Solana (SOL) Price Analysis: $77 Incoming?

Solana (SOL) Price Analysis: Potential Drop to $77?

Solana (SOL), the sixth-largest cryptocurrency by market capitalization, is showing signs of bearish pressure despite a recent surge. Let's delve into the technical and on-chain data to assess the situation.

Recent Price Action: At the time of writing, SOL is trading around $108.50, having experienced a 10% increase from $97 in the past 24 hours, accompanied by a 25% surge in trading volume. This increased activity suggests significant trader involvement.

Technical Analysis

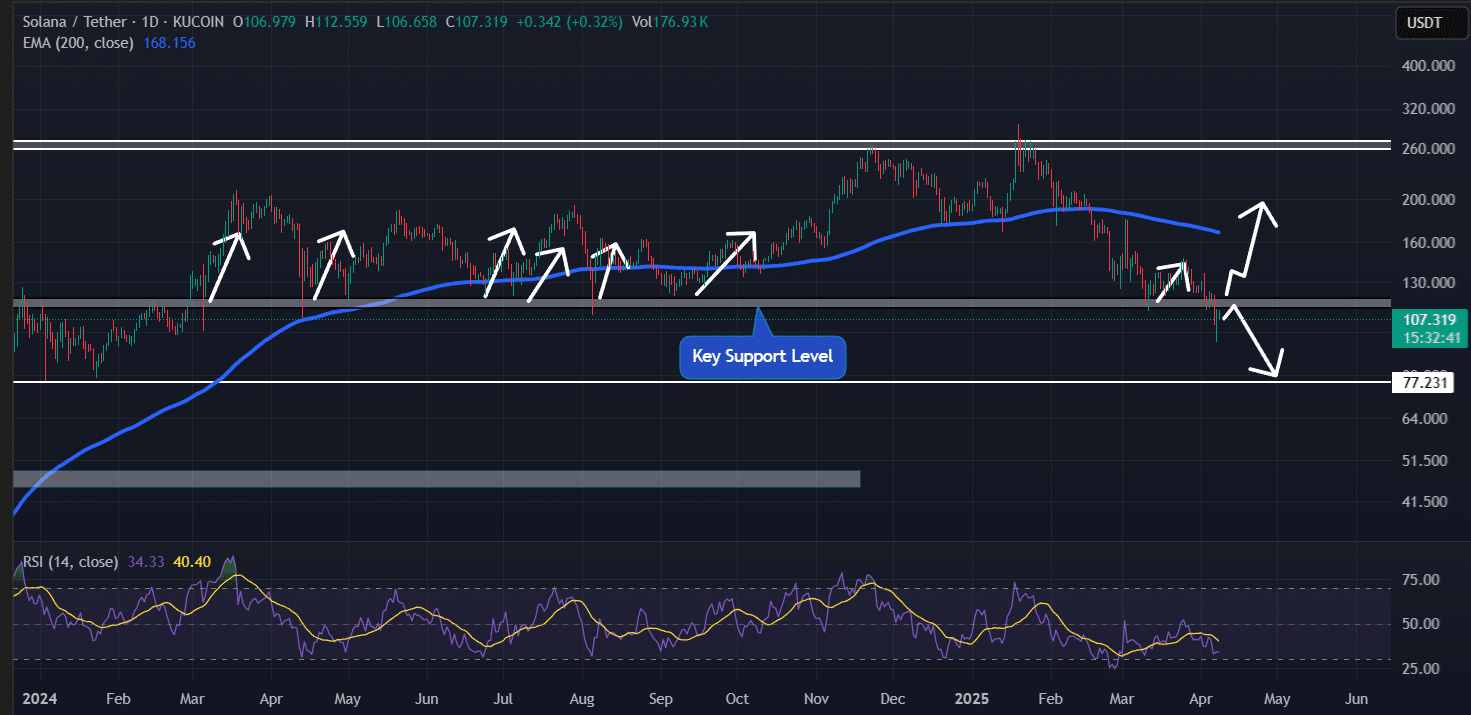

Our technical analysis reveals a concerning trend. On April 6th, 2025, SOL broke below its key horizontal support level of $114 for the first time since March 2024. This level has historically acted as a price reversal point, but this time, the pattern failed. A daily candle close below $114 strongly suggests further price declines.

Potential Downside: If SOL remains below $114, historical patterns indicate a potential 30% drop, leading to the next support level at $77. Currently, SOL trades below the 200-day Exponential Moving Average (EMA), confirming a strong downtrend.

The Relative Strength Index (RSI) is nearing oversold levels, indicating significant selling pressure. This combination of technical indicators points to a bearish outlook.

Source: TradingView

On-Chain Metrics

On-chain data reinforces the bearish sentiment. Coinglass data shows $85 million in short positions built at the $113.10 resistance level, while $23.20 million in long positions are at the $108.50 support level. The SOL Long/Short Ratio stands at 0.95, indicating slightly more short than long positions – a bearish signal.

Source: Coinglass

The combination of bearish technical analysis and on-chain metrics paints a picture of a market dominated by bearish sentiment. These significant short and long positions are vulnerable to liquidation if prices move substantially in either direction.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly risky.

Codeum: Your Partner in Blockchain Security

Codeum provides comprehensive blockchain security services including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultations, and partnerships with launchpads and crypto agencies. Contact us to learn how we can help secure your blockchain project.