Solana (SOL) Faces Price Correction at $200 Amid Profit Taking

Solana (SOL) has seen a significant price surge, briefly exceeding $200, marking a multi-month high. However, increasing profit-taking by investors poses a challenge, potentially leading to a price reversal.

Solana Investors Eye Gains

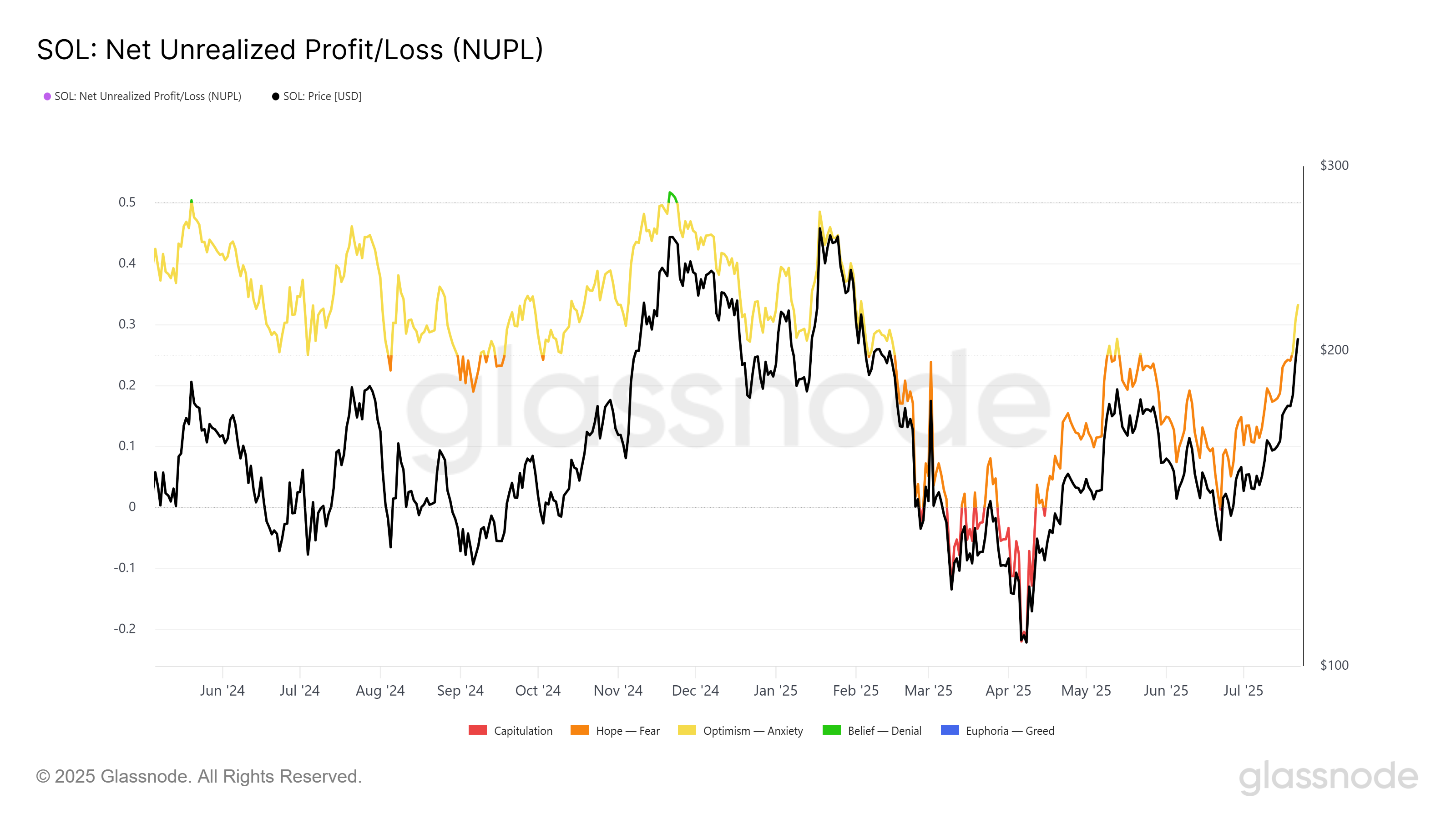

The Net Unrealized Profit/Loss (NUPL) indicator shows that Solana investors are sitting on substantial profits, the highest in five months. Historically, sharp increases in profits often trigger sell-offs as investors look to secure their gains.

This profit-taking sentiment could put downward pressure on Solana's price. Increased selling activity might quickly erase recent gains.

Technical Indicators Suggest Caution

Solana’s Relative Strength Index (RSI) is currently above 70, indicating overbought conditions. This suggests that Solana may be due for a correction, as similar levels have historically led to price pullbacks. Past RSI peaks in the overbought zone have often preceded price corrections.

While overbought conditions can persist during bullish trends, a shift in investor sentiment towards caution could impact Solana's upward momentum.

Will SOL Hold $200 Support?

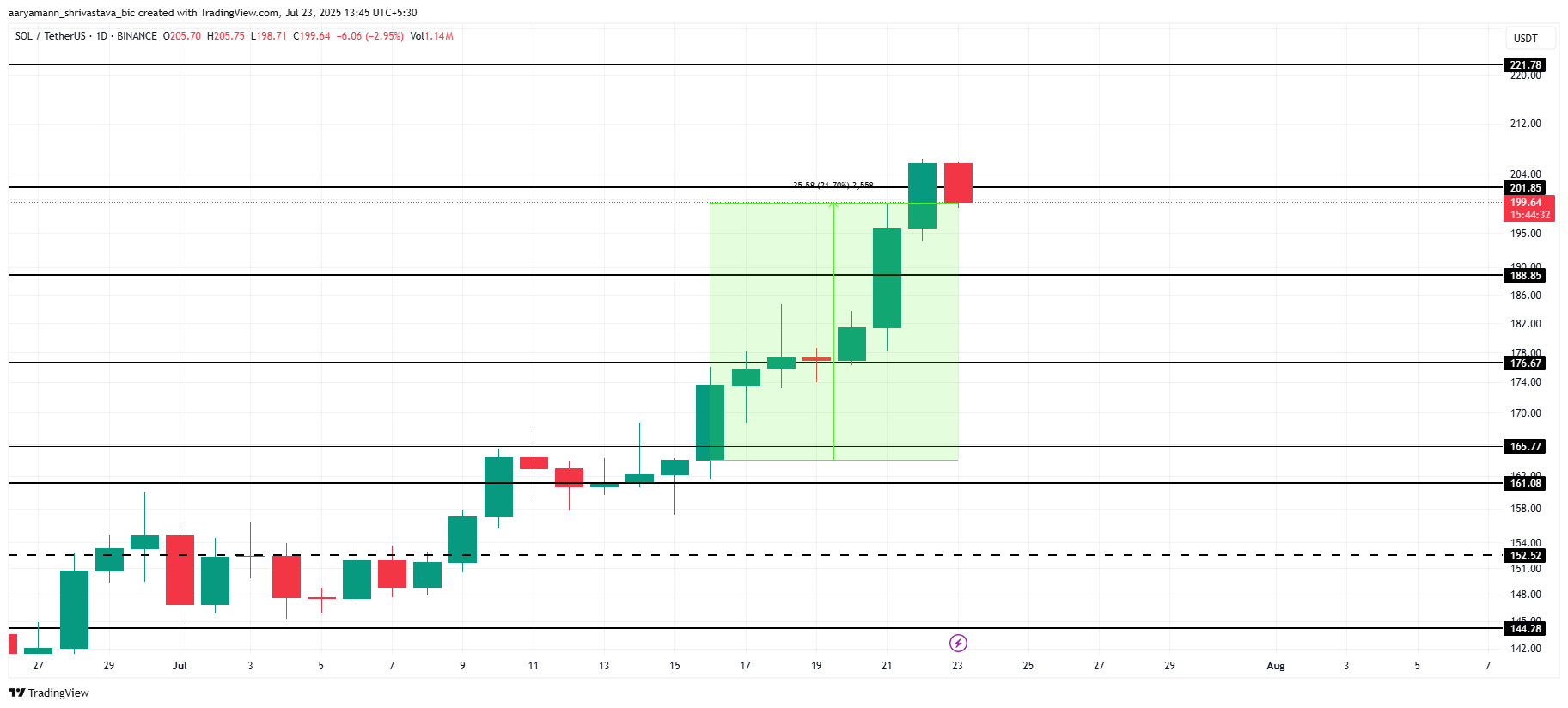

Solana's price has increased by 21% in the past week, trading around $199. Although it briefly broke the $200 barrier, it has struggled to maintain this level. The cryptocurrency now faces resistance due to profit-taking and overbought conditions.

If these factors prevail, Solana’s price could decline towards support levels at $188 or even $176. A drop below these levels could eliminate recent gains and potentially trigger a bearish trend.

Conversely, sustained investor confidence and positive market conditions could help Solana stabilize above $200. Securing this level as support might drive the price back towards $221, negating the bearish outlook.

Disclaimer: This analysis is for informational purposes only and not financial advice. Market conditions can change. Always conduct your own research.

Codeum is committed to securing blockchain projects through services such as:

- Smart contract audits

- KYC verification

- Custom smart contract and DApp development

- Tokenomics and security consultation

- Partnerships with launchpads and crypto agencies