among traders.

SOL's strong positive correlation with Bitcoin has exacerbated the situation. Since Bitcoin dipped below $100,000 on February 1st, SOL has experienced increased selling pressure.

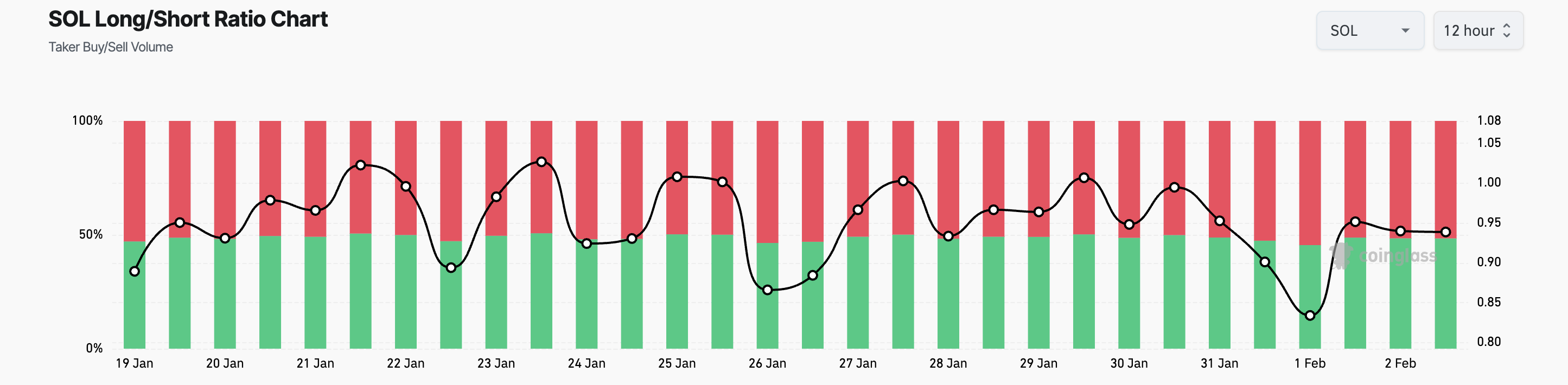

Bearish Indicators and Price Prediction

Further reinforcing the bearish outlook is SOL's long/short ratio, which stands below 1 at 0.93, indicating more short positions (bets against price increases) than long positions. This is confirmed by the Chaikin Money Flow (CMF) indicator, currently at zero, highlighting negative money flow and significant sell-offs.

If the current trend continues, SOL could potentially fall to $187.71. However, a renewed surge in demand could reverse this trend, potentially pushing the price up to $229.03.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Market conditions are volatile, and you should always conduct thorough research before making any investment decisions.